-

Články

Top novinky

Reklama- Vzdělávání

- Časopisy

Top články

Nové číslo

- Témata

Top novinky

Reklama- Kongresy

- Videa

- Podcasty

Nové podcasty

Reklama- Kariéra

Doporučené pozice

Reklama- Praxe

Top novinky

Reklama“Big Food,” the Consumer Food Environment, Health, and the Policy Response in South Africa

article has not abstract

Published in the journal: . PLoS Med 9(7): e32767. doi:10.1371/journal.pmed.1001253

Category: Policy Forum

doi: https://doi.org/10.1371/journal.pmed.1001253Summary

article has not abstract

Summary Points

-

In South Africa, as in other jurisdictions, “Big Food” (large commercial entities that dominate the food and beverage environment) is becoming more widespread and is implicated in unhealthy eating.

-

“Small food” remains significant in the food environment in South Africa, and it is both linked with, and threatened by, Big Food.

-

Big Food in South Africa involves South African companies, some of which have invested in other (mainly, but not only, African) nations, as well as companies headquartered in North America and Europe.

-

These companies have developed strategies to increase the availability, affordability, and acceptability of their foods in South Africa; they have also developed a range of “health and wellness” initiatives. Whether these initiatives have had a net positive or net negative impact is not clear.

-

The South African government should act urgently to mitigate the adverse health effects in the food environment in South Africa through education about the health risks of unhealthy diets, regulation of Big Food, and support for healthy foods.

This article was commissioned for the PLoS Medicine series on Big Food that examines the activities and influence of the food and beverage industry in the health arena.

Introduction

Despite continuing high levels of underweight and nutritional deficiencies [1], overweight and obesity among both adults and children is a rapidly growing public health problem in South Africa [2],[3],[4],[5]. In 2000, an estimated 36,504 deaths (7% of all deaths) in South Africa were attributed to excess body weight [6], and in 2004 non-communicable diseases (NCDs) linked to dietary intake—cardiovascular diseases, diabetes mellitus, cancers—together with respiratory diseases contributed 12% of the overall disease burden [7].

Paralleling this increase in overweight/obesity, there has been a steady increase in the per capita food supply of fat, protein, and total calories in South Africa [8],[9] and salt intake appears to also be in excess of recommended levels [10]. These changes of nutrient intake appear to be associated with changes in dietary patterns. So, for example, a study of adults in the North West Province showed a shift with increasing wealth from a traditional high carbohydrate–low fat diet (in which maize made the largest contribution to energy intake) to a higher-fat diet in which maize was replaced by red meat and other cereal foods [11].

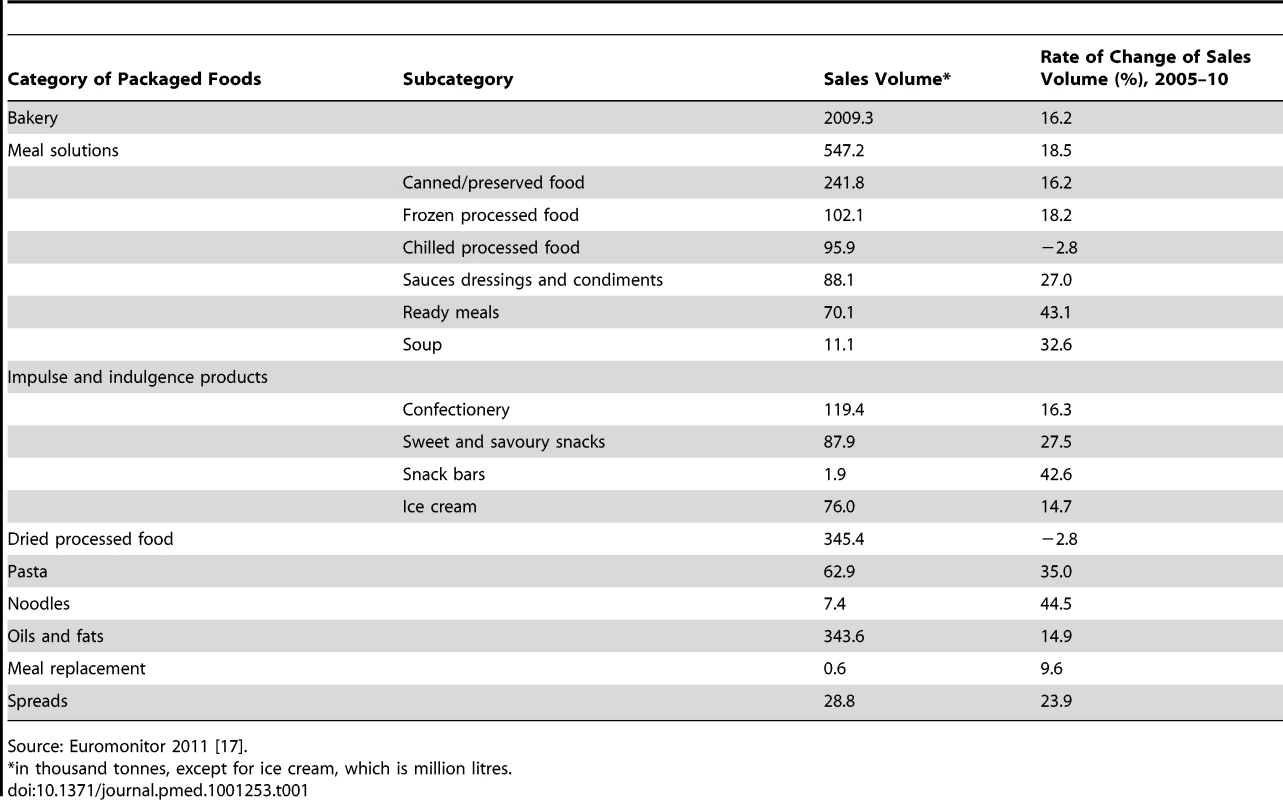

In recent years, there has also been an increase in the sales of almost all categories of packaged foods in South Africa (Table 1). For example, sales of snack bars, ready meals, and noodles all rose by more than 40% between 2005 and 2010. In addition, a recent assessment of the consumption of street food (sold by vendors) and fast food (from formal fast food outlets) revealed that, nationally, 11.3% of the population bought food from street vendors and 6.8% bought food from fast food outlets at least two times a week [12]. South Africans are also increasing their consumption of soft drinks. Compared with a worldwide average of 89 Coca-Cola products per person per year, in 2010 South Africans consumed 254 Coca-Cola products per person per year, an increase from around 130 in 1992 and 175 in 1997 [13],[14]. In 2010, up to half of young people were reported to consume fast foods, cakes and biscuits, cold drinks, and sweets at least four days a week [4]. Carbonated drinks are now the third most commonly consumed food/drink item among very young urban South African children (aged 12–24 months)—less than maize meal and brewed tea, but more than milk [15].

Tab. 1. Volume of sales of select leading categories of packaged foods, 2010, and rate of increase 2005–10.

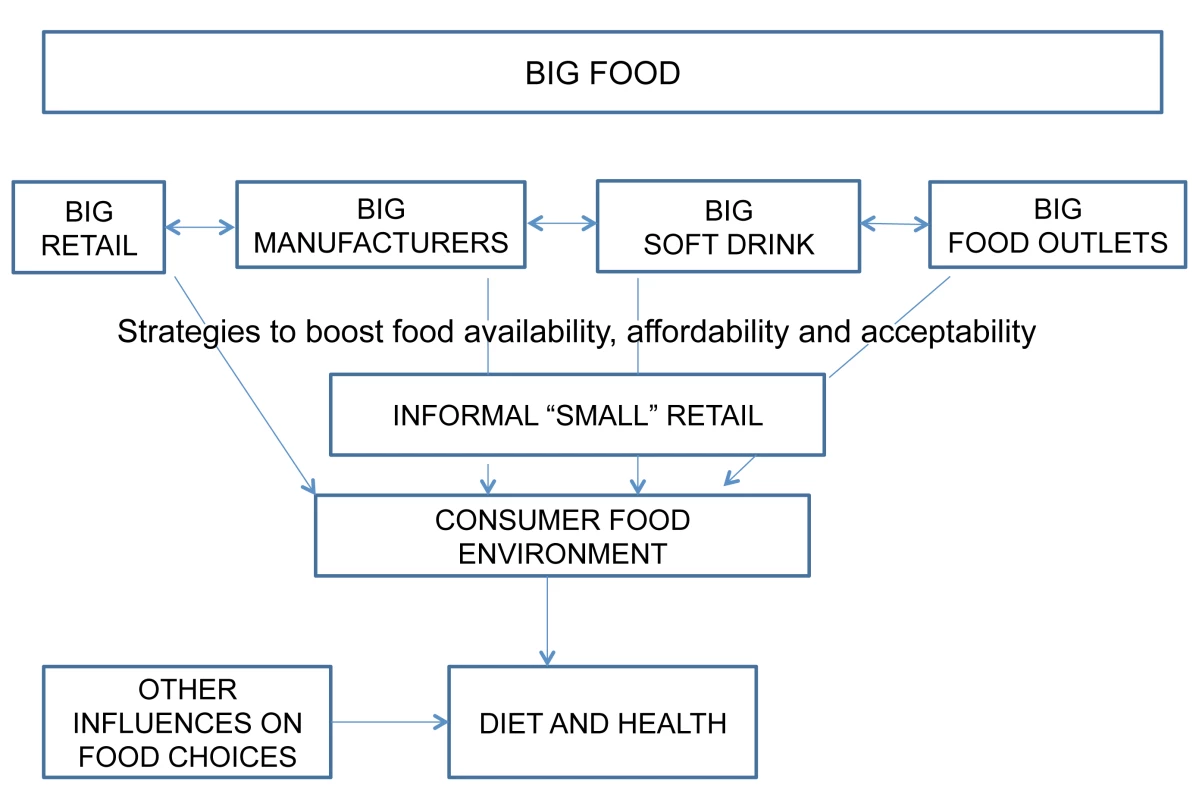

Source: Euromonitor 2011 [17]. It can be hypothesised that various strategies adopted by “Big Food” to increase the availability, affordability, and acceptability of their products have contributed to these dietary changes in South Africa and to the increased burden of obesity and NCDs (Figure 1). In this context, in this article we provide an overview of “Big Food” in South Africa. We use the term “Big Food” as shorthand for large commercial entities—both multinational and national—that increasingly dominate key components of the food and beverage environment. We include companies that have an identity with consumers—manufacturers, retailers, and food outlets—rather than agribusiness and primary processors. Although many authors have written on Big Food in the US, the UK, and other developed nations, much less has been written about their operations and practices in developing countries experiencing significant transitions. As such, this article contributes to filling a gap in the literature and provides similar nations with a process for examining the role of Big Food in health and nutrition. Our article draws on information published in the academic literature, reviews of food industry documents, data compiled by market research agencies, and data from pilot studies conducted by researchers at the University of the Western Cape, South Africa.

Fig. 1. Hypothesized link between Big Food and the consumer food environment.

We first present data on the presence of Big Food in South Africa, then examine some of the strategies used by large food corporations to change the consumer food environment in South Africa. We argue that these strategies aim to alter the availability, affordability, and acceptability of foods produced and sold by Big Food (Figure 1). Finally, we discuss the responses to health concerns made by both Big Food and the South African government, and briefly explore the policy implications.

Big Food in South Africa

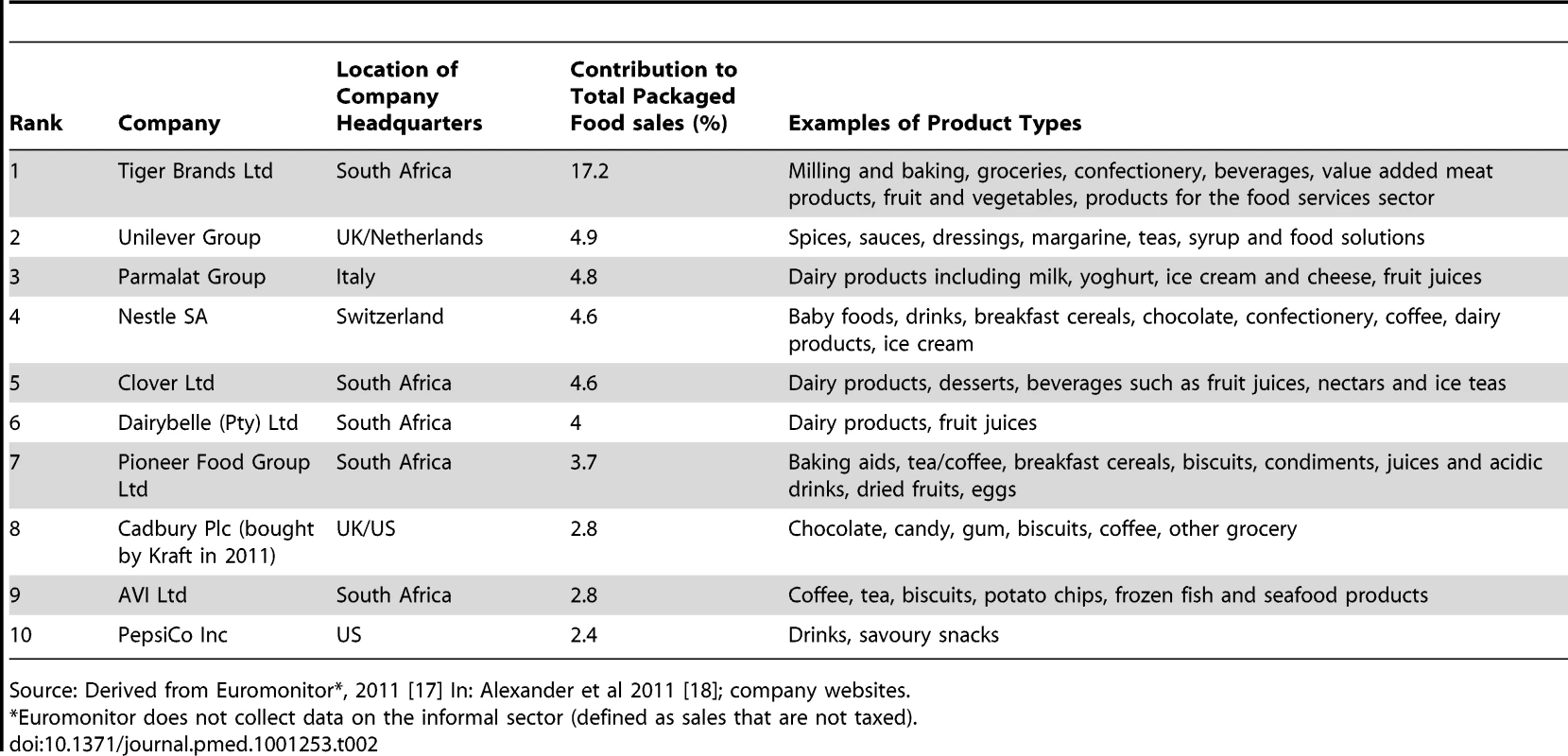

Packaged Foods

Although there are over 1,800 food manufacturing companies in South Africa, Big Food manufacturers account for a disproportionately large amount of sales [16]. The largest ten packaged food companies in South Africa account for 51.8% of total packaged food sales (Table 2), whereas artisanal packaged processed foods (products sold at the site of production, commonly bakery products), contribute only 7.3% of total sales [17],[18]. This is greater than the global average (globally in 2007, ten companies accounted for around 26% of the processed foods market) [19].

Tab. 2. Packaged Food Company Shares in South Africa, 2009.

Source: Derived from Euromonitor*, 2011 [17] In: Alexander et al 2011 [18]; company websites. Five of the top ten food manufacturing companies are South African, three of which have an international presence. Pioneer Foods, for example, has a presence in four south and east African nations, is a leading exporter, and has joint ventures with Heinz (US) (as Heinz Foods South Africa) and with a UK-based ingredients company. Many other South African companies have likewise developed joint ventures with foreign companies, such as Simba with Frito-Lay (PepsiCo, USA) and Clover with Danone Groupe (France).

Soft Drinks

The top ten soft drink companies account for 79% of the total soft drink sales in South Africa. Three companies – Coca-Cola Co., PepsiCo Inc., and Danone Groupe – account for 64.7% of the market between them, with the other top companies each contributing less than 3.5% [20]. All three market leaders are major transnational companies but are linked with South African companies. For example, Coca-Cola is bottled by SABMiller, a division of AVI, and PepsiCo is manufactured by Pioneer Foods under license.

By far the largest player is Coca-Cola (49.8% of total soft drink sales). Coca-Cola has been a dominant presence in South Africa for decades, including during the apartheid era when it distributed its products from Swaziland. After apartheid ended, Coca-Cola became a leading investor in the country [13].

Food Service Outlets

In 2010, there were 8,661 fast food outlets in South Africa, 4,991 of which were owned by fast food chains, the remainder being independent outlets (Table S1). [17]. Although there are considerably more street stalls/kiosks than fast food outlets in South Africa, the number of transactions from fast food chains has increased significantly over past decades [13]. The fast food chains are dominated by South African companies that pre-date the presence of foreign transnationals. For example, Nando's (chicken) was established years before Yum! (which owns KFC) entered the market in 1994. Today, eight of the largest ten food service companies are South African. Two of these have expanded internationally: Famous Brands purchased Wimpy UK in 2007, and Nando's has worldwide franchising operations.

Many of these fast food chains are linked with large soft drink companies through agreements concerning the drinks served in the restaurants: Wimpy and Nando's, for example, serve Coca-Cola products exclusively.

Retailers

One of the most dramatic changes in Big Food in South Africa has been the rise in supermarket retailers over past decades. Chain supermarkets now control over half of the retail share of the food market [20], which is dominated by four major chains (Shoprite, Pick n Pay, Spar, and Woolworths), all of which are South African (Table S2). Each of these companies owns several different supermarket brands, and all have expanded into other African countries.

Imports

South Africa is a net importer of various agricultural products and foods. In the past fifteen years, there has been a marked rise in imports of processed products. For example, the value of imported “Bread, Pastry, Cakes, Biscuits and Other Baker's Wares” increased from approximately R5 million (US$ 714,000; all conversions are based on the exchange rate at the relevant time) in 1992 to almost R250 million (US$ 36 million) in 2006 [21]. In addition, the import of ingredients used in processed foods has increased. For example, imports of whey, a by-product of cheese production that is used in baked products and sweet snacks, increased from R15 million (US$ 2 million) in 1993 to R80 million (US$ 11 million) in 2007 [13].

Big Food Strategies to Alter the Consumer Food Environment

Big Food manufacturers have worked to increase the market share for their products in South Africa and to increase per capita consumption by making their foods more available, affordable, and acceptable (Figure 1).

Making Their Foods More Available

Rising sales of packaged foods from large food manufacturers have gone hand-in-hand with the increase in market share held by Big Food retailers. Supermarket outlets have displaced traditional food retailers such as small convenience stores, public markets, and “spazas” (small informal shops often run from homes) as the primary place from which South Africans purchase their food in both urban and rural areas [22]. For example, a case study in the rural Ciskei region of the Eastern Cape found that 64.8% of households in villages used supermarkets [22]. The expansion of supermarkets into rural (and other lower income) areas has been greatly facilitated by their retail management and procurement models, which have allowed them to out-compete local wholesalers and small retailers on cost and quality in virtually all product offerings [23].

Big Food manufacturers depend on formal retail chains to make their manufactured products available [16]. As well as being the main source of staple products, supermarkets are the main sales channel for “non-essential” packaged foods such as “meal solution” products made by large food corporations. However, strategies to increase the availability of products made by large food manufacturers have also involved the informal retail sector. Informal traders sell soft drinks, dairy products, bakery products, and snacks such as chips (crisps) in urban settlements and rural areas [24], and Coca-Cola, in particular, has worked hard to increase product sales and consumption through this channel. Coca-Cola developed a strategy in the 1990s to “double soft drinks sales” by “building up per capita consumption” [25]. Making their products more available through informal stores was a crucial part of the strategy. They developed incentives for people to set up informal outlets in the townships, such as providing trolleys, lighting boards, point-of-sale display materials, and refrigeration equipment, and delivered the products direct to the stores [17]. By 2005, around 95% of spazas were selling Coca-Cola products, with the drinks forming a large proportion of the turnover of these small outlets [26].

Similarly, although the amount of street foods purchased remains almost twice the amount purchased from formal fast food outlets [12], fast food chains have developed aggressive expansion strategies to make their products more available. For example, McDonald's only entered the South African market in 1995 but by 2001, it had 103 outlets. It now has 161 [13]. According to the company “South Africa is one of the most successful markets in McDonald's international history. A record was set when South Africa opened 30 restaurants in just 23 months, at one stage opening 10 restaurants in 78 days” [27].

Making Their Foods More Affordable

The presence of supermarket chains has also had an impact on food prices. When purchased through informal retailers, who usually procure their goods from wholesalers, the mark-up on some processed food products is as high as 39% [22]. This mark-up is frequently attributed to transport and distribution costs and to maintaining profit margins, but may also reflect the monopoly position of local stores in poor communities [22]. Big Food retailers have developed a completely different procurement strategy based on cutting out the traditional wholesalers, consolidating their suppliers, and dealing with larger volumes [23]. Today, as a result, food prices are lower in supermarkets than in traditional retail outlets, which makes both staple foods and the packaged foods produced by large manufacturers more affordable to local populations.

Notably, however, healthier foods, which are more readily available in supermarkets than in small shops, typically cost between 10% and 60% more in supermarkets than less healthy foods when compared on a weight basis, and between 30% and 110% more when compared on the cost of food energy [28]. Refined cereals and foods with added sugar and fat are among the lowest-cost sources of energy in rural supermarkets, thus making nutrient-poor products such as biscuits, margarine, and oil-heavy snacks an effective means to cheaply consume energy while adding new and varied tastes to rural diets. Nutrient-dense foods such as lean meat, fish, fruit, and vegetables generally cost far more than these inexpensive processed food products.

The price differentials among foods manufactured in South Africa by large food corporations, small domestic companies, and imported equivalents have not been comprehensively studied. However, a small study of imported highly processed products (many of them produced by Big Food outside of South Africa) and locally produced equivalents (many of them made by South Africa's largest food company, Tiger Brands) in the Shoprite, Pick n Pay, and Spar supermarket chains suggests a complex picture [29]. For all categories of processed food except breakfast cereals, the imported products were cheaper than the local equivalents in terms of average cost per 100 g, but the price differentials varied widely. So, for instant meals, the average cost per 100 g of imported products was R0.62 (US$ 0.09) less than locally produced products, whereas the price differential for salty snacks was R1.49 (US$ 0.21). Interestingly, although the imported products appear to be cheaper, their nutritional content appears to be better; products produced by domestic food companies tend to have higher sodium and total and saturated fat content than the imported equivalents (unpublished data) [29].

Making Their Foods More Acceptable

All the components of Big Food have marketing strategies to make their foods more acceptable to the South African population. Food manufacturers work in conjunction with supermarkets to develop sales promotions for their products. PepsiCo, for example, has specific promotions on its website for each of the large retailers [30]. Competitions are also very common on manufacturer's websites. For example, the websites of both Nestlé South Africa and Cadbury South Africa (now owned by Kraft Foods) contain competitions for their main chocolate brands [31],[32].

Packaging is also used to promote products, with one of the more recent trends being statements on packages designed to appeal to health-conscious consumers. For example, Albany bread (a Tiger Brands company) promotes its products on the basis of health with statements like: “It's a great source of fibre, and fortified with vitamins and minerals, and it's cholesterol free” and some of its products carry a “low GI” symbol [33]. Similarly, Nestlé claim “Simple Goodness High in Fibre” on Maggi 2-minute noodle packets [34], and Rama margarine (a Unilever brand) is sold with the claim “Rama is a vital energy source, highly fortified with 8 GoodStart™ Vitamins, making it a highly nutritious margarine and spread” [35].

Television advertising of food is widespread. According to data from the South African Advertising Research Foundation, between 2003 and 2005, children 7–15 years old watched 2.5 hours of TV per day, and were exposed to 24 minutes of advertising per day [36]. A study undertaken in 2006 that recorded 37.5 hours of children's TV programming reported that 16% of the advertisements during this programming were for food products, and that 55% of these food-related advertisements were for foods of poor nutritional value such as refined breakfast cereals, sweets, and high-sugar drinks [37]. In a recent pilot survey, researchers at the University of Western Cape identified eight food advertisements in 7 hours of children's TV programming on the national TV channel SABC1 that they recorded in January 2012—four for sweets, one for refined breakfast cereal, two for tea, and one for a milk product (unpublished data).

Finally, although all Big Food engages in marketing in South Africa, expenditure on marketing campaigns tends to be higher by the transnationals than by South African companies. McDonald's and KFC, for example, spent more than four times than Nando's advertising their products in 2001 [13].

Response to Health Concerns

Although it is not clear to what extent Big Food can be implicated in the changing diets and changing rates of obesity and related diseases in South Africa, it is perceived as at least partially culpable because of the strategies described in the previous section. Indeed, the South African Minister of Health, Dr. Aaron Motsoaledi, recently stated that “…Africans are eating more and more junk processed foods instead of their traditional diet,” and wants to regulate junk food starting with reducing salt in bread and eliminating trans fats [38].

In response, Big Food has developed corporate social responsibility (CSR) programs that involve health. All the major food manufacturers and retailers in South Africa have active CSR programs, with Shoprite, Pick n Pay, Spar, and Woolworths having the most active examples. The focus of these programs varies, but they often have a strong focus on nutrition education. Fast food chains tend to focus more on sponsoring local sports teams and sports tournaments. For example, McDonald's was an official sponsor during the FIFA World Cup, which prompted critical comments by health and consumer organizations [39].

The generally weak national response to the influential promotion of these products is illustrative of the rudimentary status of South Africa health policy regarding regulation of the food environment. However, Dr. Motsoaledi recently convened a National Consultation on NCDs. One aspect of this consultation was a recognition of important “upstream” factors, including the changing food environment [40]. The government has also developed a number of limited policy responses in the key areas of product labelling, marketing to children, and product reformulation. Big Food has also responded in these key policy areas [41].

Product Labelling

Amidst concerns that claims made on food are “superlatives and often ludicrous” [42], the South African government changed the regulations on food product labelling in 2010. The Regulations Relating to the Labelling and Advertising of Foodstuffs, No. R. 146 of the Foodstuffs, Cosmetics and Disinfectants Act, 1972 came into effect on March 1, 2012 [41],[43]. Under the regulations, nutritional labelling remains voluntary unless a claim is made on the product. However, the regulations require a standard format for the nutritional label when used, and statements such as “A source of,” “High in,” “Low in,” “Virtually free of,” or “Free of” specific nutrients are only permitted if strict criteria are met. Manufacturers may no longer use descriptive words such as x% fat-free, nutritious, healthy, healthful, wholesome, complete nutrition, or balanced nutrition.

On a voluntary basis, several Big Food companies, including Tiger Brands, Spar, and Coca-Cola, use Guideline Daily Amount (GDA) labelling. These labels, like those used in other developed and developing countries, detail the quantity of specific nutrients in the products and the recommended daily allowance. Many Big Food companies also provide nutritional information on their websites.

Food Marketing to Children

In 2007, the South African government included restrictions on food advertising to children under 16 years old in a draft Foodstuffs, Cosmetics & Disinfectants Act. The regulations envisaged that certain foods, categorized as “non-essential to a healthy lifestyle” (e.g., carbonated drinks, confectionery, potato chips [crisps], certain fast foods), would be prohibited from being advertised or promoted to children in any manner. The regulations would also have prohibited cartoon-type characters, puppets, animation, tokens, or gifts in the advertisement or promotion of any foodstuff to children, and some foodstuffs such as soya and dairy products would have had to carry labels advising consumers to use the product in moderation and warning that excessive consumption on a regular basis may lead to poor health.

However, the Department of Health put the implementation of its proposed regulations (which were reported to have caused “much heated debate in view of the many severe restrictions that they contained and their potential far-reaching effects” [44]) on hold, deciding instead to wait for the publication of the 2010 WHO Set of Recommendations on Marketing Food and Non-Alcoholic Beverages to Children [45]. The South African government has yet to publish any regulations of its own, although it is reported that it is still deliberating on its intended course of action [46].

Meanwhile, Big Food has taken voluntary action on food marketing to children. In 2009, the South Africa Pledge on Marketing to Children was established. An initiative of the Consumer Goods Council of South Africa, it has 24 signatories, including food manufacturers, retailers, and fast food chains. The Pledge is similar to pledges made in Europe (EU Pledge) and elsewhere, but covers only advertising on TV and in schools to children under age 12 [47]. Companies do not appear to have made specific commitments to the pledge, and no monitoring report has been released.

Product Reformulation

The Ministry of Health is currently developing a salt reduction initiative that will gradually reduce salt levels in several highly consumed products, including bread, gravies and spices, brine chicken, cereal, margarine, and salty snacks, over a ten-year period [48]. It has been estimated that reducing the salt content in bread alone could prevent 6,500 deaths [48].

The Department of Health also limited the use of artificial trans fats to a maximum of 2% of oil or fat in all foods in its Regulations Relating to Trans Fats in Foodstuffs No, R 127 published in 2011[49]. These regulations specifically refer to synthetic trans fats and apply to all foodstuffs sold, manufactured in or imported into South Africa, as well as food prepared in restaurants, fast food outlets, and the catering industry. Woolworths were reported to be the first retailer to have removed trans fats from their entire brand product range (in 2007) [50], and KFC South Africa says it eliminated all trans fatty acids from its food products in August 2009 [51].

Big Food is also taking voluntary action. Unilever South Africa, for example, states that: “We are committed to improving the fat composition of our products by reducing saturated fat as much as possible and increasing levels of essential fats. All of our Flora margarine and our Rama Original and Spread for Bread tubs already contain less than 33% saturated fat as a proportion of total fat” [47]. Fast food outlets in South Africa also have salads and other “healthier” items on their menus.

Conclusions

The combined processes of rapid urbanisation, concentration of ownership of food production and distribution, and globalisation of food trade have resulted in rapid changes in the South African food environment. This article has focused on Big Food and attempted to bring together what is known about large food corporations in South Africa in the context of concerns about unhealthy eating and associated ill health. Although it provides an incomplete picture, it yields the following observations about Big Food in South Africa:

-

It has strong similarities with Big Food in other jurisdictions: it's big, it's getting more widespread, and it's implicated in unhealthy eating.

-

It consists of large packaged food and soft drink manufacturers, large retailers, and food outlets. These different components of Big Food are linked through various pathways. While “small food” remains significant in the food environment in South Africa, it is both linked with, and threatened by, Big Food.

-

It involves both “foreign” transnationals and South African companies. Many of the South African Big Food companies, particularly the supermarket chains, have invested in other African nations and around the world. This suggests that South African Big Food may become a more important global player in years to come and that global attention on Big Food should focus both on companies whose headquarters are in North America and Europe and on companies whose headquarters are in developing nations.

-

Supermarkets must not be forgotten as a key component of Big Food in South Africa, where they constitute a major sales channel for the products produced by food manufacturers.

-

Big Food in South Africa is increasingly developing “health and wellness” initiatives. The outcome of these initiatives is not yet clear: they may have a net positive impact but if they offset more rigorous government action they may have a net negative impact.

It is clear that urgent action is required to mitigate the adverse health effects of the changing food environment in South Africa. We suggest that this action should include a combination of accelerated efforts to educate the public about the adverse consequences of consuming easily available but unhealthy foods and greater regulation of Big Food and the strategies it employs to increase the availability, affordability, and acceptability of foods associated with unhealthy diets. The policy response to Big Food should also recognise the role of local and possibly subcontinental governance (e.g., the Southern Africa Development Community governments) in addressing the issue.

In conclusion, we suggest that the South African government should develop a plan to make healthy foods such as fruit, vegetables, and whole grain cereals more available, affordable, and acceptable, and non-essential, high-calorie, nutrient-poor products, including soft drinks, some packaged foods and snacks, less available, more costly, and less appealing to the South African population. Some of these approaches may require engagement with Big Food. But elsewhere, clear rules and regulations are needed. Discussions about the regulation of promotional activities and about imposing taxes on unhealthy food products would be a good place to start.

Supporting Information

Zdroje

1. NannanNNormanRHendricksMDhansayMABradshawD 2007 Estimating the burden of childhood and maternal undernutrition in South Africa in 2000. South Afr Med J 97 733 739

2. ArmstrongMELambertMILambertEV 2011 Secular trends in the prevalence of stunting, overweight and obesity among South African children (1994–2004). Eur J Clin Nutr doi 65 835 840 10.1038/ejcn.2011.46

3. Department of Health, Medical Research Council and OrcMacro 2007 South Africa Demographic and Health Survey 2003 Pretoria Department of Health

4. ReddySPJamesSSewpaulRKoopmanFFunaniNI 2010 Umthente Uhlaba Usamila – The South African Youth Risk Behaviour Survey 2008 Cape Town South African Medical Research Council

5. KrugerHSSteynNPSwartECMaunderEMWNelJH 2011 Overweight among children decreased, but obesity prevalence remained high among women in South Africa, 1999–2005. Public Health Nutr 18 1 6 doi:10.1017/S136898001100262X

6. JoubertJNormanRLambertEVGroenewaldPSchneiderM 2007 Estimating the burden of disease attributable to physical inactivity in South Africa in 2000. S Afr Med J 97 725 731

7. MayosiBMFlisherAJLallooUGSitasFTollmanSM 2009 The burden of non-communicable diseases in South Africa. Lancet 374 934 947

8. Food and Agriculture Organization of the United Nations 2004 Globalization of food systems in developing countries: impact on food security and nutrition. FAO Food and Nutrition Paper 83. FAO: Rome. Available: ftp://ftp.fao.org/docrep/fao/007/y5736e/y5736e00.pdf. Accessed 01 May 2012

9. Food and Agriculture Organization of the United Nations 2010 FAOSTAT – South Africa. Available http://faostat.fao.org/site/368/default.aspx#ancor. Accessed 01 May 2012

10. CharltonKESteynKLevittNSZuluJVJonathanD 2005 Diet and blood pressure in South Africa: intake of foods containing sodium, potassium, calcium, and magnesium in three ethnic groups. Nutrition 21 39 50

11. MacIntyreUEKrugerHSVenterCSVorsterHH 2002 Dietary intakes of an African population in different stages of transition in the North West Province, South Africa: the THUSA study. Nutrition Research 22 239 256

12. SteynNPLabadariosD 2011 Street foods and fast foods: How much do South Africans of different ethnic groups consume? Ethn Dis 21 462 466

13. HawkesC 2002 Marketing Activities of Global Soft Drink and Fast Food Companies in Emerging Markets: A Review. Globalization, diets, and non-communicable diseases Geneva World Health Organization 2002

14. Coca-Cola Company 2010 Annual Review 2010. Available: http://www.thecoca-colacompany.com/ourcompany/ar/pdf/TCCC_2010_Annual_Review_Per_Capita_Consumption.pdf. Accessed 01 May 2012

15. TheronMAmissahAKleynhansICAlbertseEMacIntyreUE 2007 Inadequate dietary intake is not the cause of stunting amongst young children living in an informal settlement in Gauteng and rural Limpopo Province in South Africa: the NutriGro study. Public Health Nutr 10 379 389

16. USDA Foreign Agricultural Services 2011 GAIN report South Africa's food processing sector offers opportunities for U.S. exports. Available: http://static.globaltrade.net/files/pdf/20120123003839246.pdf

17. Euromonitor International. Available: http://www.euromonitor.com/. Accessed 01 May 2012

18. AlexanderEYachDMensahGA 2011 Major multinational food and beverage companies and informal sector contributions to global food consumption: implications for nutrition policy. Global Health 7 26

19. ETC Group 2008 Who Owns Nature? Corporate Power and the Final Frontier in the Commodification of Life. ETC Group, Ottawa. Available: http://www.etcgroup.org/upload/publication/707/01/etc_won_report_final_color.pdf. Accessed 01 May 2012

20. GreenbergS 2010 Contesting the food system in South Africa: Issues and Opportunities. Institute of Poverty, Land and Agrarian studies research report 42. University of the Western Cape: Cape Town. Available:www.plaas.org.za. Accessed 01 May 2012

21. Department of Trade and Industry. Trade Data. Available: http://www.dti.gov.za/econdb/raportt/kraje6digprim.asp. Accessed 01 May 2012

22. D'HaeseMHuylenbroeckGV 2005 The rise of supermarkets and changing expenditure patterns of poor rural households case study in the Transkei area, South Africa. Food Policy 30 97 113

23. WeatherspoonDReardonT 2003 The Rise of Supermarkets in Africa: Implications for Agrifood Systems and the Rural Poor. Dev Policy Rev 21 333 355

24. ChopraMPuoaneT 2003 Prevention of diabetes through Obesogenic World. Diabetes Voice 48 24 26

25. No author listed 1997 Coca-Cola set to pour hundreds of millions into SA. Business Times South Africa. Available: http://www.btimes.co.za/97/0202/comp/comp8.htm. Accessed 01 May 2012

26. The Economic Impact of The Coca-Cola System on South Africa Available: http://www.moore.sc.edu/UserFiles/moore/Documents/Division%20of%20Research/sareport2.pdf. Accessed 01 May 2012

27. McDonald's South Africa. Key Facts About Us. Available: http://www.mcdonalds.co.za/content/about_story2_key_facts.php. Accessed 01 May 2012

28. TempleNJSteynNPFourieJDe VilliersA 2011 Price and availability of healthy food: A study in rural South Africa. Nutrition 27 55 58

29. SandersDIgumborEUPuoaneTSwartRSchwarzC 2011 Public health and processed food imports in South Africa. Report prepared for the Department of Trade and Industry South Africa (Unpublished)

30. http://www.pepsi.co.za/. Accessed 01 May 2012

31. Nestlé South Africa. Chocolates and confectionery. Available: http://www.nestle.co.za/Brands/ChocolateConfectionery/Pages/ChocolateConfectioneryCatalogue.aspx. Accessed 01 May 2012

32. Cadbury South Africa. Available: http://www.cadbury.co.za/. Accessed 01 May 2012

33. Albany Bakeries. The seven colours of Albany Superior. Available: http://www.albany.co.za/superior_bread.php. Accessed 01 May 2012

34. Nestlé South Africa. Food. Available: http://www.nestle.co.za/Brands/Food/Pages/MAGGINoodles.aspx

35. Unilever. Rama. Available: http://www.unilever.co.za/brands/foodbrands/rama.aspx. Accessed 01 May 2012

36. CassimB 2010 Food and beverage marketing to children in South Africa: mapping the terrain. South Afr J Clin Nutr 23 181 85

37. TempleNSteynNP 2008 Food advertisements on children's programs on TV in South Africa. Nutrition 24 781 782

38. LawrenceF 2011 Alarm as corporate giants target developing countries. The Guardian (UK) 23 Nov 2011 Available: http://www.guardian.co.uk/global-development/2011/nov/23/corporate-giants-target-developing-countries. Accessed 01 May 2012

39. BBC News Health: World cup attacked for ‘unhealthy sponsors’ 1 June 2010 Available: http://www.bbc.co.uk/news/10176403. Accessed 01 May 2012

40. National Department of Health. Summit on prevention and control of non-communicable diseases Available: http://www.doh.gov.za/eventlist.php?eid=5. Accessed 01 May 2012

41. WojcickiJMHeymanMB 2010 Malnutrition and the role of the soft drink industry in improving child health in sub-Saharan Africa. Pediatrics 126 e1617 e1621

42. DietDoc 10 May 1022 Food labelling legislation - will it help consumers? Health 24.com. Available: http://www.health24.com/dietnfood/DietDocs_articles/15-1871,62728.asp. Accessed 01 May 2012

43. Department of Health 1 March 2010 Foodstuffs, Cosmetics and Disinfectants Act, 1972 (Act 54 of 1972) Regulations relating to the labelling and advertising of foodstuffs. Available: http://www.developtechnology.co.za/images/stories/reg0146.pdf. Accessed 01 May 2012

44. SmitNThompsonK 26 April 2010 Junk food's regulations given a timeout. Available: http://ko.adamsadams.com/index.php/news/article/junk_food_regulations_given_a_timeout/. Accessed 01 May 2012

45. World Health Organization 2010 Set of Recommendations on the Marketing of Foods and Non-Alcoholic Beverages to Children. Geneva WHO Available: http://www.who.int/dietphysicalactivity/marketing-food-to-children/en/index.html. Accessed 01 May 2012

46. McLeaH 13 September 2011 Health Minister eyes ‘junk food’ industry. Times Live. Available: http://www.timeslive.co.za/local/2011/09/13/health-minister-eyes-junk-food-industry. Accessed 01 May 2012

47. HawkesCHarrisJL 2011 An analysis of the content of food industry pledges on marketing to children. Public Health Nutr 14 1403 1414

48. ByrneJ 2011 South African food industry faces regulatory action on salt. Available: http://www.foodnavigator.com/Legislation/South-African-food-industry-faces-regulatory-action-on-salt. Accessed 01 May 2012

49. Department of Health 2011 Regulations Relating to Trans Fats in Food Stuff Pretoria Department of Health Available: http://www.doh.gov.za/docs/foodcontrol/fortification/2011/Regulation%20-%20Fortification%20-%20Regulations%20relating%20to%20trans-fat%20in%20foodstuffs.pdf. Accessed 01 May 2012

50. Health 24. SA Declares War on Trans Fats. Available:http://www.health24.com/dietnfood/General/15-742,64472.asp. Accessed 01 May 2012

51. Unilever South Africa. Nutrition. Available: http://www.unilever.co.za/sustainability/healthwellbeing/nutrition/. Accessed 01 May 2012

Štítky

Interní lékařství

Článek Risk of Venous Thromboembolism in Patients with Cancer: A Systematic Review and Meta-AnalysisČlánek The Co-Management of Tuberculosis and Diabetes: Challenges and Opportunities in the Developing WorldČlánek Researching New Methods of Screening for Adverse Pregnancy Outcome: Lessons from Pre-eclampsiaČlánek HIV Treatment as Prevention: Models, Data, and Questions—Towards Evidence-Based Decision-MakingČlánek United States Private-Sector Physicians and Pharmaceutical Contract Research: A Qualitative Study

Článek vyšel v časopisePLOS Medicine

Nejčtenější tento týden

2012 Číslo 7- Není statin jako statin aneb praktický přehled rozdílů jednotlivých molekul

- Magnosolv a jeho využití v neurologii

- Biomarker NT-proBNP má v praxi široké využití. Usnadněte si jeho vyšetření POCT analyzátorem Afias 1

- Moje zkušenosti s Magnosolvem podávaným pacientům jako profylaxe migrény a u pacientů s diagnostikovanou spazmofilní tetanií i při normomagnezémii - MUDr. Dana Pecharová, neurolog

- Antikoagulační léčba u pacientů před operačními výkony

-

Všechny články tohoto čísla

- HIV Treatment as Prevention: Issues in Economic Evaluation

- Risk of Venous Thromboembolism in Patients with Cancer: A Systematic Review and Meta-Analysis

- HIV Treatment as Prevention: Natural Experiments Highlight Limits of Antiretroviral Treatment as HIV Prevention

- HIV Treatment as Prevention: Optimising the Impact of Expanded HIV Treatment Programmes

- Reduction in Infection Rates after Mandatory Hospital Public Reporting: Findings from a Longitudinal Cohort Study in Canada

- Medical Device Regulation: Time to Improve Performance

- Averting an Impending Storm: Can We Reengineer Health Systems to Meet the Needs of Aging Populations?

- Thinking Forward: The Quicksand of Appeasing the Food Industry

- The Co-Management of Tuberculosis and Diabetes: Challenges and Opportunities in the Developing World

- Community Mobilization in Mumbai Slums to Improve Perinatal Care and Outcomes: A Cluster Randomized Controlled Trial

- Researching New Methods of Screening for Adverse Pregnancy Outcome: Lessons from Pre-eclampsia

- Social Entrepreneurship for Sexual Health (SESH): A New Approach for Enabling Delivery of Sexual Health Services among Most-at-Risk Populations

- Lessons from Agriculture for the Sustainable Management of Malaria Vectors

- HIV Treatment as Prevention: Modelling the Cost of Antiretroviral Treatment—State of the Art and Future Directions

- HIV Treatment as Prevention: Considerations in the Design, Conduct, and Analysis of Cluster Randomized Controlled Trials of Combination HIV Prevention

- Antiretroviral Therapy for Prevention of Tuberculosis in Adults with HIV: A Systematic Review and Meta-Analysis

- The Effectiveness of Emergency Obstetric Referral Interventions in Developing Country Settings: A Systematic Review

- Digital Humanitarianism: Collective Intelligence Emerging

- The Ethics of Switch/Simplify in Antiretroviral Trials: Non-Inferior or Just Inferior?

- “Big Food,” the Consumer Food Environment, Health, and the Policy Response in South Africa

- Plasma Phospholipid Fatty Acid Concentration and Incident Coronary Heart Disease in Men and Women: The EPIC-Norfolk Prospective Study

- HIV Treatment as Prevention: The Utility and Limitations of Ecological Observation

- How Does Medical Device Regulation Perform in the United States and the European Union? A Systematic Review

- HIV Treatment as Prevention: Models, Data, and Questions—Towards Evidence-Based Decision-Making

- Risk Factors for Death among Children Less than 5 Years Old Hospitalized with Diarrhea in Rural Western Kenya, 2005–2007: A Cohort Study

- United States Private-Sector Physicians and Pharmaceutical Contract Research: A Qualitative Study

- HIV Treatment as Prevention: Debate and Commentary—Will Early Infection Compromise Treatment-as-Prevention Strategies?

- HIV Treatment as Prevention: Principles of Good HIV Epidemiology Modelling for Public Health Decision-Making in All Modes of Prevention and Evaluation

- Effect of a Community-Based Nursing Intervention on Mortality in Chronically Ill Older Adults: A Randomized Controlled Trial

- Surveillance of Infection Severity: A Registry Study of Laboratory Diagnosed

- Consequences of Gestational Diabetes in an Urban Hospital in Viet Nam: A Prospective Cohort Study

- Integrating Mental Health and Development: A Case Study of the BasicNeeds Model in Nepal

- Treatment of Young Children with HIV Infection: Using Evidence to Inform Policymakers

- The Impact of Transnational “Big Food” Companies on the South: A View from Brazil

- HIV Treatment as Prevention: Systematic Comparison of Mathematical Models of the Potential Impact of Antiretroviral Therapy on HIV Incidence in South Africa

- PLOS Medicine

- Archiv čísel

- Aktuální číslo

- Informace o časopisu

Nejčtenější v tomto čísle- HIV Treatment as Prevention: Issues in Economic Evaluation

- HIV Treatment as Prevention: Modelling the Cost of Antiretroviral Treatment—State of the Art and Future Directions

- HIV Treatment as Prevention: The Utility and Limitations of Ecological Observation

- Consequences of Gestational Diabetes in an Urban Hospital in Viet Nam: A Prospective Cohort Study

Kurzy

Zvyšte si kvalifikaci online z pohodlí domova

Autoři: prof. MUDr. Vladimír Palička, CSc., Dr.h.c., doc. MUDr. Václav Vyskočil, Ph.D., MUDr. Petr Kasalický, CSc., MUDr. Jan Rosa, Ing. Pavel Havlík, Ing. Jan Adam, Hana Hejnová, DiS., Jana Křenková

Autoři: MUDr. Irena Krčmová, CSc.

Autoři: MDDr. Eleonóra Ivančová, PhD., MHA

Autoři: prof. MUDr. Eva Kubala Havrdová, DrSc.

Všechny kurzyPřihlášení#ADS_BOTTOM_SCRIPTS#Zapomenuté hesloZadejte e-mailovou adresu, se kterou jste vytvářel(a) účet, budou Vám na ni zaslány informace k nastavení nového hesla.

- Vzdělávání