-

Články

- Vzdělávání

- Časopisy

Top články

Nové číslo

- Témata

- Kongresy

- Videa

- Podcasty

Nové podcasty

Reklama- Kariéra

Doporučené pozice

Reklama- Praxe

Averting Obesity and Type 2 Diabetes in India through Sugar-Sweetened Beverage Taxation: An Economic-Epidemiologic Modeling Study

Background:

Taxing sugar-sweetened beverages (SSBs) has been proposed in high-income countries to reduce obesity and type 2 diabetes. We sought to estimate the potential health effects of such a fiscal strategy in the middle-income country of India, where there is heterogeneity in SSB consumption, patterns of substitution between SSBs and other beverages after tax increases, and vast differences in chronic disease risk within the population.Methods and Findings:

Using consumption and price variations data from a nationally representative survey of 100,855 Indian households, we first calculated how changes in SSB price alter per capita consumption of SSBs and substitution with other beverages. We then incorporated SSB sales trends, body mass index (BMI), and diabetes incidence data stratified by age, sex, income, and urban/rural residence into a validated microsimulation of caloric consumption, glycemic load, overweight/obesity prevalence, and type 2 diabetes incidence among Indian subpopulations facing a 20% SSB excise tax. The 20% SSB tax was anticipated to reduce overweight and obesity prevalence by 3.0% (95% CI 1.6%–5.9%) and type 2 diabetes incidence by 1.6% (95% CI 1.2%–1.9%) among various Indian subpopulations over the period 2014–2023, if SSB consumption continued to increase linearly in accordance with secular trends. However, acceleration in SSB consumption trends consistent with industry marketing models would be expected to increase the impact efficacy of taxation, averting 4.2% of prevalent overweight/obesity (95% CI 2.5–10.0%) and 2.5% (95% CI 1.0–2.8%) of incident type 2 diabetes from 2014–2023. Given current consumption and BMI distributions, our results suggest the largest relative effect would be expected among young rural men, refuting our a priori hypothesis that urban populations would be isolated beneficiaries of SSB taxation. Key limitations of this estimation approach include the assumption that consumer expenditure behavior from prior years, captured in price elasticities, will reflect future behavior among consumers, and potential underreporting of consumption in dietary recall data used to inform our calculations.Conclusion:

Sustained SSB taxation at a high tax rate could mitigate rising obesity and type 2 diabetes in India among both urban and rural subpopulations.

Please see later in the article for the Editors' Summary

Published in the journal: . PLoS Med 11(1): e32767. doi:10.1371/journal.pmed.1001582

Category: Research Article

doi: https://doi.org/10.1371/journal.pmed.1001582Summary

Background:

Taxing sugar-sweetened beverages (SSBs) has been proposed in high-income countries to reduce obesity and type 2 diabetes. We sought to estimate the potential health effects of such a fiscal strategy in the middle-income country of India, where there is heterogeneity in SSB consumption, patterns of substitution between SSBs and other beverages after tax increases, and vast differences in chronic disease risk within the population.Methods and Findings:

Using consumption and price variations data from a nationally representative survey of 100,855 Indian households, we first calculated how changes in SSB price alter per capita consumption of SSBs and substitution with other beverages. We then incorporated SSB sales trends, body mass index (BMI), and diabetes incidence data stratified by age, sex, income, and urban/rural residence into a validated microsimulation of caloric consumption, glycemic load, overweight/obesity prevalence, and type 2 diabetes incidence among Indian subpopulations facing a 20% SSB excise tax. The 20% SSB tax was anticipated to reduce overweight and obesity prevalence by 3.0% (95% CI 1.6%–5.9%) and type 2 diabetes incidence by 1.6% (95% CI 1.2%–1.9%) among various Indian subpopulations over the period 2014–2023, if SSB consumption continued to increase linearly in accordance with secular trends. However, acceleration in SSB consumption trends consistent with industry marketing models would be expected to increase the impact efficacy of taxation, averting 4.2% of prevalent overweight/obesity (95% CI 2.5–10.0%) and 2.5% (95% CI 1.0–2.8%) of incident type 2 diabetes from 2014–2023. Given current consumption and BMI distributions, our results suggest the largest relative effect would be expected among young rural men, refuting our a priori hypothesis that urban populations would be isolated beneficiaries of SSB taxation. Key limitations of this estimation approach include the assumption that consumer expenditure behavior from prior years, captured in price elasticities, will reflect future behavior among consumers, and potential underreporting of consumption in dietary recall data used to inform our calculations.Conclusion:

Sustained SSB taxation at a high tax rate could mitigate rising obesity and type 2 diabetes in India among both urban and rural subpopulations.

Please see later in the article for the Editors' SummaryIntroduction

Sugar-sweetened beverage (SSB) consumption is established as a major risk factor for overweight and obesity, as well as an array of cardio-metabolic conditions, especially type 2 diabetes [1],[2]. The individual risk of type 2 diabetes attributable to SSB consumption remains statistically significant after adjustment for total energy consumption and body mass index (BMI) [3],[4]. While taxes on SSBs have been proposed in high-income countries to lower obesity and type 2 diabetes risks given limited success from other population measures and individual-level interventions [5], recent assessments reveal a majority of SSB sales now occur outside the US and Europe, where marketing efforts appear most focused [6]–[8]. SSB sales in India, for example, have increased by 13% year-on-year since 1998, exceeding 11 liters per capita per year (Figure 1) [9]. At the population level, the acceleration of SSB consumption among middle-income country populations has been statistically associated with increased obesity, overweight, and type 2 diabetes prevalence rates, independent of concurrent changes in other caloric consumption, physical inactivity, and aging [6],[10],[11].

Fig. 1. SSB consumption in liters per capita per year in India, 1998–2012 [9]. ![SSB consumption in liters per capita per year in India, 1998–2012 <em class="ref">[9]</em>.](https://www.prolekare.cz/media/cache/resolve/media_object_image_small/media/image/bbb2da59324d1176d80069982e11a1bf.png)

The Latin American average consumption is plotted for comparison, reflecting the population-weighted average per capita consumption from 13 countries (Argentina, Bolivia, Brazil, Chile, Colombia, Costa Rica, Dominican Republic, Ecuador, Guatemala, Mexico, Peru, Uruguay, and Venezuela). While econometric and modeling studies suggest the potential effectiveness of large (e.g., penny-per-ounce, or 20%–25%) but not smaller excise taxes on SSBs in the United States [12]–[15], and UK [16], a key unknown is whether such fiscal strategies will be wise to implement in middle-income nations like India and China, where several aspects of SSB consumption and disease risk are uniquely different from Western populations [17]. Asian countries' populations appear to be internally heterogeneous in their “nutrition transition” towards Western dietary patterns high in salt, sugar, and fat content [17],[18]. This implies that nationwide taxation may be perverse if benefits accrue among only select populations while monetary penalties apply universally, especially if the tax burden but not the tax benefit falls disproportionately on the poor. In India, processed foods make up a substantial portion of dietary consumption overall, but with marked variations between men and women and among age groups, income classes, and urban versus rural populations [19],[20]. Type 2 diabetes is similarly more prevalent among urban, higher-income men, but lower-income groups and women increasingly face a heightened burden of obesity and low diagnosis rates associated with poor health care access [21]–[23]. Furthermore, the beverages that people consume apart from SSBs also contain high caloric and glycemic loads in India and much of Asia [6], indicating that if a tax were to induce substitutions from SSBs to other beverages, the net health impacts on obesity and type 2 diabetes may be limited and, possibly, perverse [24].

We sought to characterize the influence of an SSB tax on overweight, obesity, and type 2 diabetes trajectories among multiple demographic groups in India. To perform the analysis, we first used a standard microeconomic approach to calculate how changes in SSB price relate to changes in SSB consumption (“own-price elasticity”) and substitution of SSBs for other beverages (“cross-price elasticity”), using per capita consumption and price variations data from a nationally representative household survey [25]. We then estimated how changes in overall calories and glycemic load induced by a 20% excise tax on SSBs would be expected to alter overweight, obesity, and type 2 diabetes incidence over the period 2014–2024. We chose the 20% rate for comparability against tax simulations in Western populations, where a penny-per-ounce tax amounts to an ∼20%–25% price increase [15]; the 20% change is also within the 35% SSB price variation range in the survey data employed for our assessment. We nevertheless varied the tax rate from 10% to 30% in sensitivity analyses to explore alternative forecasts. We constructed and validated a microsimulation model to estimate changes in weight and diabetes risk from the tax, examining how changes in modeled outcomes resulted from a variety of alternative assumptions. Our a priori hypothesis was that urban populations would be the primary beneficiaries of SSB taxation, given their high SSB exposure as well as elevated obesity and type 2 diabetes prevalence rates [9],[26].

Methods

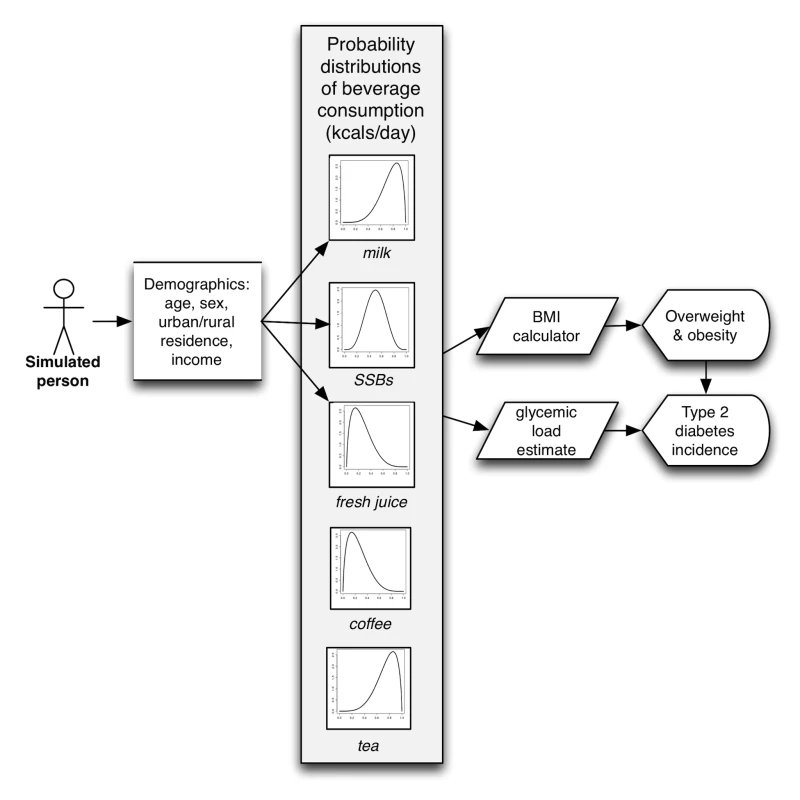

Our analysis proceeded in three steps. First, we calculated changes to overall beverage expenditure as well as own-price and cross-price elasticities between SSBs and the other major beverage types consumed in India (milk, fresh fruit juices, coffee, and tea) using survey data relating price to consumption. We next used these elasticity estimates to calculate per capita kilocalorie and glycemic load changes expected from a 20% excise tax on SSBs. Finally, constructing a discrete-time microsimulation model, we simulated changes in overweight, obesity, and type 2 diabetes incidence and prevalence over the period 2014–2023 given changes in caloric intake and glycemic load. Each component of our analysis was stratified by age-band, sex, income, and urban/rural residence, in order to analyze disparities between demographic subpopulations in India.

Data Sources

Elasticity calculations

The Indian National Sample Survey (NSS), wave 2009/2010 (the most recent data available), was used to calculate own - and cross-price elasticities corresponding to changes in SSB price in each demographic subgroup, controlling for changes in SSB availability [25]. The NSS Consumer Expenditure module is a widely used repeated quinquennial cross-sectional survey of household food consumption data from a nationally representative sample in terms of age and income distribution [25]. NSS data include beverage amount consumed and prices paid for each of the beverage categories, based on surveys of 100,855 households interviewed through a validated interviewer-assisted questionnaire with district-level validation of reported prices and oversampling of low-income, rural, and female-headed households. Our power calculations estimated that we could detect the odds ratio equivalent of a 10 kcal/person/day change with >80% power in each subgroup given a survey design effect of two [27]. We converted grams of consumption per capita into kilocalories per capita (mean and 95% confidence intervals) using a standard nutrient tables [28],[29]. Kilocalorie and glycemic load conversions included both mean and 95% confidence intervals reflecting the distribution of milk among whole, skim, and toned varieties [20]; the available fresh fruit juices on the Indian market [9]; and typical added sugar content to consumer-brewed coffee and tea [28]. Price was expressed in 2010 Indian rupees, adjusted through GDP price deflators [30].

BMI distribution and type 2 diabetes status

While the NSS provides data on consumption and price, it does not provide data on health parameters such as BMI and type 2 diabetes status. To analyze the covariance of SSB consumption with BMI and type 2 diabetes status, we used data from the Public Health Foundation of India's Indian Migration Study (IMS) 2007–2010, a national sample of 7,049 men and women from all three income tertiles and both urban and rural residency status (Figure 2). These individuals were evaluated through interviewer-administered food frequency questionnaires and anthropometric and medical assessments published previously [20],[31]. The dietary assessment was validated against independent surveys and a subsample analysis of 418 participants subjected to three 24-hour dietary recalls [20].

Fig. 2. Body mass index (BMI) distributions among cohorts (kg/m<sup>2</sup>), 2010 <em class="ref">[31]</em>. ![Body mass index (BMI) distributions among cohorts (kg/m<sup>2</sup>), 2010 <em class="ref">[31]</em>.](https://www.prolekare.cz/media/cache/resolve/media_object_image_small/media/image/07180536e6b70569d378f8809fdaea11.png)

Elasticity Calculation Details

Given the absence of a suitable instrumental variable to link with SSB prices, we calculated elasticities among the beverages using the classical Quadratic Almost Ideal Demand System [32], a standardized microeconomic system of equations that estimate how price variations affect expenditure, substitution between goods, and overall consumption (the inflationary effects of taxation). The equations are detailed in Text S1, and complete elasticity results are presented for each demographic subgroup in Table 1. A standard two-step procedure was also used to first estimate the probability of consumption, to account for censoring and zero consumption, and then estimate the share of expenditures spent on each beverage, controlling for availability and a series of socioeconomic variables detailed in Text S1 [33]–[35]. The system allows us to estimate shifting out of the purchased beverage market in the context of prices (e.g., to tap water), versus the degree of substitution between beverage classes following a price change in each beverage. The demand system was estimated in Stata version MP12.1 (StataCorp). The face validity of own-price SSB elasticity was compared against an international systematic review of elasticities [36]; our demand system revealed an own-price elasticity of SSBs of −0.94 (95% CI −0.90 to −0.98), within the review-based 95% confidence interval of −0.33 to −1.24. Cross-elasticities, as tabulated in Text S1, were also similar to published estimates, although the published estimates available have not included India [37].

Tab. 1. Elasticity given 1% change in SSB price, calculated from [25]. ![Elasticity given 1% change in SSB price, calculated from <em class="ref">[25]</em>.](https://www.prolekare.cz/media/cache/resolve/media_object_image_small/media/image/666c551ec317ea8c8c29f2d66ddcd802.png)

p<0.05. Tax Effect Estimates

To examine the kilocalorie changes attributable to a 20% SSB tax, the price elasticity for each beverage (percent change in consumption for each 1% change in SSB price) was multiplied by the change in SSB price (20% in the baseline case) and multiplied by baseline daily kilocalorie intake among multiple Indian subpopulations to estimate the change in individual daily intake for each beverage (Table 2).

Tab. 2. Kilocalorie consumption per day from beverages, overweight and obesity prevalence (% BMI≥25 kg/m2), and baseline diabetes incidence (per 100,000 persons) among cohorts, used for model initialization [20],[25],[31],[41],[42]. ![Kilocalorie consumption per day from beverages, overweight and obesity prevalence (% BMI≥25 kg/m<sup>2</sup>), and baseline diabetes incidence (per 100,000 persons) among cohorts, used for model initialization <em class="ref">[20]</em>,<em class="ref">[25]</em>,<em class="ref">[31]</em>,<em class="ref">[41]</em>,<em class="ref">[42]</em>.](https://www.prolekare.cz/media/cache/resolve/media_object_image_small/media/image/c7706ea3eb907b4baf2950954315982d.png)

Note that “income” here is measured using the Standard of Living Index (SLI), a household level asset-based scale devised for Indian surveys [38]. To estimate the potential effects of the tax on overweight and obesity prevalence (BMI≥25 kg/m2) and type 2 diabetes incidence, we constructed a microsimulation model, which simulates 10,000 adults for each cohort defined by every combination of: age (25–44, 45–65 years old), sex, income (low, middle, and high Standard of Living Index [SLI], a household-level asset-based scale devised for Indian surveys [38]), and urban/rural status (using the World Bank definition of urban residence [39]). Model details are itemized here according to ISPOR reporting guidelines [40], and the model flow diagram is depicted in Figure 2.

Sampling from the joint distribution of weight, height, consumption of each beverage type, and type 2 diabetes status from the IMS study, the model assigns simulated individuals a baseline profile of these factors, updating the estimates for secular trends (Table 2) [31],[41],[42]. Unlike a typical Markov model, the microsimulation approach can capture the impact of interventions on individual risk factor profiles, not just the average population effect of an intervention—allowing for complex relationships among multiple co-morbid risk factors to be incorporated into the experiment. This is important because reducing SSB consumption in an individual who has a high baseline intake of SSBs but also a high consumption of other beverages may have different outcomes than reducing SSB consumption for someone with less consumption of other beverages. The model was validated by comparing historical projections of 2000–2010 obesity and type 2 diabetes prevalence in India given year 2000 input values against independent World Health Organization survey-based estimates (Figure S1) [26].

We first simulated a baseline (no tax) case in which secular trends in kilocalorie consumption, glycemic load intake, and associated BMI and type 2 diabetes incidence changes were estimated. Two baseline scenarios were modeled: (1) a linear rise in SSB consumption of 13% per annum, fitting the secular trend from 1998–2012 (the longest time series available), and (2) a nonlinear rise predicted by a Bass marketing model used commonly by industry for projecting sales growth [43] (both shown in Figure 1; Bass model equation in Text S1). The model also incorporated secular trends in non-beverage calorie intake given by UN Food and Agricultural Organization estimates, to account for other caloric changes; linear trends in non-SSB beverage consumption were not statistically significant (Text S1) [9],[44]. Consumption changes were also converted into changes in glycemic load using standard glycemic index tables (Table 3) [45]. Note that these estimates include the typical distribution of sugars added by consumers to coffee and tea.

Tab. 3. Effective glycemic load (g) per kcal when accounting for typical serving sizes (g) and energy content (kcals) of beverages <em class="ref">[45]</em>. ![Effective glycemic load (g) per kcal when accounting for typical serving sizes (g) and energy content (kcals) of beverages <em class="ref">[45]</em>.](https://www.prolekare.cz/media/cache/resolve/media_object_image_small/media/image/8ba2777b227d1467e6661f022900645a.png)

To convert the calorie change estimates into changes in weight over time (Figure 3), we used a validated set of equations developed by the National Institutes of Health to estimate individual body weight change after a change in calorie consumption (reproduced in Text S1 with parameter values in Table S1) [46]. While there are many potential alternative models relating caloric intake changes to body weight, we chose this model as these equations were validated against experimental controlled feeding studies among humans in the age groups included in this simulation, and more accurately predicted changes in body weight from measured changes in energy intake than did alternative published models in head-to-head comparisons [47]. The equations account for the time delay between consumption changes and weight changes, assuming that energy must be conserved, and that changes in body composition and body weight result from imbalances between the intake and utilization rates of calories along with shifts between intracellular and extracellular compartments.

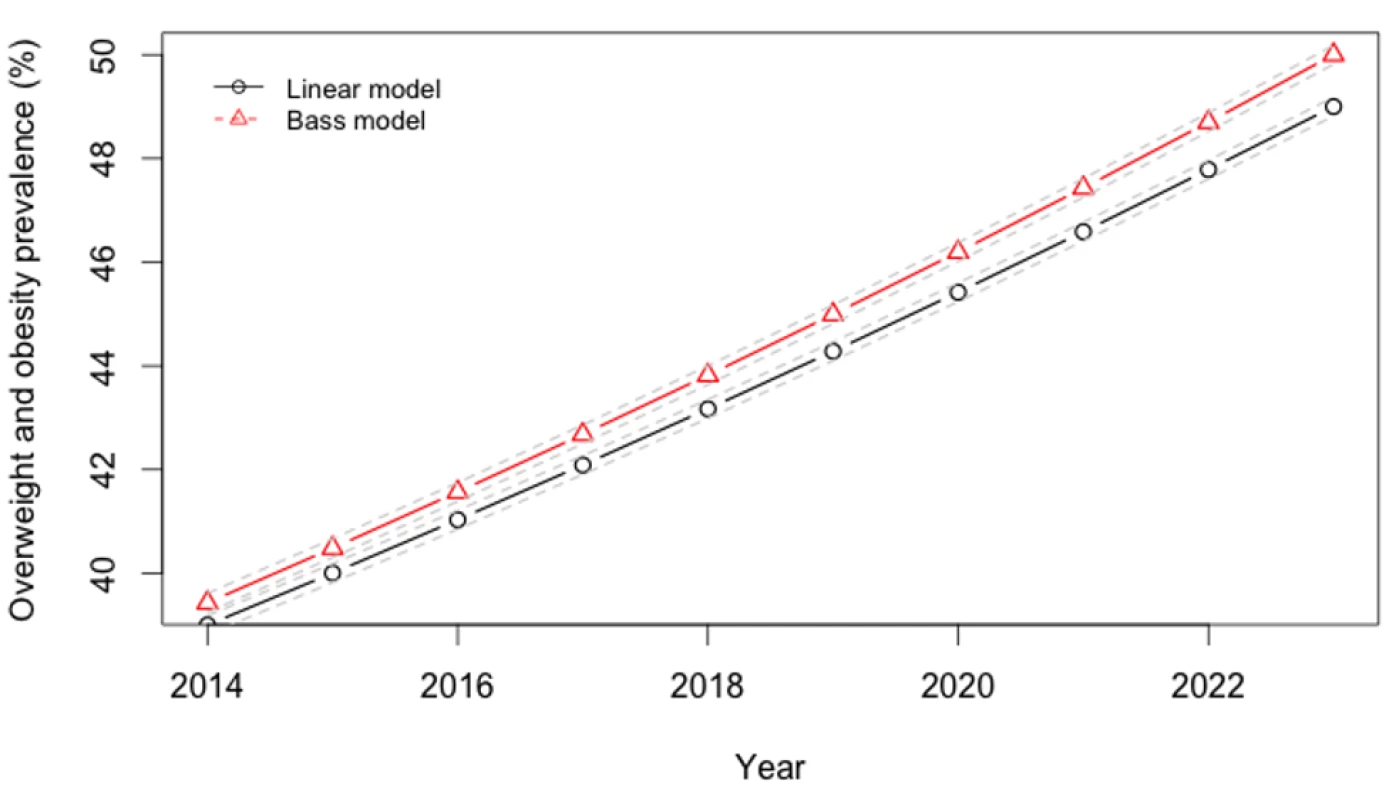

Fig. 3. Projected trajectory of overweight, obesity in India, 2013–2024.

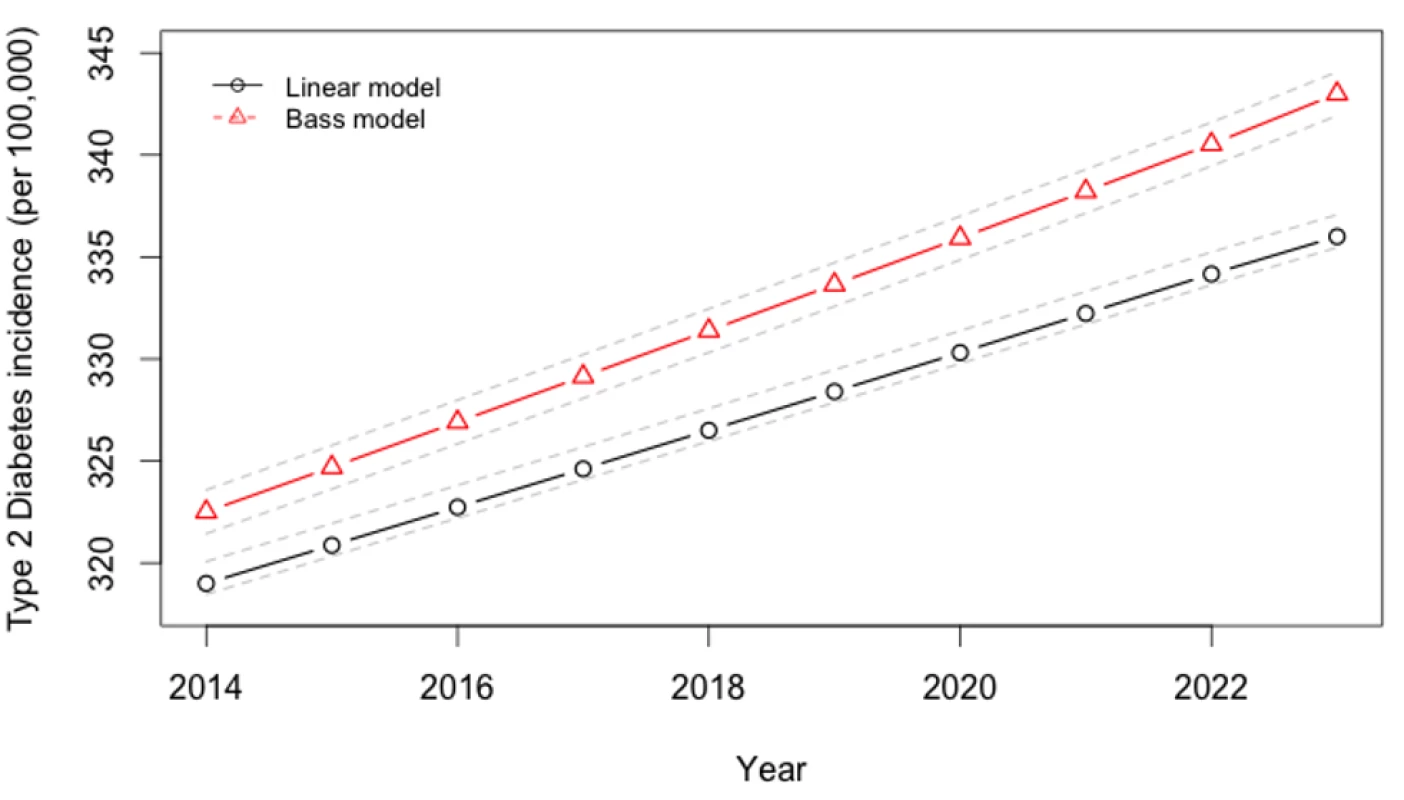

To estimate type 2 diabetes incidence (Figure 4), we employed a standard, validated hazard calculation method (Text S1) [48]. This calculation estimates how much an individual's risk of type 2 diabetes changes given changes in their beverage intake, employing an estimate of the relative risk of type 2 diabetes contributed by glycemic load, adjusted for an exponential rate of effect of 1/7.6 years−1 (95% CI 1/2.8–1/14.7 years−1) [49]. We used a type 2 diabetes relative risk estimate of 1.45 (95% CI 1.31–1.61) for each 100-g increment in glycemic load, based on a meta-analysis of 24 prospective cohort studies (p<0.001; 7.5 million person-years of follow-up) [50]. This relative risk estimate incorporates both the type 2 diabetes incidence risk associated with adiposity due to consumption, and the indirect pancreatic and hepatic effects of glycemic consumption that are obesity-independent (both obesity-mediated and non-obesity-mediated pathways) [51],[52]. We chose to use glycemic load relative risk estimates rather than relative risk estimates of diabetes specifically calculated only for SSBs [3], to account for the metabolic effects of beverages substituted for SSBs. This would be expected to produce conservative results from our simulation. Furthermore, the glycemic load calculation accounts for the fact that the impact on diabetes of different types of calories is different; that is, because the glycemic load per calorie is much higher for SSBs than other beverages (Table 3), a net change in calories alone does not predict type 2 diabetes risk, and the glycemic load estimate is used to account for the fact that some calories confer higher risk than others.

Fig. 4. Projected trajectory of type 2 diabetes incidence in India, 2013–2024.

For prospective simulation of the period 2014–2023, 10,000 simulations were performed of the overall model (10,000 simulations each with 10,000 individuals per cohort) in MATLAB version R2013b (MathWorks), sampling repeatedly from the probability distributions of the input parameter values to estimate 95% confidence intervals around modeled outcomes (Figure 5). All model parameters—including kilocalorie consumption, elasticities, glycemic load, relative risks, and the metabolic parameters—were included in the uncertainty analysis.

To simulate the 20% excise SSB tax, we simulated full country-wide tax coverage starting at the beginning of the year 2014. In sensitivity analyses, we varied the SSB tax rate from 10% to 30%. In a further sensitivity analysis, SSB consumption trends were simulated using a standard Bass diffusion model employed by industry to project sales growth (Figure 1, R2 = 0.98) [43], rather than the baseline linear trend also shown in Figure 1.

For outcomes analysis, we computed both overweight and obesity prevalence, because the threshold of 25 kg/m2 has been the Indian government standard for BMI surveillance [53], given elevated risk of type 2 diabetes among South Asians at lower BMI levels (>24 kg/m2) [54] than the international obesity threshold of 30 kg/m2.

Ethics Statement

Ethics committee approval for the IMS Study that was used to inform the model was obtained from the All India Institute of Medical Sciences Ethics Committee, reference number A-60/4/8/2004; for the overall modeling research, ethics committee approval was obtained from the Stanford University Institutional Review Board, reference number eP-28811.

Results

SSB Consumption, Obesity, and Type 2 Diabetes Rates

We observed little variation in SSB consumption levels among demographic cohorts in India (Table 2). Among the 390 kcal/person/day typically consumed from beverages among surveyed Indians, approximately 12% (46 kcal/person/day) were conferred by SSBs. Consumption varied from 9% (37 kcal) among the older cohort of 45–65 year olds to 13% (52 kcal) of overall beverage consumption among the younger 25–44 year old cohort, and was roughly equal among urban (12%, 48 kcal) and rural populations (12%, 45 kcal). SSBs composed 14% of beverage calories among the poorest income tertile and 12% among the wealthiest tertile. However, overall beverage calories were lowest among the poor (310 kcal/person/day) versus the wealthiest tertile (404 kcal/person/day), hence absolute consumption varied insignificantly by wealth (44 versus 47 kcal/person/day).

Rates of obesity and type 2 diabetes universally increased across cohorts in our projections over the period 2014–2023. We observed that if linear secular trends in SSB consumption continued in the absence of a tax (Figure 1), Indian overweight and obesity prevalence (percent adults 24–65 with BMI≥25 kg/m2) would be expected to increase from 39% to 49% and type 2 diabetes incidence would be expected to rise in parallel from 319 to 336 per 100,000 per year over the period 2014–2023. Amplification of these trends to 50% overweight prevalence and 343 per 100,000 type 2 diabetes incidence by year 2023 were observed in the Bass diffusion scenario, in which SSB consumption followed the curvilinear rise of marketing model projections (Figure 1), which forecast consumption increasing from 12.8 l/person/year in 2014 to 36.3 l/person/year in 2023 (approximately one-fourth the 2012 rates in Latin American countries [9]; Figure 1).

Elasticities

Much of the rise in SSB consumption would be expected to shift toward other beverage consumption in the context of an SSB tax. On the basis of microeconomic demand system estimates of expenditure data, SSB consumption was observed to decline by 0.94% for each 1% increase in SSB price (95% CI, a 0.90%–0.98% reduction). Substitution among beverages revealed a 0.049% (0.011%–0.087%) increase in milk consumption, 0.31% (0.27%–0.35%) increase in fresh fruit juice consumption, and a 0.13% (0.098%–0.16%) increase in tea consumption for each 1% rise in SSB price in the overall population, with small variations between groups (Table 1), but a non-significant degree of substitution with coffee (0.004%, −0.064% to 0.073%). Full elasticity estimate details are provided in Table 1.

Tax Effects

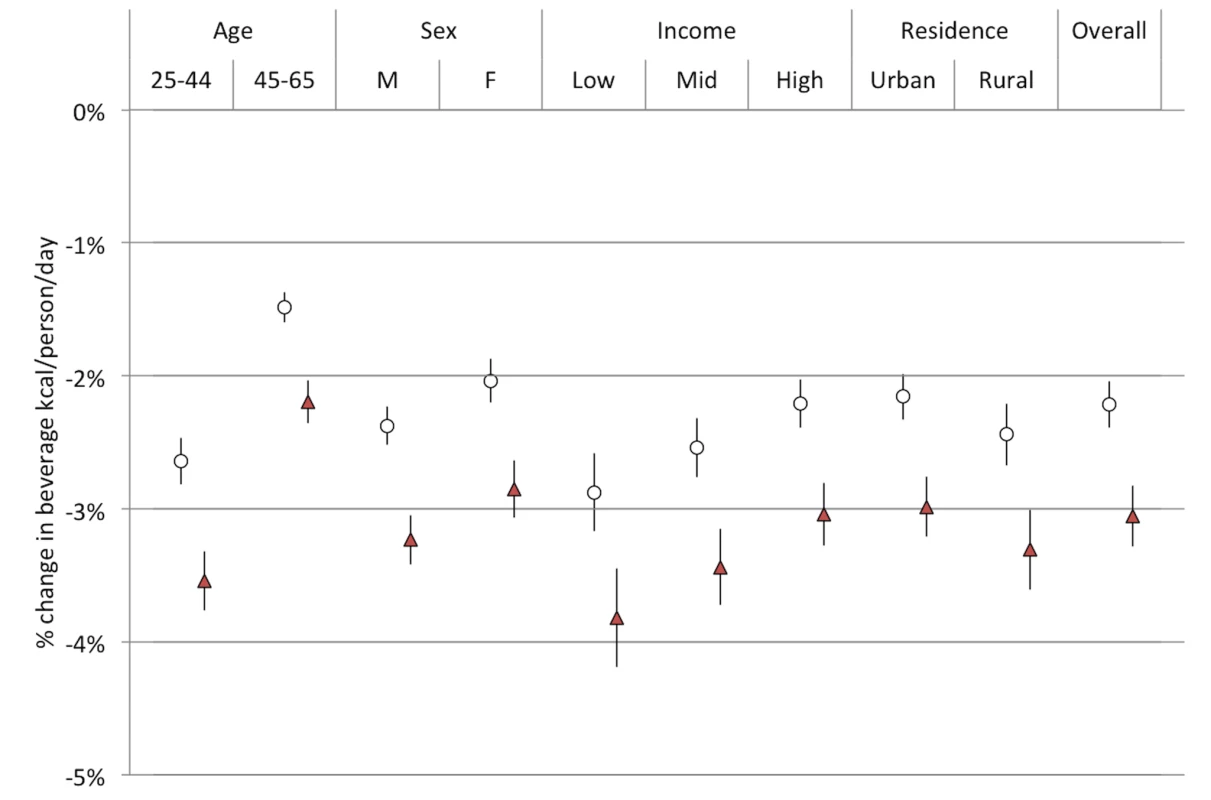

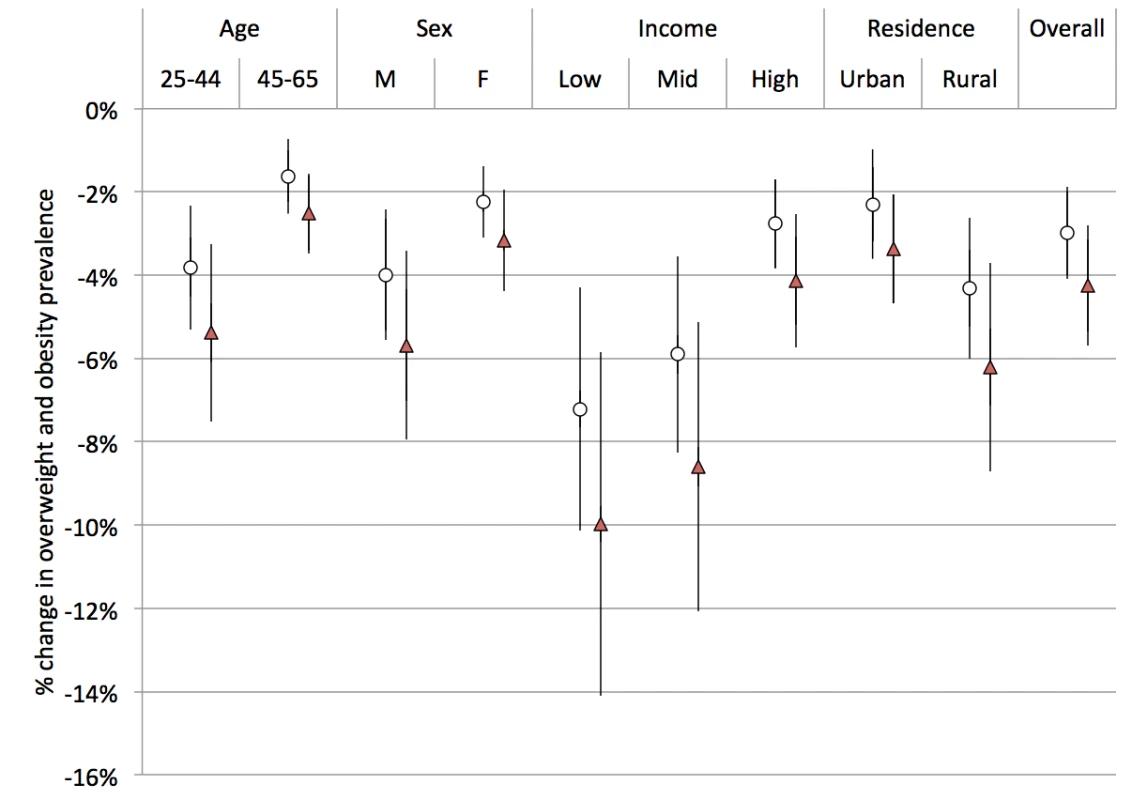

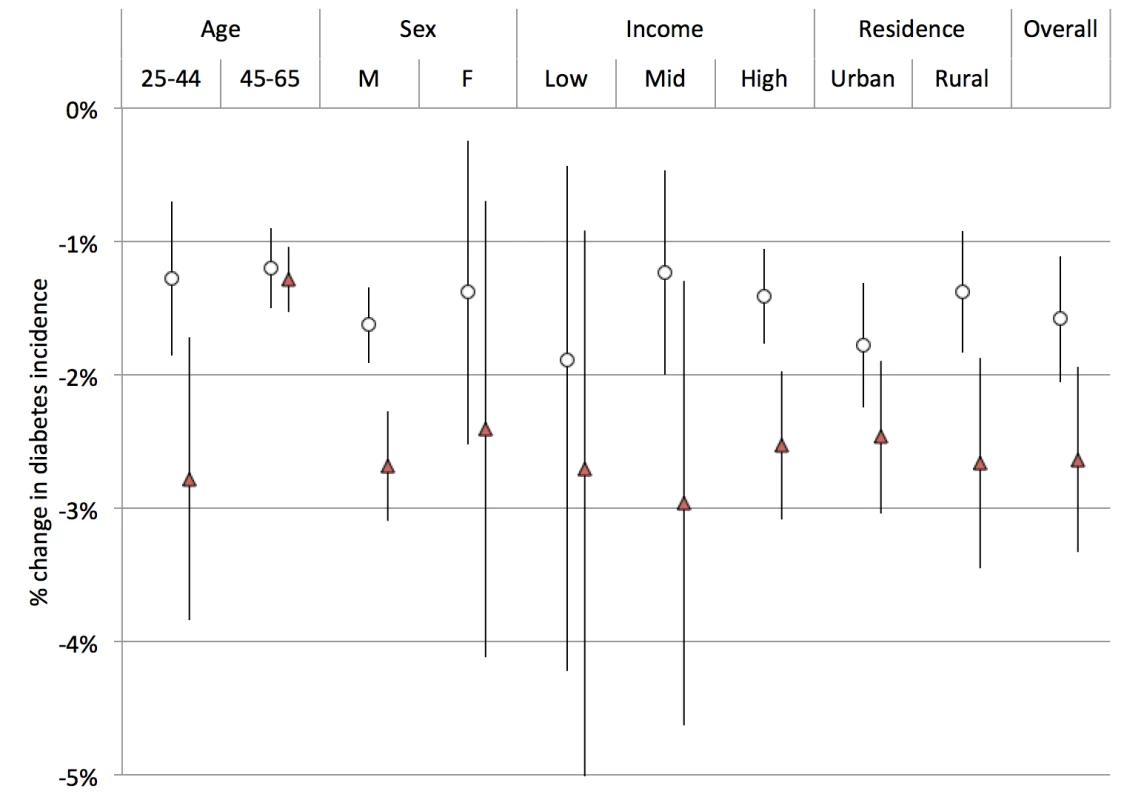

Using the calculated elasticities to project the effects of a 20% excise tax on SSBs (Figures S2–S6), we estimated obesity and type 2 diabetes rate changes among demographic cohorts (Figures 6–8). Overweight and obesity prevalence declined by 1.6% to 5.9% and type 2 diabetes incidence by 1.2% to 1.9% from the baseline estimates among the Indian subpopulations under a 20% SSB tax (Figures 7 and 8; 3.0% overweight/obesity reduction and 1.6% type 2 diabetes reduction in the overall population). Different sensitivities to the tax among cohorts were driven primarily by differences in the distribution of BMI, such that groups with lower current median BMIs were more easily able to maintain members of the cohort below the threshold of 25 kg/m2 (Table 2). In the setting of linear consumption increases in SSBs, younger (25–44 year olds), male, low-income, and rural populations were observed to experience the largest relative decline in kilocalorie consumption from beverages and associated declines in overweight and obesity prevalence (Figures 6–8). When differential glycemic load among beverages and different baseline incidence rates of type 2 diabetes were accounted for, urban rather than rural populations experienced the largest relative declines in type 2 diabetes incidence (Figure 8). As shown in Figures 6, 7, and 8, a large confidence interval was observed among females and low-income populations due to imprecision in current diabetes incidence estimates among these groups, resulting from less robust surveillance quality among these cohorts.

Fig. 6. Projected changes in kilocalories per person per day consumed from all beverages.

Open circles, linear model; red triangles, Bass model of changes in SSB consumption over time. Fig. 7. Change in overweight and obesity prevalence (relative change in percent of adults with body mass index >25 kg/m2).

Open circles, linear model; red triangles, Bass model of changes in SSB consumption over time. Fig. 8. Change in type 2 diabetes incidence (per 100,000) under a 20% excise tax on SSBs.

Open circles, linear model; red triangles, Bass model of changes in SSB consumption over time. Converting the relative rate declines into absolute numbers of averted overweight, obesity, and type 2 diabetes cases—accounting for population size differences and demographic trends in population growth [55]—revealed large variations among population subgroups. The largest number of prevalent overweight and obesity cases averted from 2014–2023 would still be expected among the younger cohort (3.9 million people avoiding overweight in the 25–44 year group versus 1.1 million in the 45–65 year old group), as well as males (2.9 million versus 2.1 female), and rural populations (3.1 million versus 1.4 million urban), but also among the highest income tertile (1.7 million versus 1.4 million in the mid tertile and 1.1 million among the lowest tertile). In absolute numbers, the most type 2 diabetes cases averted from 2014–2023 were among the older cohort (573,000 among 45–65 year olds versus 477,000 in 25–44 year olds over 2014–2023), men (1.6 million versus 1.2 million women), the highest income tertile (603,000 versus 248,000 in lowest tertile), and rural populations (877,000 versus 741,000 urban). In total, 11.2 million overweight and obesity cases (−3.0%, 95% CI 7.5–15.0 million) and 400,000 type 2 diabetes cases (−1.6%, 95% CI 300,000–500,000) would be averted from 2014–2023 by a 20% SSB excise tax, according to our model.

Sensitivity Analyses

The preventive impact of the tax was amplified by 40% to 60% when we shifted our assumptions from a linear trend in SSB consumption to a Bass diffusion model of SSB consumption trends, but qualitative differences between population subgroups were unaltered (Figures 6–8). Should consumer trends in SSB consumption increase according to the Bass trajectory, the preventive efficacy of a 20% SSB tax would rise by 40% to 60% over the baseline forecast, reducing overweight and obesity prevalence by 2.5%–10.0% and averting 1.0%–2.8% of incident type 2 diabetes (a 4.2% reduction in overweight/obesity prevalence, or 15.8 million people, 95% CI 10.4–21.1 million, and 2.5% reduction in type 2 diabetes incidence in the overall population, or 600,000 people, 95% CI 400,000–800,000; Figures 7 and 8).

The sensitivity of overweight, obesity, and type 2 diabetes to tax rate variations was linear in the case of overweight and obesity rates, but nonlinear for type 2 diabetes incidence, such that reducing the tax from 20% to 10% reduced the projected impact of the tax on overweight and obesity by 50% and on type 2 diabetes incidence by 62%. Conversely, increasing the tax from 20% to 30% increased the projected impact of the tax on overweight and obesity by 50% and on type 2 diabetes incidence by 33%. The nonlinearity in diabetes rates arose from complex changes in glycemic load intake when accounting for substitutions between beverages; increasing the SSB tax, for example, produces diminishing returns as substituted goods contribute to total glycemic load consumption to varying degrees, conditional on their price and total per capita expenditures on beverages.

Discussion

An excise tax on SSBs would be expected to mitigate increases in overweight, obesity, and type 2 diabetes cases in India under numerous alternative scenarios and assumptions, even after accounting for beverage substitution patterns. Under the conservative scenario of a linear rise in SSB consumption, a 20% SSB excise tax would be expected to prevent 11.2 million new cases of overweight and obesity (a 3.0% decline), and 400,000 cases of type 2 diabetes (a 1.6% decline) over the decade 2014–2023, according to a microsimulation model informed by nationally representative consumer expenditure, price, BMI, and type 2 diabetes incidence data. Under the case in which consumption follows business marketing models, which mirror recent SSB sales increases, a 20% SSB tax would be expected to avert 4.2% of prevalent overweight/obesity and 2.5% of incident type 2 diabetes from 2014–2023. As compared to other population-level obesity interventions (e.g., nutrition labels and consumer education) that have been studied to date, which typically result in <1% reductions in overweight and obesity and non-significant changes in diabetes rates [56]–[60], this implies a comparatively large population-level impact from SSB taxation. While a number of low - and middle-income countries are creating an array of large-scale interventions to address increased obesity and diabetes, to date none have sustained reductions in BMI [18].

The SSB tax appeared likely to significantly lower both BMI and type 2 diabetes incidence among all demographic cohorts, without perverse increases in BMI or type 2 diabetes due to substitution effects. However, the effect sizes of the tax varied notably among different demographic groups. Contrary to our a priori hypothesis, the largest relative declines in overweight and obesity prevalence were observed among young rural men, as this group with lower current BMI more easily maintained itself below the BMI threshold of 25 kg/m2 in scenarios with SSB taxation than without such taxation. The BMI threshold of 25 kg/m2 corresponds to a critical inflexion point of increasing type 2 diabetes risk among Indians [54].

These findings offer substantial contributions to the existing literature on non-communicable disease prevention in low - and middle-income countries. Our assessment is the first to our knowledge to study the impact of SSB taxation in India, which is expected to experience more deaths from non-communicable diseases than any other country in the world over the next decade, and is considered a policy leader among developing nations devising chronic disease interventions [61]. Unlike most assessments of large-scale interventions in developing countries, our study is based on disaggregated population-representative data specific to different income groups, urban/rural residence, both sexes, and both middle-aged and older adults, accounting for within-country heterogeneity in consumption behavior and disease risk. Prior policy models have been criticized for either projecting results from Western populations onto other countries, or aggregating large, heterogeneous developing country populations into a single population average, which can produce perverse outcomes when policies benefit one segment of the population while potentially risking poor outcomes among others [17],[62].

Our results also incorporate the effects of substitution among beverage classes through a direct estimation method rather than assumptions alone, an advance over most models of fiscal policy that have been criticized for ignoring this issue or assuming arbitrary levels of substitution [63]. The research also lends insights into the fact that obesity and diabetes impacts of SSB taxes may not be entirely parallel, in light of the glycemic load effects of food intake on type 2 diabetes risk. This glycemic load factor incorporates the differential impact of each calorie of SSBs versus other beverages on diabetes risk, given that glycemic load per calorie of SSBs is about 5.3 times that of milk, for example (Table 3).

The impact of BMI on chronic disease among Indians is notably different than among other populations. A large literature suggests that Indians at BMIs ranging from 20–22 kg/m2 have percent body fats equivalent to non-Hispanic white Americans or British adults with BMIs of 27–30 kg/m2, and Indians have an increased risk type 2 diabetes at much lower BMI levels than these other populations [64]–[68]. Our estimates therefore relied directly on both adiposity-related and direct metabolic impact estimates of type 2 diabetes risk associated with glycemic load consumption changes. The estimates incorporate the glycemic load impact of fruit juices as substitutes for SSBs, given the literature suggesting that fruit juice consumption may have adverse metabolic effects consistent with glycemic load contributions, even if having lower calories than SSBs [69].

As with other projections of fiscal policy interventions, our assessment relies on mathematical modeling, which inherently requires several assumptions and limitations. First, we employ the assumption that consumer expenditure behavior from prior years, captured in price elasticities, will reflect future behavior among consumers. This abstraction makes it impossible to account for the potential increased willingness-to-pay for SSBs in the context of social trends in popularity and income increases. Second, our metabolic equations calculating weight change in the context of caloric change does not account for diet beverages (which are currently <0.1 l/person/year in India [9]) that have unclear relationships to metabolic syndrome [70]–[72], and assumes that physical activity will not change directly as a result of soda taxation, even though compensatory activity after substitution may also occur (e.g., individuals who change their diet may decide to exercise more or less based on perceptions of the healthfulness of their dietary change). Third, we abstract from dietary food frequency questionnaires that are validated against 24-hour dietary recalls and independent databases [20], but are still subject to recall bias and underreporting. Fourth, our model produced wide confidence intervals among the lowest-income tertile and women due to undersampling of rural low-income populations. Nevertheless, our purpose in employing this model was not to predict exact future rates of disease, which is impossible from any model, but to understand potential demographic differences in taxation impact and estimate the sensitivity of forecasts to varying assumptions about future SSB consumption. A consistent finding among all cohorts was that a rise in SSB consumption in accordance with recent trends would portend increasing overweight, obesity, and type 2 diabetes rates, but also render an excise tax on SSBs differentially more effective as a preventive population strategy. Finally, we did not account for safety concerns if SSB taxation shifts to increasing tap water usage in the context of some populations have unsafe water supplies in India; however, this is unlikely to produce a true epidemiological shift in disease burden as populations already exposed to non-potable water-based pathogens would likely to continue to be exposed, and unexposed populations are unlikely to be newly exposed because of an SSB tax given that nearly all populations drink some tap water in their locality. Similarly, we did not track the vitamin and mineral-related implications of SSB taxation as it implies differential consumption of fruit juices that may have other nutritional benefits but that also contribute to type 2 diabetes risks [69].

Another limitation of our analysis is that our treatment of the SSB taxation strategy is unable to quantify the attendant ethical, political, and social dilemmas presented by taxation strategies. Sufficient data are not available on changes in beverage intake behaviors among Indian children, or the long-term metabolic and cardiovascular consequences of SSB consumption changes among children aside from weight gain [73]. Hence, we focused on validated models of adult metabolism, since the cardiovascular and metabolic disease burden and health care cost would be expected to accrue most among adults over the near-term policy window that we simulated here. Excise taxation on foods can also be viewed as discriminatory, paternal, or regressive (in an economic sense). An alternate perspective is that preventing obesity and diabetes among lowest-income populations, who are among the most affected over time, will produce the greatest social benefit as low-income populations are also least likely to obtain diagnosis and treatment for chronic disease [5]. Another unresolved political issue is the administrative challenge of enforcing taxes on purchases in informal settings, given that SSBs are often sold by small vendors, with potential implications for household income, economic growth, and poverty given the employment impact of SSB sales. Excise taxes at the manufacturing level would allow bypassing of some enforcement obstacles, but remain politically opposed by beverage companies. Studies of existing SSB taxes in Western populations have highlighted that the taxes imposed have been generally too small to have meaningful effect size, while imposing larger taxes at equivalent levels to those simulated here may confer greater benefits [14],[15]. Future research should replicate the findings observed here in other rapidly developing middle-income countries where SSB consumption is increasing at a rapid rate [6].

For policy, our research indicates that SSB price increases are likely to generate substantial reductions in overweight, obesity, and type 2 diabetes through pathways affecting caloric intake and glycemic load. Fiscal strategies could mitigate obesity and type 2 diabetes in India over the next decade, even for more remote and low-income populations that are less likely to have transitioned to other components of Western diets in the near term.

Supporting Information

Zdroje

1. MalikVS, SchulzeMB, HuFB (2006) Intake of sugar-sweetened beverages and weight gain: a systematic review. Am J Clin Nutr 84 : 274–288.

2. MalikVS, PopkinBM, BrayGA, DesprésJ-P, WillettWC, et al. (2010) Sugar-sweetened beverages and risk of metabolic syndrome and type 2 diabetes: a meta-analysis. Diabetes Care 33 : 2477–2483.

3. SchulzeMB, MansonJAE, LudwigDS, ColditzGA, StampferMJ, et al. (2004) Sugar-sweetened beverages, weight gain, and incidence of type 2 diabetes in young and middle-aged women. JAMA 292 : 927–934.

4. The InterAct consortium (2013) Consumption of sweet beverages and type 2 diabetes incidence in European adults: results from EPIC-InterAct. Diabetologia 56 : 1520–1530.

5. BrownellKD, FarleyT, WillettWC, PopkinBM, ChaloupkaFJ, et al. (2009) The public health and economic benefits of taxing sugar-sweetened beverages. N Engl J Med 361 : 1599–1605.

6. Basu S, McKee M, Galea G, Stuckler D (2013) Relationship of soft drink consumption to global overweight, obesity, and diabetes: a cross-national analysis of 75 countries. Am J Public Health: e1–e7.

7. KleimanS, NgSW, PopkinB (2012) Drinking to our health: can beverage companies cut calories while maintaining profits? Obes Rev Off J Int Assoc Study Obes 13 : 258–274.

8. BarqueraS, Hernandez-BarreraL, TolentinoML, EspinosaJ, NgSW, et al. (2008) Energy intake from beverages is increasing among Mexican adolescents and adults. J Nutr 138 : 2454–2461.

9. Euromonitor International (2013) Passport Global Market Information Database. New York: Euromonitor.

10. BasuS, StucklerD, McKeeM, GaleaG (2012) Nutritional determinants of worldwide diabetes: an econometric study of food markets and diabetes prevalence in 173 countries. Public Health Nutr 1 : 1–8.

11. BasuS, YoffeP, HillsN, LustigRH (2013) The relationship of sugar to population-level diabetes prevalence: an econometric analysis of repeated cross-sectional data. PLoS ONE 8: e57873 doi:10.1371/journal.pone.0057873

12. FinkelsteinEA, ZhenC, NonnemakerJ, ToddJE (2010) Impact of targeted beverage taxes on higher - and lower-income households. Arch Intern Med 170 : 2028–2034.

13. PowellLM, ChaloupkaFJ (2009) Food prices and obesity: evidence and policy implications for taxes and subsidies. Milbank Q 87 : 229–257.

14. SturmR, PowellLM, ChriquiJF, ChaloupkaFJ (2010) Soda taxes, soft drink consumption, and children's body mass index. Health Aff (Millwood) 29 : 1052–1058.

15. WangYC, CoxsonP, ShenYM, GoldmanL, Bibbins-DomingoK (2012) A Penny-per-ounce tax on sugar-sweetened beverages would cut health and cost burdens of diabetes. Health Aff (Millwood) 31 : 199–207.

16. BriggsADM, MyttonOT, KehlbacherA, TiffinR, RaynerM, et al. (2013) Overall and income specific effect on prevalence of overweight and obesity of 20% sugar sweetened drink tax in UK: econometric and comparative risk assessment modelling study. BMJ 347: f6189.

17. EbrahimS, PearceN, SmeethL, CasasJP, JaffarS, et al. (2013) Tackling non-communicable diseases in low - and middle-income countries: is the evidence from high-income countries all we need? PLoS Med 10: e1001377 doi:10.1371/journal.pmed.1001377

18. PopkinBM, AdairLS, NgSW (2012) Global nutrition transition and the pandemic of obesity in developing countries. Nutr Rev 70 : 3–21.

19. ReardonT, TimmerCP, MintenB (2012) Supermarket revolution in Asia and emerging development strategies to include small farmers. Proc Natl Acad Sci U S A 109 : 12332–12337.

20. BansalD, SatijaA, KhandpurN, BowenL, KinraS, et al. (2010) Effects of migration on food consumption patterns in a sample of Indian factory workers and their families. Public Health Nutr 13 : 1982–1989.

21. SubramanianS, CorsiDJ, SubramanyamMA, Davey SmithG (2013) Jumping the gun: the problematic discourse on socioeconomic status and cardiovascular health in India. Int J Epidemiol 42 : 1410–1426.

22. VellakkalS, SubramaniaSV, MillettC, BasuS, StucklerD, et al. (n.d.) Socioeconomic inequalities in non-communicable diseases prevalence in India: disparities between self-reported diagnoses and standardized measures. PLoS ONE 8: e68219 doi:10.1371/journal.pone.0068219

23. DeepaM, AnjanaRM, ManjulaD, NarayanKMV, MohanV (2011) Convergence of prevalence rates of diabetes and cardiometabolic risk factors in middle and low income groups in urban India: 10-year follow-up of the Chennai Urban Population Study. J Diabetes Sci Technol 5 : 918–927.

24. FletcherJM, FrisvoldDE, TefftN (2010) The effects of soft drink taxes on child and adolescent consumption and weight outcomes. J Public Econ 94 : 967–974.

25. Ministry of Statistics and Programme Implementation (2012) National Sample Survey. Delhi: Government of India.

26. World Health Organization (2012) WHO Global InfoBase.Geneva: WHO.

27. Cohen J (1988) Statistical power analysis for the behavioral sciences. New York: Routledge Academic.

28. US Department of Agriculture (2013) National Nutrient Database for Standard Reference. Release 25. Washington (D.C.): National Agricultural Library.

29. Gopalan C, Sastri BVR, Balasubramanian SC (1971) Nutritive value of Indian foods. Hyderabad: Hyderabad Natl Inst Nutr.

30. OECD (2013) Main Economic Indicators - complete database. Paris: Organisation for Economic Co-operation and Development. Available: http://www.oecd-ilibrary.org/content/data/data-00052-en. Accessed 9 June 2013.

31. EbrahimS, KinraS, BowenL, AndersenE, Ben-ShlomoY, et al. (2010) The effect of rural-to-urban migration on obesity and diabetes in India: a cross-sectional study. PLoS Med 7: e1000268 doi:10.1371/journal.pmed.1000268

32. BanksJ, BlundellR, LewbelA (1997) Quadratic Engel curves and consumer demand. Rev Econ Stat 79 : 527–539.

33. ShonkwilerJS, YenST (1999) Two-step estimation of a censored system of equations. Am J Agric Econ 81 : 972–982.

34. HainesPS, GuilkeyDK, PopkinBM (1988) Modeling Food Consumption Decisions as a Two-Step Process. Am J Agric Econ 70 : 543–552.

35. PollakRA, WalesTJ (1978) Estimation of complete demand systems from household budget data: the linear and quadratic expenditure systems. Am Econ Rev 68 : 348–359.

36. AndreyevaT, LongMW, BrownellKD (2010) The impact of food prices on consumption: a systematic review of research on the price elasticity of demand for food. Am J Public Health 100 : 216–222.

37. DharmasenaS, CappsO (2012) Intended and unintended consequences of a proposed national tax on sugar-sweetened beverages to combat the US obesity problem. Health Econ 21 : 669–694.

38. International Institute for Population Sciences (IIPS) (2007) National Family Health Survey (NFHS-3). Mumbai: IIPS.

39. World Bank (2012) World Development Indicators. Washington (D.C.): IBRD.

40. CaroJJ, BriggsAH, SiebertU, KuntzKM (2012) Modeling Good Research Practices—Overview A Report of the ISPOR-SMDM Modeling Good Research Practices Task Force–1. Med Decis Making 32 : 667–677.

41. SadikotSM, NigamA, DasS, BajajS, ZargarAH, et al. (2004) The burden of diabetes and impaired glucose tolerance in India using the WHO 1999 criteria: prevalence of diabetes in India study (PODIS). Diabetes Res Clin Pract 66 : 301–307.

42. DanaeiG, FinucaneMM, LuY, SinghGM, CowanMJ, et al. (2011) National, regional, and global trends in fasting plasma glucose and diabetes prevalence since 1980: systematic analysis of health examination surveys and epidemiological studies with 370 country-years and 2.7 million participants. Lancet 378 : 31–40.

43. BassFM (2004) Comments on “A New Product Growth for Model Consumer Durables The Bass Model.”. Manag Sci 50 : 1833–1840.

44. Food and Agricultural Organization (2013) FAOSTAT database. Rome: United Nations.

45. AtkinsonFS, Foster-PowellK, Brand-MillerJC (2008) International Tables of Glycemic Index and Glycemic Load Values: 2008. Diabetes Care 31 : 2281–2283.

46. HallKD, SacksG, ChandramohanD, ChowCC, WangYC, et al. (2011) Quantification of the effect of energy imbalance on bodyweight. Lancet 378 : 826–837.

47. HallKD, JordanPN (2008) Modeling weight-loss maintenance to help prevent body weight regain. Am J Clin Nutr 88 : 1495–1503.

48. LimSS, GazianoTA, GakidouE, ReddyKS, FarzadfarF, et al. (2007) Prevention of cardiovascular disease in high-risk individuals in low-income and middle-income countries: health effects and costs. Lancet 370 : 2054–2062.

49. CDC (n.d.) CDC's Diabetes Program - Data & Trends - Duration of Diabetes - Distribution of Diabetes Duration Among Adults Aged 18–79 Years, United States, 1997–2009. Available: http://www.cdc.gov/diabetes/statistics/duration/fig2.htm. Accessed 19 December 2012.

50. LiveseyG, TaylorR, LiveseyH, LiuS (2013) Is there a dose-response relation of dietary glycemic load to risk of type 2 diabetes? Meta-analysis of prospective cohort studies. Am J Clin Nutr 97 : 584–596.

51. BremerAA, Mietus-SnyderM, LustigRH (2012) Toward a unifying hypothesis of metabolic syndrome. Pediatrics 129 : 557–570.

52. TeffKL, GrudziakJ, TownsendRR, DunnTN, GrantRW, et al. (2009) Endocrine and metabolic effects of consuming fructose - and glucose-sweetened beverages with meals in obese men and women: influence of insulin resistance on plasma triglyceride responses. J Clin Endocrinol Metab 94 : 1562–1569.

53. Indian Consensus Group (1996) Indian consensus for prevention of hypertension and coronary heart disease. A joint scientific statement of Indian Society of Hypertension and International College of Nutrition. J Nutr Env Med 6 : 309–318.

54. ChiuM, AustinPC, ManuelDG, ShahBR, TuJV (2011) Deriving ethnic-specific BMI cutoff points for assessing diabetes risk. Diabetes Care 34 : 1741–1748.

55. Registrar General & Census Commissioner (2011) Census of India. Delhi: Ministry of Home Affairs.

56. TuahNA, AmielC, QureshiS, CarJ, KaurB, et al. (2011) Transtheoretical model for dietary and physical exercise modification in weight loss management for overweight and obese adults. Cochrane Database Syst Rev 10: CD008066.

57. ShawK, O'RourkeP, Del MarC, KenardyJ (2005) Psychological interventions for overweight or obesity. Cochrane Database Syst Rev 2: CD003818.

58. WatersE, de Silva SanigorskiA, HallBJ, BrownT, CampbellKJ, et al. (2012) Interventions for preventing obesity in children (review). Cochrane Collab 1–212.

59. ThomasDE, ElliottEJ, BaurL (2007) Low glycaemic index or low glycaemic load diets for overweight and obesity. Cochrane Database Syst Rev Online CD005105.

60. Prevention I of M (US) C on AP in O, Glickman D (2012) Accelerating Progress in Obesity Prevention: Solving the Weight of the Nation. Washington (D.C.): National Academies Press.

61. World Health Organization (2011) United Nations high-level meeting on noncommunicable disease prevention and control. Geneva: WHO.

62. BasuS, BabiarzKS, EbrahimS, VellakkalS, StucklerD, et al. (2013) Palm oil taxes and cardiovascular disease mortality in India: economic-epidemiologic model. BMJ 347: f6048.

63. EylesH, MhurchuCN, NghiemN, BlakelyT (2012) Food pricing strategies, population diets, and non-communicable disease: a systematic review of simulation studies. PLoS Med 9: e1001353 doi:10.1371/journal.pmed.1001353

64. MisraA, KhuranaL (2009) The metabolic syndrome in South Asians: epidemiology, determinants, and prevention. Metab Syndr Relat Disord 7 : 497–514.

65. MisraA, VikramNK (2004) Insulin resistance syndrome (metabolic syndrome) and obesity in Asian Indians: evidence and implications. Nutr Burbank Los Angeles Cty Calif 20 : 482–491.

66. BhatDS, YajnikCS, SayyadMG, RautKN, LubreeHG, et al. (2005) Body fat measurement in Indian men: comparison of three methods based on a two-compartment model. Int J Obes 2005 29 : 842–848.

67. Deurenberg-YapM, SchmidtG, van StaverenWA, DeurenbergP (2000) The paradox of low body mass index and high body fat percentage among Chinese, Malays and Indians in Singapore. Int J Obes Relat Metab Disord J Int Assoc Study Obes 24 : 1011–1017.

68. KesavachandranCN, BihariV, MathurN (2012) The normal range of body mass index with high body fat percentage among male residents of Lucknow city in north India. Indian J Med Res 135 : 72–77.

69. BazzanoLA, LiTY, JoshipuraKJ, HuFB (2008) Intake of fruit, vegetables, and fruit juices and risk of diabetes in women. Diabetes Care 31 : 1311–1317.

70. De Koning L, Malik VS, Kellogg MD, Rimm EB, Willett WC, et al.. (2012) Sweetened beverage consumption, incident coronary heart disease, and biomarkers of risk in men. Circulation 125: : 1735–1741, S1.

71. De KoningL, MalikVS, RimmEB, WillettWC, HuFB (2011) Sugar-sweetened and artificially sweetened beverage consumption and risk of type 2 diabetes in men. Am J Clin Nutr 93 : 1321–1327.

72. DuffeyKJ, SteffenLM, Van HornL, JacobsDRJr, PopkinBM (2012) Dietary patterns matter: diet beverages and cardiometabolic risks in the longitudinal Coronary Artery Risk Development in Young Adults (CARDIA) Study. Am J Clin Nutr 95 : 909–915.

73. De RuyterJC, OlthofMR, SeidellJC, KatanMB (2012) A trial of sugar-free or sugar-sweetened beverages and body weight in children. N Engl J Med 367 : 1397–1406.

Štítky

Interní lékařství

Článek vyšel v časopisePLOS Medicine

Nejčtenější tento týden

2014 Číslo 1- Není statin jako statin aneb praktický přehled rozdílů jednotlivých molekul

- Magnosolv a jeho využití v neurologii

- Moje zkušenosti s Magnosolvem podávaným pacientům jako profylaxe migrény a u pacientů s diagnostikovanou spazmofilní tetanií i při normomagnezémii - MUDr. Dana Pecharová, neurolog

- Biomarker NT-proBNP má v praxi široké využití. Usnadněte si jeho vyšetření POCT analyzátorem Afias 1

- S prof. Vladimírem Paličkou o racionální suplementaci kalcia a vitaminu D v každodenní praxi

-

Všechny články tohoto čísla

- Soon Will Be Ten: A Call for Papers on the Health of Pre-adolescent Children

- Home Blood Pressure Monitoring: New Evidence for an Expanded Role

- Cervical Cancer Screening in Older Women: New Evidence and Knowledge Gaps

- Taxes on Sugar-Sweetened Beverages to Curb Future Obesity and Diabetes Epidemics

- The Failure of Screening and Treating as a Malaria Elimination Strategy

- Averting Obesity and Type 2 Diabetes in India through Sugar-Sweetened Beverage Taxation: An Economic-Epidemiologic Modeling Study

- Managing Incidental Genomic Findings in Clinical Trials: Fulfillment of the Principle of Justice

- Associations between Intimate Partner Violence and Termination of Pregnancy: A Systematic Review and Meta-Analysis

- Developing a Sustainable Nutrition Research Agenda in Sub-Saharan Africa—Findings from the SUNRAY Project

- Scale-up of Malaria Rapid Diagnostic Tests and Artemisinin-Based Combination Therapy: Challenges and Perspectives in Sub-Saharan Africa

- Preterm Birth and Childhood Wheezing Disorders: A Systematic Review and Meta-Analysis

- Cervical Screening at Age 50–64 Years and the Risk of Cervical Cancer at Age 65 Years and Older: Population-Based Case Control Study

- Improving Women's Health through Universal Health Coverage

- A Risk Prediction Model for the Assessment and Triage of Women with Hypertensive Disorders of Pregnancy in Low-Resourced Settings: The miniPIERS (Pre-eclampsia Integrated Estimate of RiSk) Multi-country Prospective Cohort Study

- Risk Stratification by Self-Measured Home Blood Pressure across Categories of Conventional Blood Pressure: A Participant-Level Meta-Analysis

- Impact of Intermittent Screening and Treatment for Malaria among School Children in Kenya: A Cluster Randomised Trial

- Muscle-Strengthening and Conditioning Activities and Risk of Type 2 Diabetes: A Prospective Study in Two Cohorts of US Women

- PLOS Medicine

- Archiv čísel

- Aktuální číslo

- Informace o časopisu

Nejčtenější v tomto čísle- Associations between Intimate Partner Violence and Termination of Pregnancy: A Systematic Review and Meta-Analysis

- Risk Stratification by Self-Measured Home Blood Pressure across Categories of Conventional Blood Pressure: A Participant-Level Meta-Analysis

- A Risk Prediction Model for the Assessment and Triage of Women with Hypertensive Disorders of Pregnancy in Low-Resourced Settings: The miniPIERS (Pre-eclampsia Integrated Estimate of RiSk) Multi-country Prospective Cohort Study

- Scale-up of Malaria Rapid Diagnostic Tests and Artemisinin-Based Combination Therapy: Challenges and Perspectives in Sub-Saharan Africa

Kurzy

Zvyšte si kvalifikaci online z pohodlí domova

Autoři: prof. MUDr. Vladimír Palička, CSc., Dr.h.c., doc. MUDr. Václav Vyskočil, Ph.D., MUDr. Petr Kasalický, CSc., MUDr. Jan Rosa, Ing. Pavel Havlík, Ing. Jan Adam, Hana Hejnová, DiS., Jana Křenková

Autoři: MUDr. Irena Krčmová, CSc.

Autoři: MDDr. Eleonóra Ivančová, PhD., MHA

Autoři: prof. MUDr. Eva Kubala Havrdová, DrSc.

Všechny kurzyPřihlášení#ADS_BOTTOM_SCRIPTS#Zapomenuté hesloZadejte e-mailovou adresu, se kterou jste vytvářel(a) účet, budou Vám na ni zaslány informace k nastavení nového hesla.

- Vzdělávání