-

Medical journals

- Career

Legislative aspects of the development of medical devices

Authors: Petra Marešová; Blanka Klímová; Ondřej Krejcar; Kamil Kuča

Published in: Čes. slov. Farm., 2015; 64, 133-138

Category: Review Articles

Overview

European industry of medical device technologies represents 30% of all world’s sales. New health technologies bring effective treatment approaches, help shorten stays in hospital1),bring better treatment results and accelerate rehabilitation which leads to the earlier patient’s recovery.

Legislative aspects are one of the key areas influencing the speed of development of medical devices and their launching. The aim of this article is to specify current state of legislation in the development of medical devices in the European Union in comparison with the market leaders such as China, Japan and USA.

The best established market of medical devices is in the USA. Both Japan and China follow the USA model. However, a non-professional code of ethics in China in some respect contributes to the decrease of quality of medical devices, while Japan as well as the EU countries try really hard to conform to all the regulations imposed on the manufacturing of medical devices.Keywords:

medical devices • market • legislative aspects • developmentIntroduction

The USA, the EU countries, Japan and China are the world’s largest medical device markets2). The United States’ medical device market is the largest research and development center for medical device technologies and clinical tests. Japan’s medical device market is likely to be rising owing to Japan’s elderly population. However, the medical device technologies imported into the developed countries have been also increasing in importance lately. The reason is that the import of these medical devices from the developing countries such as Mexico or China is less expensive3). The global innovation center for this sector is located in California’s Silicon Valley where more than 50% of medical equipment manufacturing companies have their headquarters4). BCC research estimated the global market for medical device technologies at 0.3 billion in 2012. In 2013 it was 1.8 billion and the market is expected to attain 8.7 billion in 2018, registering a compound annual growth (CAGR) of 5.5% over the next five years. Asia is also the biggest competitor on the global market for medical devices. It already reached .1 billion in 2013 and is expected to reach .8 billion by 2018, increasing at a CAGR of 8.5% from 2013 through 20185). The potential of medical device market growth in the EU countries is based on the high ratio of GDP expenditure on medical services and on the ageing population and rising demand for new technological products. In Europe there are about 25,000 companies specializing in medical device technologies out of which 95% of this industry is formed by small and medium-sized companies. Only in 2012 more than 10,000 patented applications were registered. Moreover, annual investments into research and development are about four billions EUR6).

The importance of medical device technologies consists in helping prolong and improve people’s lives, reduce or remove pain and suffering, cure injuries or compensate handicaps, or compensate their effects, increase the quality of medical care and improve their results. The medical device can be understood as a tool, instrument, machine equipment, implant, in vitro reagent or calibration reagent, software, material or other similar object intended for its use, either independently or in combination, for human beings, for one or more purposes7):

- for diagnosis, prevention, monitoring, treatment or for reducing a disease or injury

- pro screening, replacements, modification or support of anatomic and physiological process

- for support and maintaining life

- for regulation of conception

- for disinfection of medical devices

- for providing information for medical purposes through in vitro sample tests removed from the human body and

- which does not attain its primary expected effect in the human body or on its surface by pharmacological, immunological or metabolic devices, however, which by these devices can help its function

Industrial production of medical device technologies nowadays offers at least 500,000 of different products. Nevertheless, the medical technologies represent less than 7% of all health costs, which is a very modest share in comparison with the benefits these technologies provide to people8). Therefore there are tremendous opportunities for widening their offer as well as for its constant innovation. If the industry of medical device technologies manages to offer solutions to the issues such as aging population, an increase of the number of persons with chronic diseases, or an occurrence of new pathological syndromes, its share in the world’s health systems will be continuously growing.

The aim of this article is to specify current state of legislation in the development of medical devices in the European Union in comparison with the market leaders such as China, Japan and USA.

Methods

The method of this study consists of a method of literature review analyzing the data in the area of legislation and basic economic market characteristics. In addition, a method of comparison of different research studies discussing various aspects and factors of the both areas above mentioned is used.

Medical device market in Europe

The medical device industry in the European countries is comparatively innovative. The products are replaced by new ones in the course of 18–24 months. The medical device technologies contribute to reducing the period of hospital stays. According to the available data from 2000–2008 savings were about 13%, which significantly cuts costs of medical budgets. The portfolio of medical devices is wide and has approximately 500,000 items, ranging from bandage material to orthopedic implants or cardio stimulators. The area of the industry of medical device technologies includes 12% of all European patents. Precisely, it contains 16,500 patent applications. On average the EU countries invest 8.3% of GNP into health care. The medical devices only make 4.2% of all medical costs9). The results of the last 25 years of the development of medical devices are as follows:

- increase of average life span at the moment of birth for about 4.3 years

- increase of the expected average life span of population 65+ of 12%

- reduction of mortality as a consequence of heart attack of 50%

- reduction of mortality as a consequence of stroke of 44%

- reduction of mortality as a consequence of breast cancer of 18%1)

Legislative measures on the medical device market

The importance of the political and legal aspects for business is obvious. As part and parcel of institutional quality, it directly influences implementation and effectiveness of business activities and overall economic effectiveness. Factors related to power distribution and legislative aspects are very important in this field. Government’s and other state institutions’ activities can considerably affect business on various types of market. This section describes legislation related to the medical devices.

European Union

The regulation of medical devices in the EU countries is governed by three EU council directives and their subsequent amendments:

- Active Implantable Medical Devices (AIMDD) Directive 90/385/EEC

- Medical Devices Directive (MDD) Directive 93/42/EEC

- In Vitro Diagnostic Directive (IVDD) Directive 98/79/EC

- MDD amended by Directive 2000/70/EC (derivates of human blood and plasma); Directive 2003/32/EC (tissues of animal origin) and Directive 2007/47/EC – amending AIMDD, MDD and placing of biocidal products on the market10)

The European Commission provides a range of guiding documents to help its stakeholders in implementing Directives, related to medical devices. The guiding documents, called ‘MEDDEVs’, are written in compliance with all stakeholders: national competent authorities, industrial associations, health professional associations, Notified Bodies and European standardization organizations11).

Its main trends are as follows12):

- application of directives and definitions of “medical devices”, “accessory” and “manufacturer”, field of application of directive “active implantable medical devices”, Borderline products, drug-delivery products and medical devices incorporating as their integral part)

- basic requirements

- classification of medical devices

- process of agreement evaluation (Quality assurance. Regulatory auditing of quality systems of medical device manufacturers)

- clinical trials and clinical assessments (Guide for Competent Authorities in making an assessment of clinical investigation notification)

- notified persons (Designation and monitoring of Notified Bodies within the framework of EC Directives on Medical devices)

- subsequent supervision and the vigilance system

All medical device technologies entering the EU market must conform to the relevant directive. The level of medical device evaluation thus varies according to the perceived risk of the device. For medium and high risk devices, companies are requested to have their quality systems and technical documentation reviewed by a notified body before their products can be enter the market. The notified body is in charge of confirming that the corresponding requirements are met prior to the issue of certification.

Potential sources of financing healthcare, including the development of medical devices are as follows13):

- The European Regional Development Funds (ERDF), which enforces integration, specifically economic, social and territorial one, by keeping the balance among various regions

- The European Social Funds (ESF), which is the main tool of the EU for investing in its population

- Horizon 2020

These programs are relevant and provide investment opportunities to complement those financed through Structural Funds. Furthermore, the Commission strongly promotes Public Private Partnerships as a means of increasing the levels of investment and innovation in a wide range of public services including health care14).

In order to ensure the smooth functioning of a support system, it is necessary to have a clear and efficient legislation, which must be implemented across the whole of the EU in a sustainable way and which enables immediate access to the latest technologies.

Legislation of medical devices in the Czech Republic

The cornerstone of the current Czech legislation in the area of medical devices is Act no. 268/2014 of Legal Code, on medical devices and the amendment of Act no. 634/2004 of Legal Code, on administrative fees, as subsequently amended and connected with Government Directive no. 54/2015 of Legal Code, no. 55/2015 of Legal Code and no. 56/2015 of Legal Code. This national legislation is based on Directive no. 93/42/EEC for medical devices, no. 90/385/EEC for active implantable medical devices and no. 98/79/EC for diagnostic medical devices in vitro (IVD). Other important documents are as follows:

- 336/2004 of Legal Code. Government Directive which sets technical specifications of medical devices

- 154/2004 of Legal Code Sb. Government Directive which sets technical requirements of active implantable medical devices

- 453/2004 of Legal Code Sb. Government Directive which sets technical requirements of diagnostic medical devices in vitro

- documents at the level of EU

On 1 April 2015 new Act on medical devices no. 268/2014 of Legal Code came into effect. It deals with relevant regulations of the EU adjusting the handling of medical devices and their equipment.

Individual powers in the area of medical devices have been so far divided among different authorities of state administration. However, now they will be mainly administered by a special body – the State Institution for Drug Control. This body will have the following tasks:

- to register producers in newly established Register of medical devices, their executives, importers, distributors, persons doing service, contracting authority of clinical trials and notified persons

- to notify medical devices launching or imported to the Czech market

- to supervise clinical trials of medical devices

- to decide whether a certain product is a medical devices or not

- to decide of classification of medical device into risk classes, or

- to decide what will happen with the medical device which is wrongfully marked as CE or it does not have any marking at all

To increase the control of medical devices traded on the Czech market, a new Register of Medical Devices is being established. All the producers, importers, distributors and persons doing service will have to register there15).

Discussion – international differences in legislation, their weaknesses and strengths in the European legislation

This part describes the legislation of medical devices of the main market leaders in this business and compares it with the legislation of the EU countries.

Legislation in the USA

In the USA the medical devices are regulated by the US Food and Drug Administration (FDA) within the Center for Devices and Radiological Health. Center for Devices and Radiological Health is in charge of protecting and promoting the public health by ensuring the safety, effectiveness, and quality of medical devices, providing the safety of radiation-emitting products, fostering innovation, and providing the public with accurate, science-based information about the products. The FDA has been in existence since 1976. It does not regulate the practice of medicine. Devices are classified based on complexity and level of risk Post-1976 devices of lower complexity and risk that are substantially equivalent to a marketed “predicate” device may be cleared through the 510(k) premarket notification process. Clinical data are typically not needed for 510(k) clearance. In contrast, higher-risk devices typically require premarket approval. Premarket approval applications must contain data demonstrating reasonable assurance of safety and efficacy, and this information typically includes clinical data. For novel devices that are not high risk, the de novo process allows FDA to simultaneously review and classify new devices. Devices that are not legally marketed are permitted to be used for clinical investigation purposes in the United States under the Investigational Device Exemptions regulation16).

Legislation in China

In March 1998 the Ministry of Health’s Department of Drug Administration merged with the State Pharmaceutical Administration of China (SPAC) and the State Drug Administration (SDA) was established. This organization nowadays controls all drug production, trade, and registration. In 2003, the SDA was restructured and got the new name the State Food and Drug Administration (SFDA). Its regulations follow US FDA’s model. All the pharmacological companies must be registered with this organization if they want to do business in China. The SFDA has similar responsibilities as other state’s drug administration organizations such as draft law and administrative regulations on drug administration and supervise their enforcement, but in case of China this organization also implements protection system for certain traditional Chinese medicinal preparations and administrative protection system for pharmaceuticals in accordance with law or regulations21).

Legislation in Japan

The Japanese medical device market is the second largest in the world after the USA and Japan is the world’s third largest importer of medical devices17).

The distribution of medical devices in Japan is regulated in accordance with the Pharmaceutical and Medical Device Act (PMD Act) regulation by the Ministry of Health, Labour and Welfare (MHLW). The former regulation, Japanese Pharmaceutical Affairs Law (JPAL) was replaced by PMD Act on 25 November 2014. The revision includes third party certification systems for Class III medical devices and expansion of the responsibility of quality management system to legal manufactures who have all to be registered.

The distribution of medical devices in Japan is regulated in accordance with the Pharmaceutical and Medical Device Act (PMD Act) regulation by the Ministry of Health, Labour and Welfare (MHLW). The former regulation, Japanese Pharmaceutical Affairs Law (JPAL) was replaced by PMD Act on 25 November 2014.

The Pharmaceuticals and Medical Devices Agency is responsible for the following tasks:

- drug and medical device testing:

- scientific evaluation of market authorization applications based on Japanese pharmaceutical law

- counselling on clinical trials or in the preparation of dossiers for the registration procedure (New Drug Applications (NDA))

- control and conformity assessment of Good Clinical Practice (GCP), Good Laboratory Practice (GLP), and Good Practice Systems and Programs (GPSP)

- auditing of manufacturers to ensure they conform to Good Manufacturing Practice (GMP) and have a suitable Quality Management System (QMS)18)

Legislation in the EU countries

In the European Union (EU) directives should be in fact the same in all member states in order to minimize conflicting regulatory decisions. Nevertheless, due to different systems, traditions and customs, there are some differences in legislation of medical devices such as the language which should be used for medical device information or the period of medical device registration.

In comparison with the three market leaders mentioned above, companies located in North/South America and Asia are more optimistic about the marketing of medical devices than those located in Europe19). Furthermore, in comparison with the USA, the established medical and drug administration companies are comparatively young, without much experience. Also to receive approval to market a device in the EU, the manufacturer must demonstrate that the device is safe and that it performs in a manner consistent with the manufacturer’s intended use. To receive approval to market a class III high-risk (and some class II) device in the United States, the manufacturer must demonstrate that the device is reasonably safe and effective.

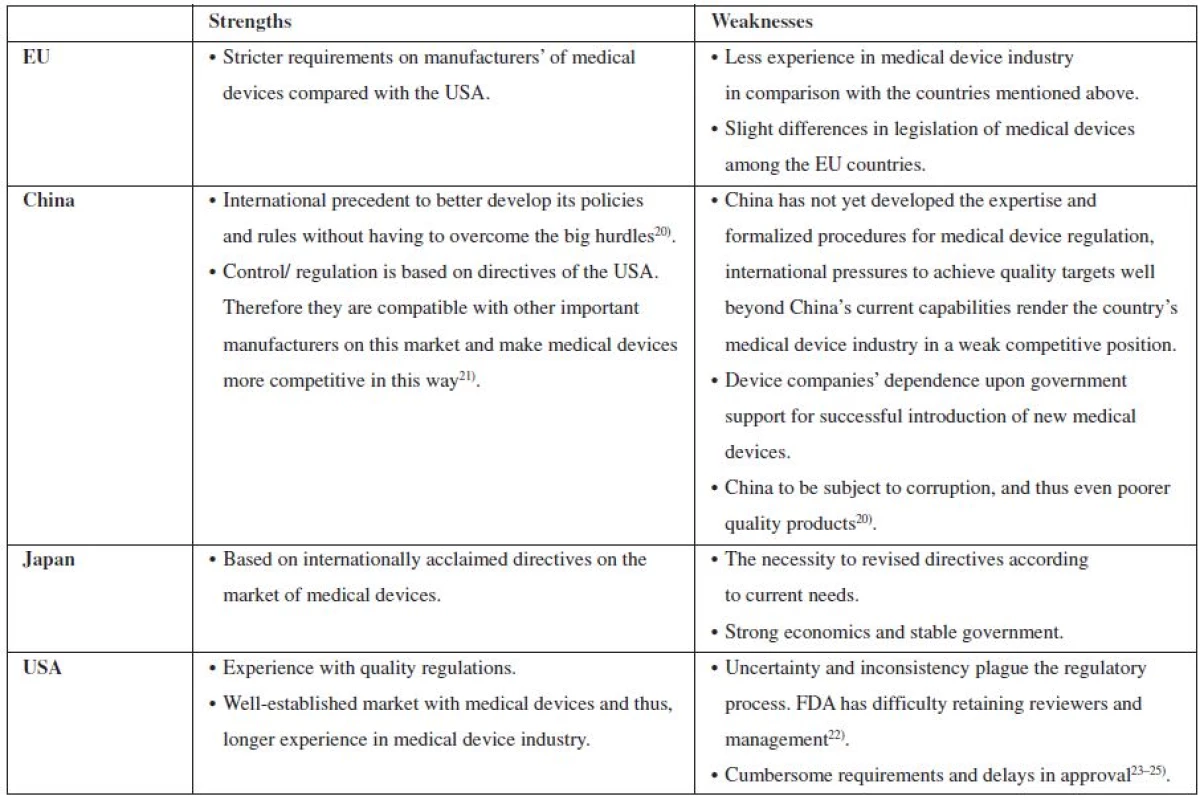

Table 1 below provides an overview of strengths and weaknesses of control on the market with medical devices in the USA, Japan, China, and the EU countries. As Table no….indicates, probably the best established market of medical devices in the USA. Both Japan and China follow the USA model. However, a non-professional code of ethics in China in some respect contributes to the decrease of quality of medical devices, while Japan as well as the EU countries try really hard to conform to all the regulations imposed on the manufacturing of medical devices.

1. An overview of strengths and weaknesses of control on the market with medical devices in the EU, China, Japan and USA

Conclusion

The market with medical devices is an important part of the European economies and as such it experiences growth which is forecasted also for future years. The European Union is besides the USA and Japan one of the biggest markets. The importance of norms and regulation is essential, particularly with respect to the expected trends of further growth of this market, for example, due to the aging population.

The aim of this article was to specify current state of legislation in the development of medical devices in the European Union in comparison with the market leaders such as the USA, Japan and China. In this sense the EU countries have a relatively stable system of control of medical devices. However, the weakness might be acceptance of partial provisions within the individual EU countries. But the Czech Republic tries hard to follow the directives of the EU and since 1 April 2015 there has existed new act on medical devices which complies with the EU regulations. The main incentive, however, resulted from long-term criticism of companies and individual entities which pointed out these partial shortcomings. Nevertheless, overall, the EU legislation in the area of medical devices seems to be well developed and through different financial funds enables companies to invest in the medical device industry.

Acknowledgements

This paper is created with the non-financial support of the specific research project “Economic and Managerial Aspects of Processes in Biomedicine” funded by the University of Hradec Králové and long term development plan FNHK.

Conflict of interest: none.

Received 8 July 2015

Accepted 8 August 2015

P. Marešová • B. Klímová

University of Hradec Králové, Faculty of Informatics and Management

O. Krejcar

University of Hradec Králové, Center for Basic and Applied Research

prof. Ing. Kamil Kuča, Ph.D.

University of Hradec Králové, Center for Basic and Applied Research

Rokitanskeho 62, 500 03 Hradec Králové 3, Czech Republic

University Hospital Hradec Králové, Biomedical Research Center

Sokolská 581, 500 05 Hradec Králové

e-mail: kamil.kuca@fnhk.cz

Sources

1. CzechMed a: CzechMed: What has Ferrari with Linet? 2015. http://www.czechmed.cz/media/tiskove-zpravy/czechmed-co-ma-spolecneho-ferrari-s-linetem/ (accessed 2014 June 23).

2. Trade Information Center Us (2014). Discover Global Markets: Healthcare and Life Sciences 2014. http://www. export.gov/ minnesota/discoverglobalmarketshealthcareandlifesciences/highlightedcountries/index.asp (accessed 2014 June 23).

3. Jiangxi Association For Medical Devices Industry. Information Inauguration of Jiangxi Association for Medical Device Industry’s general meeting. 2010. http://kau.diva-portal.org/smash/get (accessed 2014 June 23).

4. Rios M. S., Sánchez M. C. C., Porcayo D. H. O., Blat J. M. M. Roadmap for the Medical Device Industry. Mexico City 2012.

5. Pr Newswire (2014). Medical Device Markets in the World to 2018 – Market Size, Trends, and Forecasts. Retrieved from: http://finance.yahoo.com/news/medical-device-markets-world-2018-230500065.html

6. European Commission (EC). Medical Device – Competitiveness. European Commission website of Public Health. 2013. http://ec.europa.eu/health/medical-devices/competitiveness/index_en.htm (accessed 2015 May 10)

7. European Commission (EC). Medical Device. European Commission website in the Czech Republic. 2014. http://ec.europa.eu/health/medical-devices/index_cs.htm (accessed 2015 May 10)

8. European Commission (EC). Investing in Health. Commission Staff Working Document. 2013. http://ec.europa.eu/health/strategy/ docs/swd_investing_in_health.pdf (accessed 2015 May 10)

9. CzechMed b: Basic facts about the market.2015. http://www. czechmed.cz/zdravotnicke-prostredky/zakladni-fakta-o-trhu/ (accessed 2014 June 23).

10. Directive 2007/47/ec of the European parliament and of the council”. Eur-lex Europa. 5 September 2007 (retrieved 2014 June 15).

11. EC: 2015. Návrh nařízení Evropského parlamentu a Rady o zdravotnických prostředcích a změně směrnice 2001/83/ES, nařízení (ES) č. 178/2002 a nařízení (ES) č. 1223/2009 http://data.consilium.europa.eu/doc/document/ST-9769-2015-INIT/cs/pdf

12. Bergsland J., Elle O. J., Fosse E. Barriers to medical device innovation.2014. Medical Devices: Evidence and Research 2014; 7, 205–209.

13. Coggi P. T. Investice do zdraví je prioritou pro tzv. sociální investiční balíček. European Commission website in the Czech Republic. 2013. Available at:

http://ec.europa.eu/health/newsletter/106/focus_newsletter_cs.htm (accessed 2015 May 10)

14. Dowdeswell B. Structural Fund investment in the Health Sector Context and Policy Framework. 2013. The report of European Centre for Health Assets and Architecture. Available at: www.mzcr.cz/Soubor.ashx (accessed 2015 May 10).

15. Celerýn J. Nový zákon o zdravotnických prostředcích. 2015. http://www.epravo.cz/top/clanky/novy-zakon-o-zdravotnickych-prostredcich-97108.html (accessed 2014 June 23).

16. Jonathan P. J., Baxley J. H. Medical devices: US medical device regulation. Urologic Oncology: Seminars and Original Investigations 2015; 33, 128–132.

17. Espicom. The Medical Device Market: Japan. 2015. http://www.espicom.com/japan-medical-device-market.html (accessed 2014 June 23).

18. Nagasaka S., Lang B., Mihoko Shintani M., Ueno S. An Overview of Pharmaceutical and Medical Device Regulation in Japan. Special Report Life Science 2012. Dostupné z: http://www.morganlewis.com/~/media/files/publication/outside%20publication/article/overview_pharma_device_reg.ashx (accessed 2014 June 23).

19. Emergo Group. Outlook for the medical device industry in 2014, Annual Survey. 2014. Available at:

http://www.emergogroup.com/research/annual-medical-device-industry-survey (accessed 2015 May 10)

20. Sun P. Medical Device Regulation in China and the US: A Comparison and a Look Forward. Intersect: The Stanford Journal of Science, Technology and Society, [S.l.], v. 5. 2012. http://ojs.stanford.edu/ojs/index.php/intersect/article/view/359 (accessed 2015 July 6)

21. Zhe L., Xiaotong W. Analysis on Opportunities and Challenges of Chinese Medical Device Industry under New Health Care Reform Reference of Sweden, USA and UK. 2010. Degree Project, Master of Business Administration, Karlstads universitet.

22. Heather T. State of Medtech 2011 and Beyond: A SWOT Analysis. 2011. http://www.mddionline.com/article/state-medtech-2011-and-beyond-swot-analysis (accessed 2014 June 23).

23. Kramer D. B., Xu S., Kesselheim A. S. How Does Medical Device Regulation Perform in the United States and the European Union? A Systematic Review 2012. Plos Medicine. http://journals.plos.org/ plosmedicine/article?id=10.1371/journal.pmed.1001276#pmed-1001276-t001(accessed 2014 June 23).

24. Gottlieb S. How the FDA could cost you your life. Wall Street Journal 2011; A17.

25. Kaplan A. V., Baim D. S., Smith J. J., Feigal D. A., Simons M., et al. Medical device development: from prototype to regulatory approval. Circulation 2004; 109, 3068–3072.

Labels

Pharmacy Clinical pharmacology

Article was published inCzech and Slovak Pharmacy

2015 Issue 4-

All articles in this issue

- Determination of flavonoids in natural materials with HPLC

-

Effectiveness of phytotherapy in supportive treatment of type 2 diabetes mellitus

III. Momordica (Momordica charantia) -

Study of local anaesthetics: Part 206*

Micellization of selected of quaternary ammonium salt derived from heptacaine - Medicinal products for human use in veterinary prescription

- Legislative aspects of the development of medical devices

- Influence of Ganoderma lucidum (Curt.: Fr.) P. Karst. on T-cell-mediated immunity in normal and immunosuppressed mice line CBA/Ca

- Czech and Slovak Pharmacy

- Journal archive

- Current issue

- Online only

- About the journal

Most read in this issue- Medicinal products for human use in veterinary prescription

- Determination of flavonoids in natural materials with HPLC

-

Effectiveness of phytotherapy in supportive treatment of type 2 diabetes mellitus

III. Momordica (Momordica charantia) - Legislative aspects of the development of medical devices

Login#ADS_BOTTOM_SCRIPTS#Forgotten passwordEnter the email address that you registered with. We will send you instructions on how to set a new password.

- Career