-

Medical journals

- Career

GLOBAL CENTERS OF MEDICAL DEVICE TECHNOLOGY: UNITED STATES, EUROPE AND CHINA

Authors: Petra Hospodkova 1; Miroslav Barták 2; Klara Vacikova 3; Erika Urbankova 1

Authors‘ workplace: Department of Economic Theories, Faculty of Business and Economics, Czech University of Agriculture in Prague, Czech Republic 1; Depatment of Addictology, First Faculty of Medicine of Charles University and General University Hospital in Prague, Czech Republic 2; Department of Biomedical Technology, Faculty of Biomedical Engineering, Czech Technical University in Prague, Czech Republic 3

Published in: Lékař a technika - Clinician and Technology No. 4, 2018, 48, 136-144

Category:

Overview

The global market for medical technologies is concentrated in the most advanced countries of the world, namely the U.S.A., Europe and Japan. China is the most important of fast-growing markets. According to some estimates China's global share in 2030 will be as much as 25%. The aim of the article is to provide an overview of the development of selected economic indicators of medical devices in the regions of the U.S.A., Europe and China. We address the last decade and comment on the estimated future development of these markets. The article is based on selective literature research. Indicators of the market value, global market share, market trends, and export and import values in the three world regions are the key elements of the analysis. We found that U.S. holds about 40%, the market value (170 billion USD) and Europe holds currently about 30% of the global market (110 billion USD). The Medtech market in China is about 10% of global one (53,6 billion USD). The U.S. market growth is about 10%, the European 5% and China market shows far largest growth rate about 20–25% per year. According China will become one of the major player in the Medtech market. The Chinese market, which has focused on low-cost production in the past, is currently coming to the forefront thanks to its development of high-end medical device technology.

Keywords:

medical device – international comparison – economic growth – global market

Introduction

The global market for medical technologies (Medtech) is concentrated. About 80% of all purchases are realized in the most advanced countries of the world, namely the U.S.A., Europe and Japan. China (along with India) can be ranked among the most important fast-growing markets. China's market share, which was only 3% in 2012, representing 1.4% of the country's GDP, is continually growing at a rapid pace. According to some estimates China's share in 2030 will be as much as 25%. Rising expenditure in the healthcare sector, increasing demand for healthcare, and the overall better awareness in the area of healthcare services are all the possible factors that support the development of the Chinese medical device market [1].

Medical technologies, which are one of the driving forces behind the increase in expenditure, have a significant impact on the overall expenditure of the healthcare system [2].

The specific characteristics of the global production and market are summarized by numerous studies [2–11] and include the high research and development costs and/or heavy market regulation as well as growing expectations of healthcare consumers.

The aim of the article is to provide an overview of the development of selected economic indicators of medical devices in the regions of the U.S.A., Europe and China in the last decade and to comment on the estimated development of these markets based on selective literature research.

Data and methods

Like other related articles [3], this study is based on selective literature research which aims to describe the selected characteristics of the Medtech market in selected regions of the world. The work is based on publicly available data sources and does not utilize a large amount of commercial data from marketing and consulting firms, as it is available only for high fees. Temporally, the study aims to cover the period of the last decade with a focus on the latest data sources that can be used as the basis for reaching partial conclusions about possible trends in the Medtech market in the medium term. In the study, the individual markets are ranked according to their current global market share. The article uses the method for the international comparison of healthcare systems, in particular the "side-by-side comparison" method, using comparable indicators for the individual monitored regions, in particular the global market for medical devices. It is thus a descriptive sectoral analysis that of characteristics of the markets of selected world regions [4].

For the purpose of the article, reviewed sources obtained using the Web of Science and Scopus databases (status December 2018) are used in particular, and the article was created within the principles of the PRISMA method [5]; however, this method is not applied in its entirety as part of the review. The criteria allow the inclusion of articles on the economic assessment of the medical device market within the timeframe of the past ten years, and articles on medical devices that include a prediction of the future market are also taken into consideration. Other criteria used include the focus of articles on market value, global market share, market trends, and export-import, and all of these criteria are applied to the topic of medical devices.

In this publication, a comparison of the selected economic indicators for the individual regions described is presented. These indicators include: market value, i.e. a definition of the market in financial units (in USD billion; for China, some data are available only in CNY, for which an approximate conversion to USD is carried out); the percentage share of the individual regions of the global medical device market; market trends, i.e. a description of the nature of the market in the time-frame of the study; last but not least, exports and imports, which are expressed in USD billion.

First the data for the global market is introduced, then the data for the individual regions of the U.S.A., Europe and China, followed by a side-by-side comparison, and finally discussions and conclusions.

For the purpose of this work, pharmaceuticals are not taking into consideration.

Global medical device market

The medical device market development is closely linked to the development of healthcare sector in general. The global demand for healthcare services is growing, and it is not very sensitive to price changes [6], which allows manufacturers of medical devices to increase the price of their technologies over time. However, in the study the price changes vary over time with different technologies. They do not show homogeneous growth with tendencies to decrease in sime segments. Overall, the global demand for medical devices is rising steadily [7, 8], as Medtech play a key role in the healthcare system and the value of the overall global Medtech market is constantly increasing [9]. The proportional representation of individual types of Medtech in the overall product portfolio is thus changing. For example, the global market for diagnostic Medtech grew by 20% between 2016 and 2017 [10].

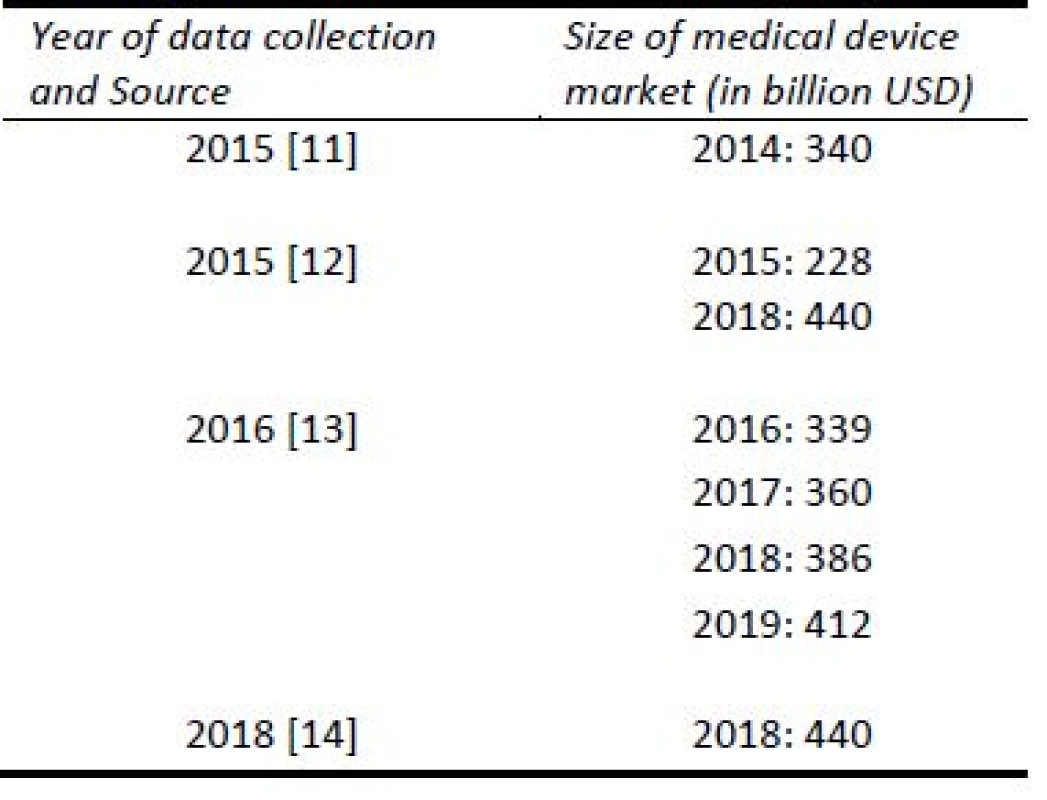

The data comparison that represents the global market is shown in Table 1.

1. Values of the global medical device market.

The growth in the global market in 2018 was about 4.4% [15]. However, the growth in the market by region varies significantly around the world. The medical device market has long been dominated by the US, which is the largest producer, distributor and consumer of these technologies. The US currently occupies over 40% of the Medtech market, followed by Europe, which holds approximately 30% of the Medtech market, and Japan, with a market share of approximately 15% [12, 16]. China, which is moving from the position of lagger to that of major market opportunity and thus entering the forefront of interest with annual market growth of more than 20%. Available studies confirm, China is an important destination in terms of market opportunity [12, 17].

In the prediction for 2020, the studies estimate that the size of the global market will be in the approximate range of USD 435 to 483 billion [13, 18, 19]. For the year 2030, it will be as much as USD 795 billion [18], with the future ranking of the individual countries as actors in the Medtech market differing significantly from the present ranking. Ongoing healthcare reform and increased demand for healthcare in India and China are the reasons for this change in the structure of shares in the global market [17, 20].

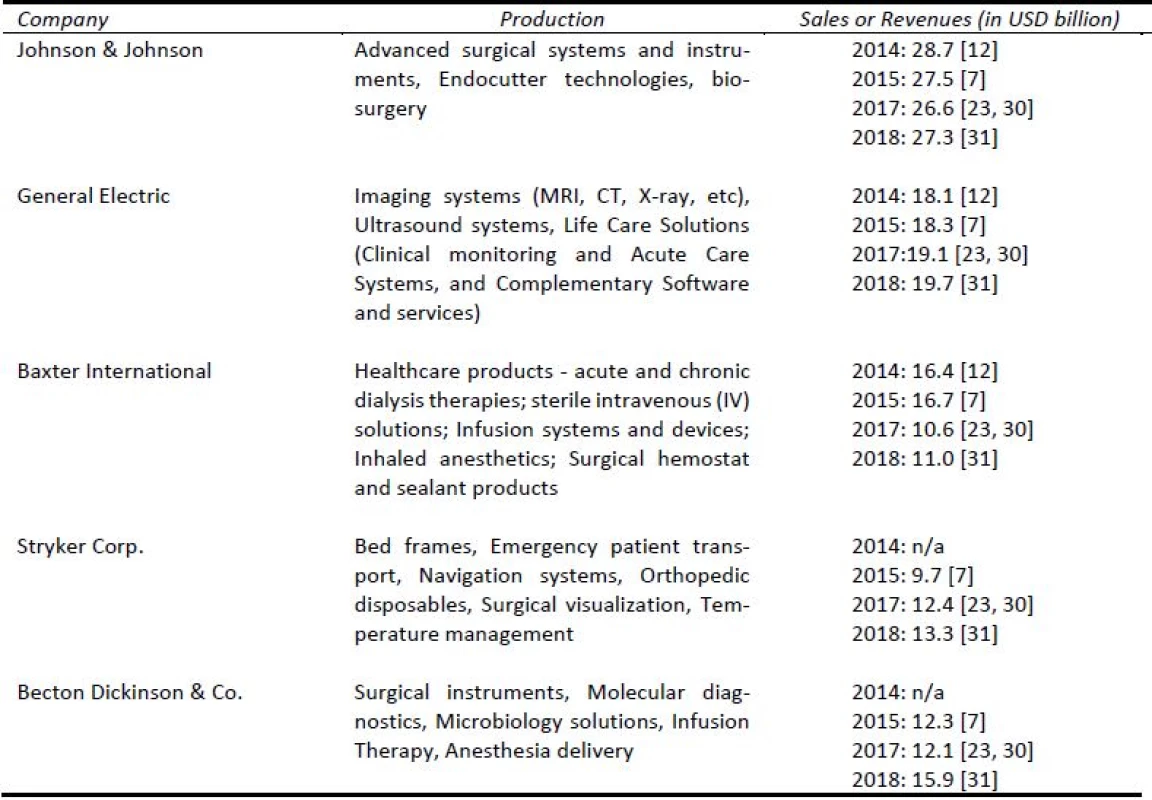

In the global market, there is a relatively small number of large companies with a dominant position and there are a large number of small and medium-sized enterprises [7]. Johnson & Johnson dominates among Medtech producers according to the available studies, other important players are Siemens Health, General Electric, Medtronics, Baxter International an Philips Healthcare [12, 23]. The profit margin of large companies producing Medtech is typically 20–30% [7]. Literature shows that a number of large transactions involving medical device companies in recent years were generally motivated by the desire to pursue higher growth, either through product portfolio acquisitions or divestments [24].

U.S. medical device market

The available data show that the US medical device companies currently hold the largest market share, (i.e. about 40–45% [8, 13]), and the size of the market is constantly increasing. In the US, there are approximately 7,000 companies in the Medtech market, which directly employ 400,000 people and indirectly employ more than 2 million people [12, 20].

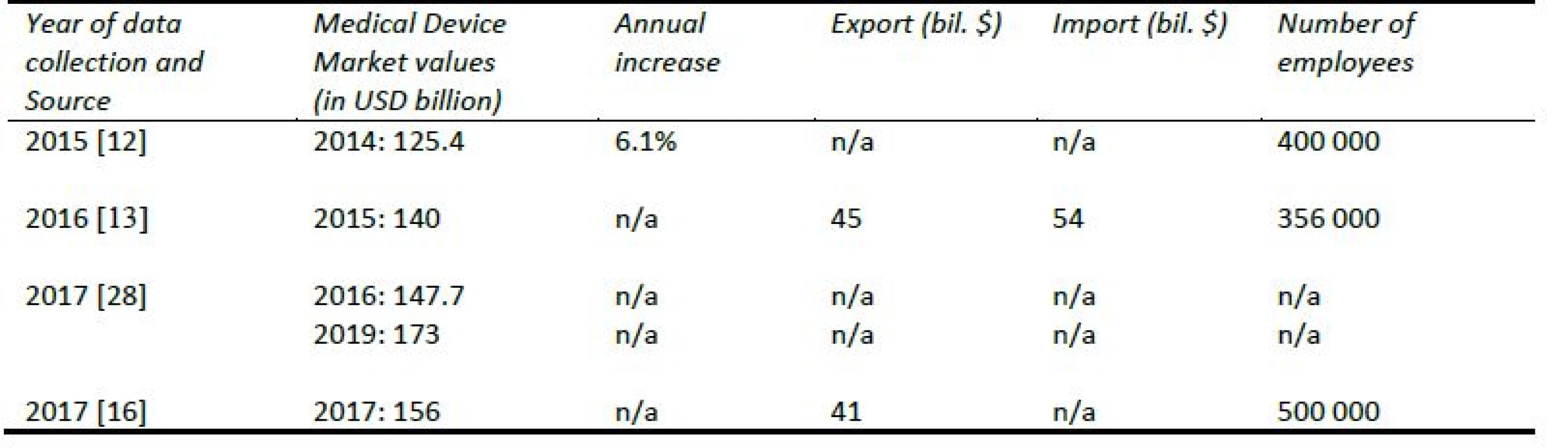

Selected economic indicators of the market in the US are in table 2.

2. Selected economic indicators of the market in the US.

Investment in medical device research and development nearly doubled in the US from 2007 to the present, and the same trend can be expected in the future [13]. Total U.S. Medical & Health R&D spending for 2015 amounted to USD 158.7 billion, and the year-on-year change represented an increase of 4.5% [25]. Compared to other sectors (e.g. the automotive industry, defence, or telecommunications), investments in research and devel-opment in the area were the highest. The level of research and development for 2017 was at around 7% of total revenue [16].

According to the statistics of US and European Patent Offices, the US was the region with the highest number of patents granted for medical devices between 2006 and 2016 [26]. European patent applications filed in 2016 for medical devices (41%) came mostly from Europe (5,023 submissions), while 38% were from the US. The U.S. medical market is globally renowned for its high level of research and development [27].

1. Top 7 Markets for Medical Devices—Prediction for 2030 [18, 21, 22]. ![Top 7 Markets for Medical Devices—Prediction

for 2030 [18, 21, 22].](https://www.prolekare.cz/media/cache/resolve/media_object_image_small/media/image/20ab1125c0990860f3a7654678b2c855.jpeg)

International trade plays a very significant role in the Medtech market in the US, as 35–40% of domestic production is destined for export [7]. The export value is USD 43–45 billion [13]. The percentage share of imports is similar - foreign sales represent 40–50% of the total revenues [7]. In relation to Canada, U.S. companies benefit from the similarities between the U.S. and Canadian regulatory platforms and quality requirements for Medtech [19]. In terms of the structure of American exports, the category “Surgical and Medical Instruments” is the largest.

With regards to imports, it should be noted that the volume of imported devices is constantly increasing. Low-tech products represent the largest proportion of imports [13]. For potential importers of Medtech to the US, the strongest competitors are domestic competitors, followed by producers from Canada, China and Europe [28]. In terms of the import structure, Surgical Appliances and Supplies[1] and Electro-Medical Apparatuses have the largest representation[2] [13]. According to the Department of Commerce (DOC), the value of exports from the U.S. in 2017 was more than USD 41 billion [16].

Neurology is the fastest growing area of devices (9.1% year-on-year increase till 2024), diagnostic imaging and orthopedics are predicted as the ones with the lowest increase (3.7%) [29].

Key players in the market in USA are in Table 3.

3. Key players in the market in USA (in USD billion).

European medical device market

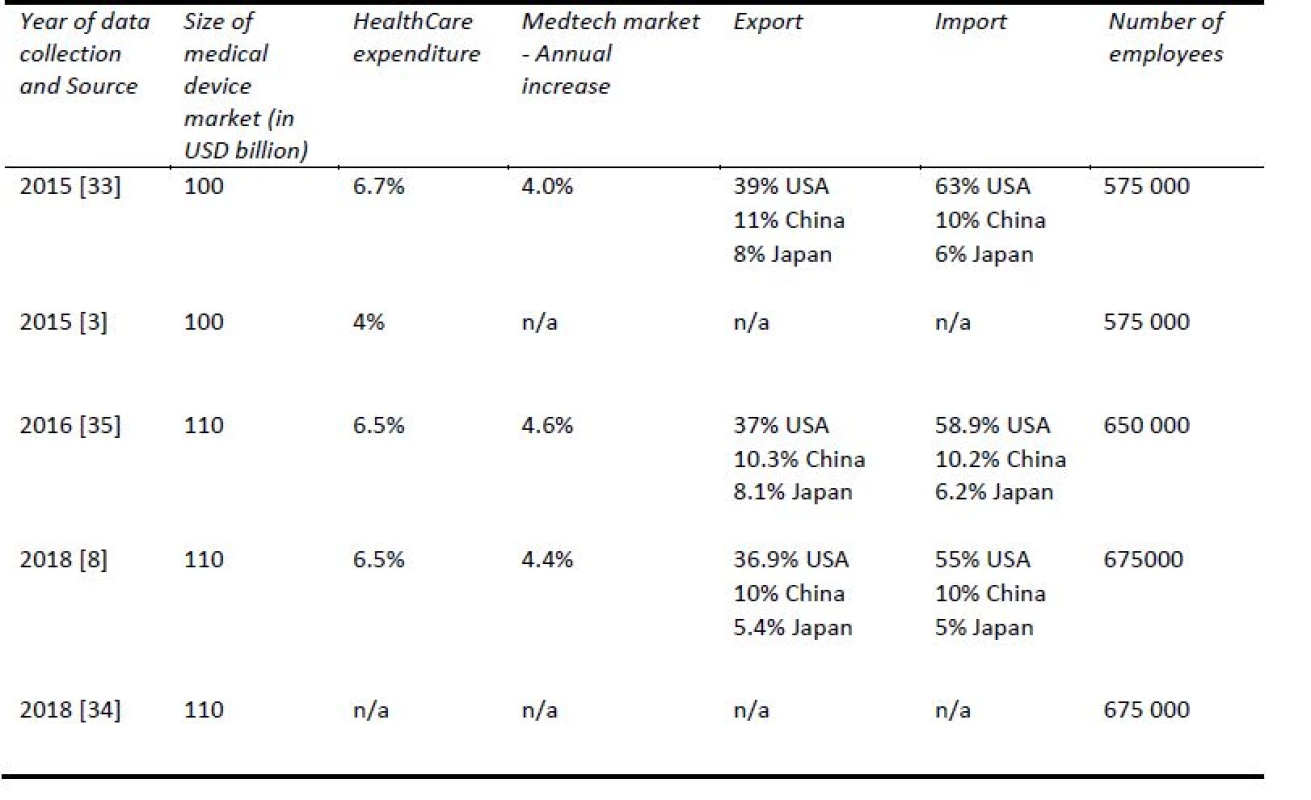

The Europe represents currently approximately 30% of the global market, and thus far it represents the second most important region for Medtech. The value of the European market currently represents around USD

130–143 billion (EUR 100–110 billion). Year-on-year growth of the market in the period between 2006 and 2016 averages at 4.5% [8, 32]. In Europe, an average of 10.4% of the gross domestic product (GDP) is invested in healthcare. Of that, approximately 6.8% is invested in medical devices. However, the expenditure varies considerably among countries, namely between 5 and 10% of their total healthcare expenditure. For Europe in 2014, it was found that the expenditure on medical technology, which includes medical devices along with invitro devices, was EUR 195 per person and increased to EUR 203 in 2017. The value determined for the US was USD 380 [8, 33].In Europe in 2018, there are approximately 27,000 small and medium-sized companies manufacturing medical devices, employing 675,000 people [7, 34]. The number of employees per capita in the medical tech-nology industry is highest in Ireland and Switzerland, according to a survey from 2016 [8]. Analysis of the reports of the European Patent Office show that

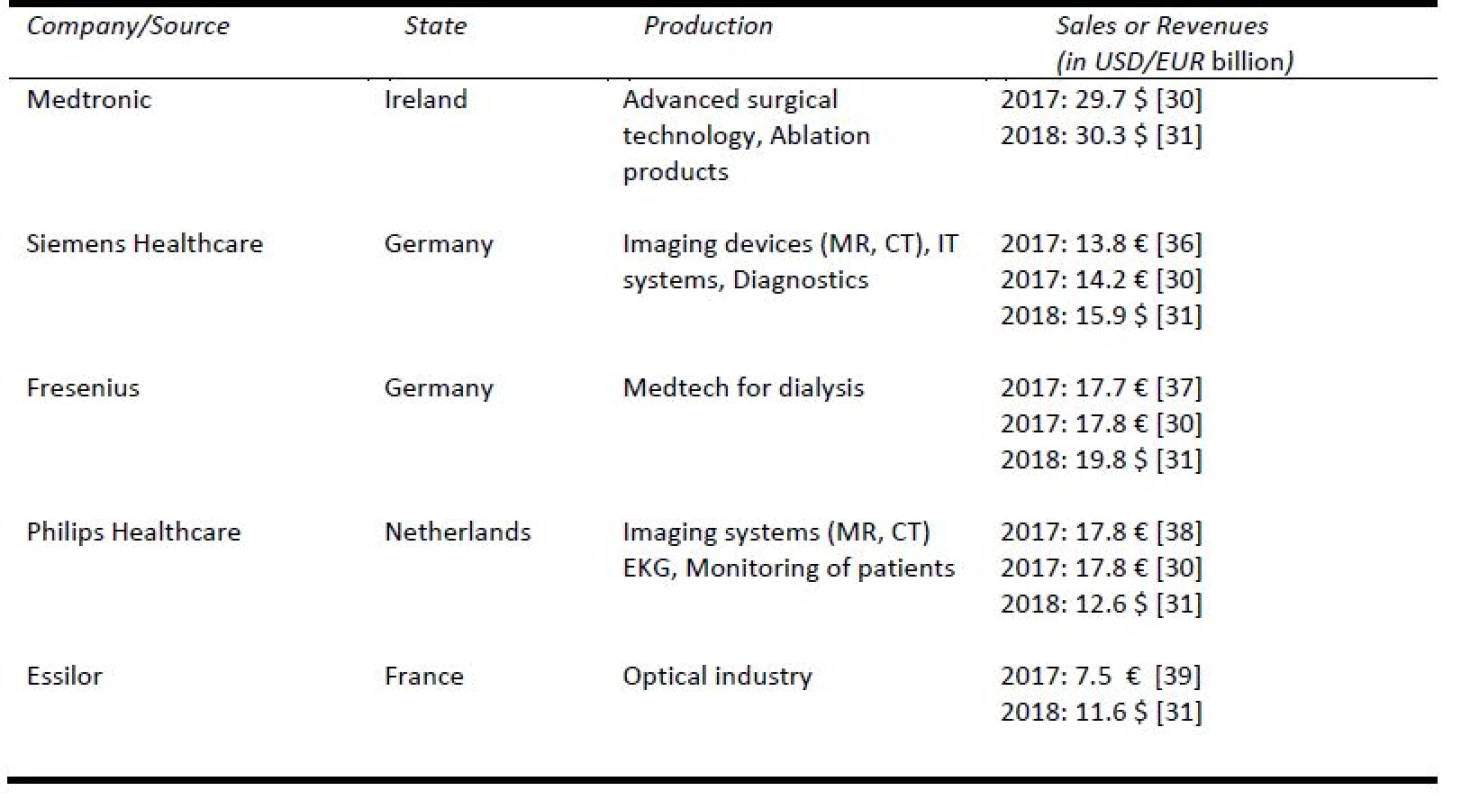

patent applications for medical technologies represented approximately 7.7% of the total for all industries in 2016 [26].Table 4 shows selected economic indicators of the market in Europe and Table 5 below shows an overview of the key players in the in Europe, the focus of their production, their revenues and the number of employees in selected year.

4. Selected economic indicators of the market in Europe

5. Key players in the market in Europe.

Chinese medical device market

The medical device market in China currently represents around 6–10% of the global market, and it has had a high year-on-year growth rate in the last decade [40]. Between 2015 and 2016, its growth was as much as 20%. Annual growth of 6.5–7% is expected for the expenditure on healthcare to 2020 [17]. This expen-diture was at around 5% of GDP until 2010 [41]. It can be concluded that the main causes include the growing demand for healthcare, which is influenced by the higher age of the population and the more frequent occurrence of chronic diseases and agerelated diseases. The overall increase in the demand for healthcare is also influenced by the increased demand for high-quality healthcare from rural areas [42] and for premium healthcare [43]. A series of healthcare reforms leading to a higher coverage by health insurance in the population and better patent protection in the area of research and development are currently underway in China. The completion of these reforms has been announced for 2020 [1, 17, 42].

The period leading up to 2010 was characterized by the fact that the companies producing Medtech mainly focused on midrange products with low technology. At present, these producers are also able to provide high-tech products. The "Made in China 2025" initiatives—a plan announced in 2015—favours expanding the production of state-of-the-art medical devices [40]. This change mainly concerns therapeutic and diagnostic technologies [2, 20, 44]. Several years ago, the government focused on this market and launched a number of initiatives for innovation. The Office for the Evaluation of Innovative Medical Devices (part of the CFDA) provides subsidies and loans for local manufacturers to support research and development for diagnostic imaging, cardiovascular implants, IV diagnostics, etc. These initiatives, along with reforms of reimbursement

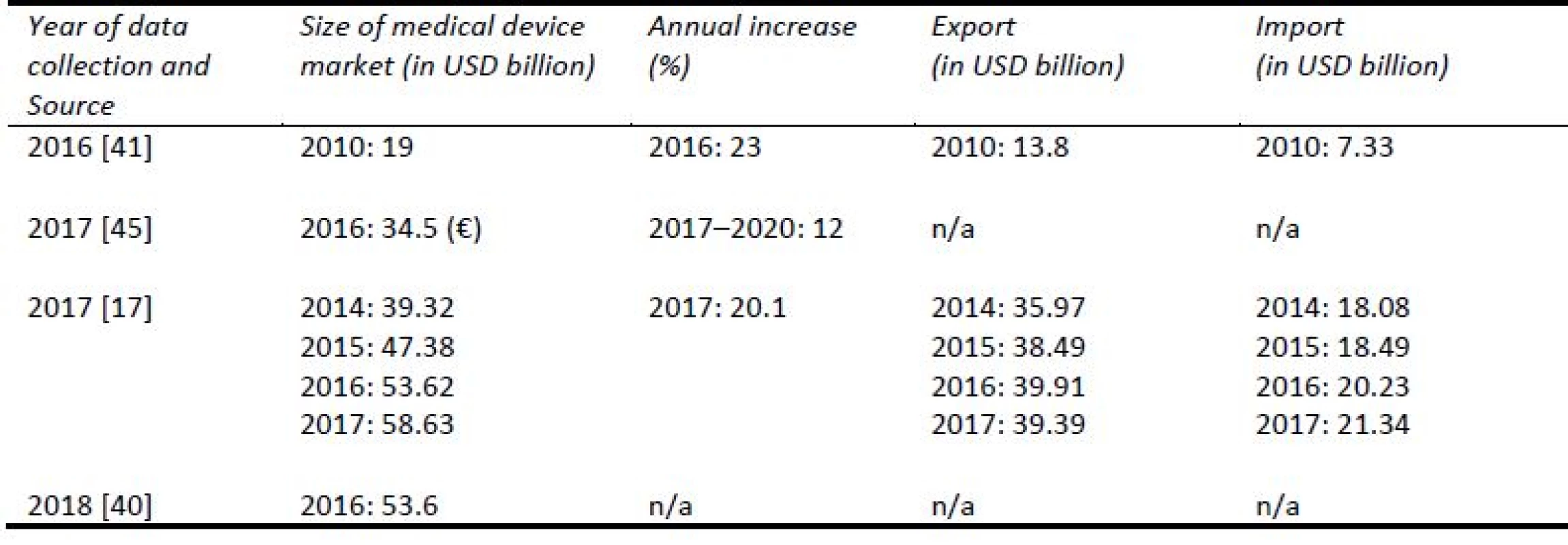

processes and tendering procedures, strengthen the competitiveness of local producers [45]. The support for local producers is also grounded in the 12th Five-Year Plan of the Ministry of Science and Technology [40]. Table 6 shows a synthesis of data from professional publications.

6. Selected economic indicators of the market in Chna

In 2009, 3000 producers who had a limited share in the MEDTECH market and were concentrated more on low-tech products were registered there [40]. In 2017, approximately 16,000 domestic manufacturers of medical devices and equipment, which were small and medium-sized enterprises, were registered there [17]. In 2014, more than 80% of them still focused on low to midrange products, but the predictions anticipate a 14% increase in diagnostic imaging products by 2020, a 12% increase in IV-diagnostics and even a 21% increase for orthopaedics & prosthetics production [46]. There are also foreign manufacturers on the market, mainly key global players (e.g., J&J, Philips and Siemens). More than 80% of Chinese medical device manufacturers are small to medium-sized enterprises [40]. Foreign key players actively expand their business in China through strategic actions, such as mergers and acquisitions or partnerships [43].

The largest supplier of medical devices to China is the US, followed by Germany and Japan. The total imports for 2016 amounted to USD 20.3 billion, with the US accounting for 32.8% (USD 6.64 billion), Germany for 16.7% (USD 3.4 billion) and Japan for 11.8% (USD 2.3 billion). The largest share of imports was represented by diagnostic medical devices - eight out of ten imported devices were diagnostic technologies [17, 46, 47].

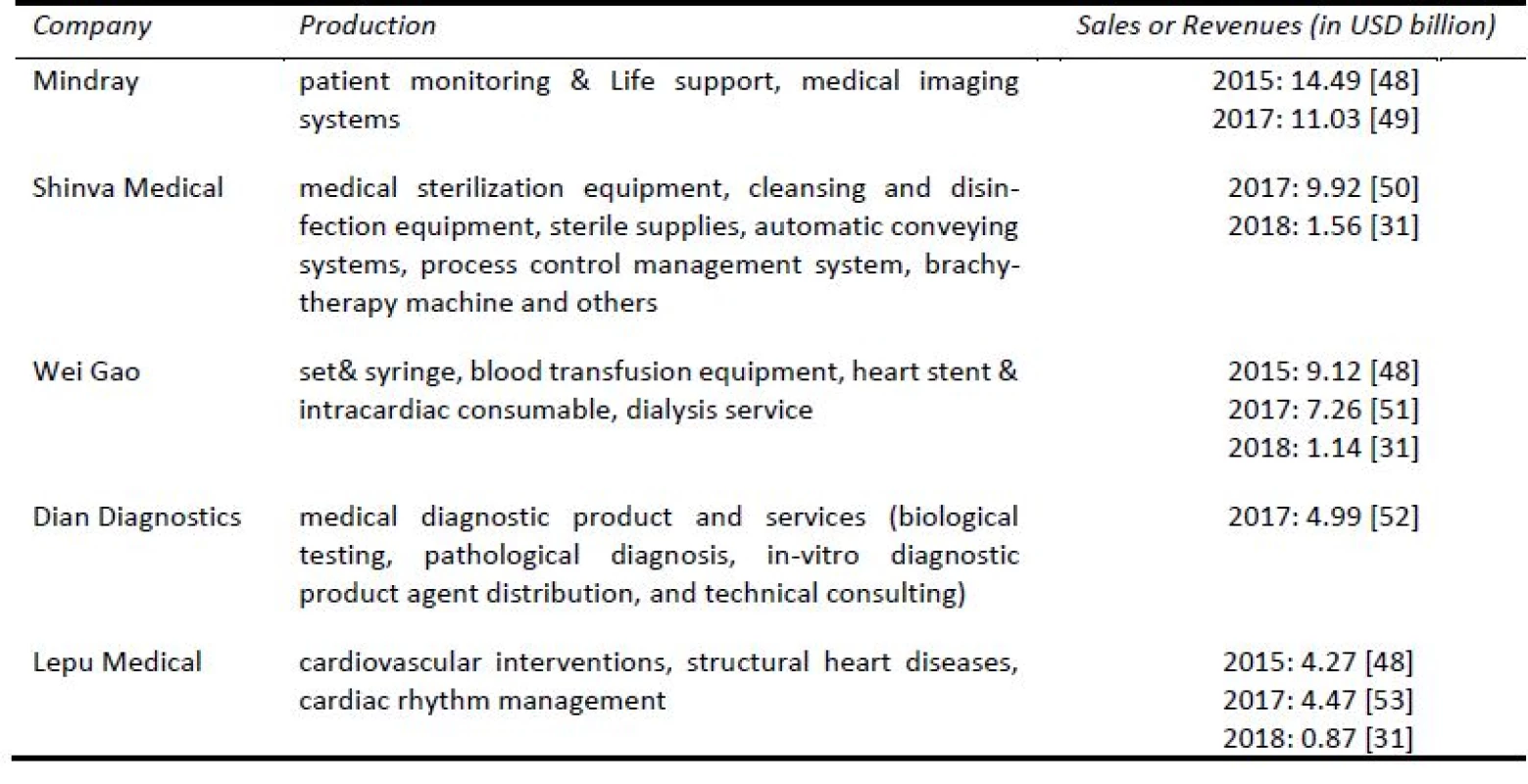

Key players in the market in USA are in Table 7.

7. Key players in the Medtech market in China.

Discussion and conclusion

In our review we found that U.S. holds about 40%, the global market (170 billion USD) and the industry provides about 500,000 jobs. Europe holds currently about 30% of the global market with market value about 110 billion USD that provides about 675,000 jobs. U.S. and Europe are controlling about 70% of Medtech market. The Medtech market in China represents about 10% of global one. The value of the market is about 53.6 billion USD. Market growth is about 10% in the US, Europe about 5% and China market show far largest growth rate about 20–25% per year.

In terms of the predictions, the importance of China's market will grow continuously and the country will become one of the leading Medtech regions. China is recently characterized by rapid growth in production with high added value. As the literature suggests China achievements in economics are dramatic in terms of infrastructure as well as export among others [54] so the development in the field of Medtech more or less copy the china’s economics trends. The largest companies in field in China have similar revenues in comparison with their U.S. and European competitors.

The "Made in China 2025" initiatives—a plan announced in 2015—favours expanding the production of state-of-the-art medical devices [40]. Several years ago, the government became involved in the market and launched a number of initiatives for innovation in the sector. The support for local producers is also grounded in the 12th Five-Year Plan of the China’s Ministry of Science and Technology.

European countries, and developed countries elsewhere, face the budgetary restrictions originated in high share of public funding of their health systems, which is often limited.

There are limitations of this study. It references a heavily heterogeneous database. This does not allow for a complete statistical comparison of the regions and the impossibility of obtaining all the data for the same period. In addition, it is faced with different coverage of individual sources. This situation is basically the same as that in a number of other studies in the area of health economics. Moreover, the individual underlying studies often differ in terms of the financial or percentage representation of the individual variables studied, i.e. it is necessary to think in terms of interval estimates, which is again the standard approach. Finally, the study does not include major medical device markets such as Japan and Australia, as well as many emerging markets in Asia and South America.

According to the evidence China will become one of the major player in the global Medtech market. China, which has focused on low-cost production in the past, is currently coming to the forefront thanks to its development of high-end medical device technology. On the other hand the U.S. and European markets are also innovative and will be strong competitors and are not ready to abandon their current global market share and existing dominance.

Acknowledgement

The work has been supported by research grant IGA No. 20181025 (Czech University of Agriculture in Prague).

Ing. Petra Hospodková, MBA

Department of Economic Theories

Faculty of Business and Economics

Czech University of Agriculture in Prague

Kamýcká 129, CZ-165 00 Prague 6 - Suchdol

E-mail: hospodkova@pef.czu.cz

Phone: +420 739 318 121

PhDr. Miroslav Barták, Ph.D.

Department of Addictology

First Faculty of Medicine of Charles University and General University Hospital in Prague

Apolinářská 4, CZ-128 00 Praha 2

E-mail: miroslav.bartak@lf1.cuni.cz

Phone: +420 224 968 272

Bc. Klára Vacíková

Department of Biomedical Technology

Faculty of Biomedical Engineering

Czech Technical University in Prague

nám. Sítná 3105, CZ-272 01 Kladno

E-mail: vacikkla@fbmi.cvut.cz

Ing. Erika Urbánková, Ph.D.

Department of Economic Theories

Faculty of Business and Economics

Czech University of Agriculture in Prague

Kamýcká 129, CZ-165 00 Prague 6 - Suchdol

E-mail: urbankovae@pef.czu.cz

Sources

[1] ZHANG, Weifan, Rebecca LIU a Chris CHATWIN. The Chinese medical device market: Market drivers and investment prospects. Journal of Commercial Biotechnology [online]. 2016, 22(2), 27–33 [vid. 2019-01-10]. ISSN 1478-565X. Available from: doi:10.5912/jcb741.

[2] IVLEV, Ilya, Peter KNEPPO a Miroslav BARTAK. Multi-criteria Decision Analysis: A Multifaceted Approach to Medical Equipment Management. Technological and Economic Develop-ment of Economy [online]. 2014, 20(3), 576–589 [vid. 2019-01-10]. ISSN 2029-4913. Available from: doi: 10.3846/20294913. 2014.943333.

[3] KUCA, Kamil, Petra MARESOVA, Marek PENHAKER a Ali SELAMAT. The potential of medical device industry in techno-logical and economical context. Therapeutics and Clinical Risk Management [online]. 2015, 1505. ISSN 1178-203X. Available from: doi:10.2147/TCRM.S88574.

[4] BARTÁK, Miroslav. The management of chronic diseases in international comparison. Vnitrni lekarstvi [online]. 2014, 60(5–6), 462–6 [vid. 2019-01-10]. Available from: http://www.ncbi.

nlm.nih.gov/pubmed/24974750.[5] MOHER, David, Alessandro LIBERATI, Jennifer TETZLAFF a Douglas G. ALTMAN. Preferred Reporting Items for Sys-tematic Reviews and Meta-Analyses: The PRISMA Statement. Annals of Internal Medicine [online]. 2009, 151(4), 264 [vid. 2019-01-10]. ISSN 0003-4819. Available from:doi:10.7326/0003-4819-151-4-200908180-00135.

[6] GRAVELLE, Jane G. The Medical Device Excise Tax: Economic Analysis The Medical Device Excise Tax: Economic Analysis Congressional Research Service [online]. 2015 [vid. 2019-01-15]. Available from: www.crs.govR43342.c11173008.

[7] MEDPAC. An overview of the medical device industry. In: Medicare and the Health Care Delivery System [online]. 2017, s. 207–242 [vid. 2019-01-10]. Available from: http://www.medpac.gov/docs/default-source/reports/jun17_ch7. pdf?sfvrsn=0.

[8] MEDTECH EUROPE. The European Medical Technology Industry-in figures / 2018 [online]. 2017 [vid. 2019-01-10]. Available from: https://www.medtecheurope.org/wp-content/ uploads/2018/06/MedTech-Europe_FactsFigures2018_FINAL_ 1.pdf.

[9] AWAIS IQBAL. Medical Device Industry Faces a Rising Demand Curve [online]. 2013 [vid. 2019-01-10]. Available from: https://www.fool.com/investing/general/2013/09/20/medical-device-industry-faces-a-rising-demand-curv.aspx.

[10] HEALTH SCIENCE POLICY COUNCIL. ISPOR 2018 TOP 10 HEOR TRENDS [online]. 2018. Available from: https://www. ispor.org/docs/default-source/publications/top10trends.pdf?sfvr sn=e6052ae7_2.

[11] COLLINS SARAH. What Factors Affect Growth in the US Orthopedics Device Market? [online]. 2015 [vid. 2019-01-10]. Available from: https://marketrealist.com/2015/11/must-read-overview-medical-device-industry.

[12] CUNNINGHAM, James, Brendan DOLAN, David KELLY a Chris YOUNG. Medical Device Sectorial Overview [online]. 2015 [vid. 2019-01-10]. Available from: http://galwaydash board.ie/publications/medical-sector.pdf.

[13] U.S. DEPARTMENT OF COMERCE: INTERNATIONAL TRADE ADMINISTRATION. 2016 Top Markets Report Medi-cal Devices A Market Assessment Tool for U.S. Exporters [online]. 2016 [vid. 2019-01-10]. Available from: https://www. trade.gov/topmarkets/pdf/Medical_Devices_Top_Markets_Report.pdf.

[14] RAJBHANDARY, Sujan a Atticus FRANK. Trends to Watch in the Medical Device Industry in 2018 [online]. 2018 [vid. 2019-01-15]. Available from: www.mercercapital.com.

[15] WORLD TRADE ORGANIZATION. 2018 Press Releases - Strong trade growth in 2018 rests on policy choices [online]. 2018 [vid. 2019-01-10]. Available from: https://www.wto.org/ english/news_e/pres18_e/pr820_e.htm.

[16] U.S. DEPARTMENT OF COMMERCE. Medical Technology Industry Spotlight [online]. 2018 [vid. 2019-01-10]. Available from: https://www.selectusa.gov/medical-technology-industry-united-states.

[17] EXPORT.GOV. China - Medical Devices [online]. 2017 [vid. 2019-01-10]. Available from: https://www.export.gov/ article?id=China-Medical-Devices

[18] KPMG INTERNATIONAL. Global Strategy Group [online]. 2018 [vid. 2019-01-10]. Available from: https://assets.kpmg/ content/dam/kpmg/xx/pdf/2017/12/medical-devices-2030.pdf.

[19] HAWORTH, Lee Anne. The Global Medical Device Market Offers Export Opportunities for PA Companies [online]. 2018 [vid. 2019-01-16]. Available from: https://pghtechfuse.com/ made-in-pa/global-medical-device-market-offers-export-opps-pa-companies/.

[20] TORSEKAR, Mihir. U.S. Medical Devices and China’s Market: Opportunities and Obstacles 1 [online]. 2014 [vid. 2019-01-10]. Available from: https://www.usitc.gov/publications/332/id-036 workingpaperusmedicaldevicesfinalss.pdf.

[21] BCG. Medical Technology: Vision 2025 [online]. 2014 [vid. 2019-03-04]. Available from: https://www.fdanews. com/ext/resources/files/09-14/09-14-CIIBCG-Report.pdf.

[22] Medical Devices Manufacturing in India. India Heals [online]. 2017 [vid. 2019-03-04]. Available from: www.ibef.org/arab-health-2017.

[23] STATISTA. Top medical technology companies worldwide by revenue 2017| Statistic [online]. 2017 [vid. 2019-01-10]. Avail able from: https://www.statista.com/statistics/281544/revenue-of-global-top-medical-technology-companies/.

[24] MERCER CAPITAL. Value Focus: Medical Device Industry [online]. 2018 [vid. 2019-02-27]. Available from: www.mercer capital.com.

[25] RESEARCHAMERICA. U.S. Investments in Medical and Health Research and Development 2013 - 2015 [online]. 2016 [vid. 2019-01-15]. Available from: https://www.researchameri ca.org/sites/default/files/2016US_Invest_R&D_report.pdf.

[26] O’CEARBHAILL, Roisin M., Timothy E. MURRAY a Michael J. LEE. Medical device patents—a review of contemporary global trends with an Irish comparison. Irish Journal of Medical Science (1971 -) [online]. 2018, 1–7 [vid. 2019-01-16]. ISSN 0021-1265. Available from: doi:10.1007/s11845-018-1880-4.

[27] PROCK, Thomas. Medtech remains strongest sector for patent filings in 2016 [online]. 2017 [vid. 2019-01-16]. Available from: https://medtechengine.com/article/medtech-patents-2016/.

[28] EMERGO. USA – Overview of medical device industry and healthcare statistics [online]. 2017 [vid. 2019-01-10]. Available from: https://www.emergobyul.com/resources/market-united-states.

[29] EVALUATE. EvaluateMedTech World Preview 2018, Outlook to 2024 | Evaluate [online]. nedatováno [vid. 2019-02-27]. Available from: http://www.evaluate.com/thought-leadership/ medtech/evaluatemedtech-world-preview-2018-outlook-2024# download.

[30] IGEAHUB. Top-10 Medical Devices Companies 2018 - IgeaHub [online]. 2018 [vid. 2019-01-15]. Available from: https:// www.igeahub.com/2018/08/03/top-10-medical-devices-compa-nies-2018/.

[31] MD+DI. Top 115 Medical Device Companies of 2018 [online]. 2018 [vid. 2019-02-27]. Available from: https://directory.qmed. com/who-are-the-top-dogs-in-the-medtech-industry-find-file09 2825.html.

[32] COPP, Josh, Ruth De BACKER, Colin FIELD-EATON a Gerti PELLUMBI. The growth imperative for medical-device compa-nies | McKinsey [online]. 2018 [vid. 2019-01-16]. Available from: https://www.mckinsey.com/industries/pharmaceuticals-and-medical-products/our-insights/the-growth-imperative-for-medical-device-companies.

[33] MEDTECH EUROPE. The European Medical Technology industry IN FIGURES [online]. 2015 [vid. 2019-01-10]. Available from: https://www.medtecheurope.org/wp-content/ uploads/2015/12/MEDTECH_FactFigures_ONLINE3.pdf.

[34] EUROPEAN COMMISSION. Medical Devices | Internal Market, Industry, Entrepreneurship and SMEs [online]. 2018 [vid. 2019-01-16]. Available from: https://ec.europa.eu/growth/ sectors/medical-devices_en.

[35] MEDTECH EUROPE. The European Medical Technology Industry-in figures [online]. 2016 [vid. 2019-01-10]. Available from: https://www.medtecheurope.org/wp-content/uploads/ 2017/01/MedTech_FactsFigures2016_20160105.pdf.

[36] KRAEMER, Matthias. Siemens Healthineers fully on track to meet the targets [online]. 2018 [vid. 2019-01-16]. Available from: https://www.healthcare.siemens.com/press-room/press-releases/pr-20180503015shs.html.

[37] FRESENIUS MEDICAL CARE. Annual Report 2017 [online]. 2017 [vid. 2019-01-16]. Available from:https://www.fresenius medicalcare.com/fileadmin/data/com/pdf/investors/News___Publications/Annual_Reports/2017/FME_Annual_Report_2017.pdf.

[38] PHILIPS. Annual Report 2017 [online]. 2017 [vid. 2019-01-16]. Available from: https://www.philips.com/static/annualresults/ 2017/PhilipsFullAnnualReport2017-English.pdf.

[39] ESSILOR. Through the eyes of Essilor [online]. 2017 [vid. 2019-01-16]. Available from: https://www.essilor.com/annualreport 2017/pdf/ESSILOR_RA2017-2018_EN.pdf.

[40] TORSEKAR, Mihir P. China’s Changing Medical Device Exports. Journal of International Commerce and Economics [online]. 2018 [vid. 2019-01-10]. Available from: https://www. usitc.gov/publications/332/journals/china_medtech_jice_508_

compliant.pdf.[41] ZHANG, Weifan, Rebecca LIU a Chris CHATWIN. Chinese Medical Device Market and The Investment Vector [online]. 2016 [vid. 2019-01-20]. Available from: http://arxiv.org/abs/ 1609.05200.

[42] BOYER, Philip, Bashir I. MORSHED a Tofy MUSSIVAND. Medical Device Market in China. Artificial Organs [online]. 2015, 39(6), 520–525 [vid. 2019-01-10]. ISSN 0160564X. Available from: doi:10.1111/aor.12427.

[43] DELOITTE. China’s healthcare provider market: Riding the waves of reform [online]. 2015 [vid. 2019-01-20]. Available from: https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Life-Sciences-Health-Care/gx-lshc-china-healthcare-provider-market-en-150512.pdf.

[44] EMERGO. CHINA – Overview of medical device industry and healthcare statistics | Emergo [online]. 2016 [vid. 2019-01-10]. Available from: https://www.emergobyul.com/resources/market -china.

[45] RAAMT, Helgert Van a Bart Van den MOOTER. The Chinese Medtech Market 2017-2020 [online]. 2017 [vid. 2019-01-20]. Available from: https://www.tforg.com/wp-content/uploads/ 2017/02/TforG-wp-china-medtech-market.pdf.

[46] BRUCHE, Gert. The Chinese Medical Device Market: Oppor-tunities, Challenges [online]. 2015 [vid. 2019-01-20]. Available from: https://www.bgmassociates.net/uploads/6/8/9/2/68925041/bgm_associates-2015-chinese_medical_devices_market.pdf.

[47] QUALTECH. CHINA: Medical Device Market Overview and Importation Process - January 2018 - Qualtech Consulting Corporation [online]. 2018 [vid. 2019-01-10]. Available from: http://www.qualtech.com.tw/en/about-qualtech/news1/964-chin a-medical-device-market-overview-and-importation-process-jan uary-2018.html.

[48] DORA, Sumit, Dinesh KHANNA, Ying LUO, Lillian POON a Christoph SCHWEIZER. Medtech May Be Emerging Markets’ Next New Thing [online]. 2017 [vid. 2019-01-10]. Available from: https://www.bcg.com/publications/2017/globalization-me dical-devices-technology-medtech-may-be-emerging-markets-next-new-thing.aspx.

[49] THE WALL STREET JOURNAL. Shenzhen Mindray Bio-Medi-cal Electronics Co. Ltd. [online]. 2018 [vid. 2019-01-21]. Avail-able from: https://quotes.wsj.com/CN/XSHE/300760.

[50] THE WALL STREET JOURNAL. CN Financial Statements - Shinva Medical Instrument Co. Ltd. [online]. 2018 [vid. 2019-01-21]. Available from: https://quotes.wsj.com/CN/XSHG/600 587/financials.

[51] THE WALL STREET JOURNAL. Shandong Weigao Group Medical Polymer Co. Ltd. [online]. 2018 [vid. 2019-01-21]. Available from: https://quotes.wsj.com/HK/XHKG/1066.

[52] THE WALL STREET JOURNAL. Dian Diagnostics Group

Co. Ltd. [online]. 2018 [vid. 2019-01-21]. Available from: https://quotes.wsj.com/CN/XSHE/300244.[53] THE WALL STREET JOURNAL. CN Financial Statements - Lepu Medical Technology (Beijing) Co. Ltd. [online]. 2018 [vid. 2019-01-21]. Available from: https://quotes.wsj.com/CN/ XSHE/300003/financials.

[54] FAN, Shenggen, Ravi KANBUR, Shang-Jin WEI a Xiaobo ZHANG. The Oxford Companion to the Economics of China [online]. B.m.: Oxford University Press, 2014. ISBN 9780 199678204. Available from:doi:10.1093/acprof:oso/97801996 78204.001.0001.

Labels

Biomedicine

Article was published inThe Clinician and Technology Journal

2018 Issue 4-

All articles in this issue

- Computer-aided modeling and additive manufacturing fabrication of patient-specific mandibular implant

- Immediate effect of physical on blood flow velocity in radial artery in young adults

- Nanofiber scent carrier

- NANOFIBERS FROM POLYVINYL ALCOHOL AND CAN ENLARGE THE SET OF TRAPPED ODOROLOGICAL TRACES

- GLOBAL CENTERS OF MEDICAL DEVICE TECHNOLOGY: UNITED STATES, EUROPE AND CHINA

- The Clinician and Technology Journal

- Journal archive

- Current issue

- Online only

- About the journal

Most read in this issue- GLOBAL CENTERS OF MEDICAL DEVICE TECHNOLOGY: UNITED STATES, EUROPE AND CHINA

- Computer-aided modeling and additive manufacturing fabrication of patient-specific mandibular implant

- Nanofiber scent carrier

- Immediate effect of physical on blood flow velocity in radial artery in young adults

Login#ADS_BOTTOM_SCRIPTS#Forgotten passwordEnter the email address that you registered with. We will send you instructions on how to set a new password.

- Career