-

Medical journals

- Career

OTC market – comparing Czech Republic and Greece

Authors: Božena Macešková; Marios-Panagiotis Tsadaris; Michail Machlis

Published in: Čes. slov. Farm., 2019; 68, 78-85

Category: Original Article

Overview

Medicines for self-medication (over-the-counter, OTC) are available through pharmacies, in some countries they are also available in supermarkets and other outlets. The use of OTC in European Union countries shows some differences at national level, in pharmacies and in patients’ preference. This study aimed to completing the lists of marketed OTC in Czech Republic and Greece. Next topics are: finding out the real range of OTC products offered by pharmacies, finding and evaluating number of packages sold in pharmacies in 20 particular common OTC in 2016, and indentification of factors influencing the sales. Web pages of national drug authorities (Czech Republic, Greece) were searched to complete lists of marketed OTC in each country. Data on range of OTC drugs and sales of them were extracted from computer systems (Czech Republic) and other types of documents (Greece) kept in pharmacies. The percentage of the real range of OTC products in pharmacies was calculated as the ratio to the number of OTC in national lists. Numbers of sold packages were compared among pharmacies. Classification system ATC (anatomical/therapeutical/chemical) was employed to present findings in all parts of the research. The Czech list contained 1,160 of marketed OTC in 10 ATC (1st level), with the maximum in ATC R (243 drugs). The Greek list contained 1,254 OTC in 13 ATC (1st level), with the maximum in ATC D (272 drugs). In lists of both countries, there were detected 86 drugs identical in 9 ATC (1st level). At least one OTC in each of

10 listed ATC was found in Czech pharmacies as a part of range of products, the range of OTC in Greek pharmacies comprised 11 ATC. The highest sales (year 2016) were found in ATC R (drug ACC long tbl eff) in CR and in ATC A (drug: Imodium cps) in Greece. The differences in the range of OTC drugs and in their sales were found between Czech Republic and Greece, and between types of pharmacies inside each country. Factors influencing them were detected: ownership of the pharmacy, locality (number of inhabitants).OTC drugs • pharmacy • Czech Republic • Greece

Keywords:

Czech Republic – OTC drugs – pharmacy – Greece

Introduction

Medicines for self-medication are often called „nonprescription“ or „over-the-counter“ (OTC) and are available through pharmacies. In some countries OTC products are also available in supermarkets and other outlets. Responsible self-medication has been identified as an important element in long-term health policy by the institutions of the European Community1). Research shows that 81 percent of adults use OTC medicines as a first response to minor ailments2).

Harmonization between countries’ regulatory agencies is a positive development3). Even if a specific directive4) has been approved, the situation of self-medication products in European Union (EU) countries is still far from being harmonized5). The final EU Medicines Agencies Network Strategy 2020 emphasises that this strategy has a key role in improving patients access to well-established medicines including the nonprescription ones. Multi Annual Work Plan (MAWP) incorporates the same objective: enhancement and improvement of existing tools such as the mutual recognition/decentralized procedures (MRC/DCP) and achievement of agreements on common criteria for the authorisation of OTC products. It recommends to explore ways how to facilitate the greater number of product switches which should result in improving the availability of nonprescriptoin medicines through simplified regulatory reqiurements6). It is often expected that through deregulation in the community pharmacy sector the prices of OTC medicines will go down. In reality these expectations could not be fully met. Deregulation has led to the opening of new pharmacies and of OTC dispensaries, since OTC sale outside pharmacies is usually permitted7).

Situation in Czech Republic

Though one of the smallest markets, the Czech Republic has a strict control of a drug on its launch and a rigorous system of drug registration8). Any proprietary medicinal product is subject to marketing authorisation prior to its placement on the market in the Czech Republic. The marketing authorisation procedure is the responsibility of State Institute for Drug Control and it includes an assessment of a dossier, in which the future marketing authorisation holder evidences the safety, efficacy, and quality of the product9). Patients can have access to a small amount of OTC drugs subcategory „selected drugs“ in many points except pharmacies19). Spending on retail pharmaceuticals as a share of GDP (2013): total 1.3%, private 0.5%11). The expenditure per capita (2015): 404 USD12), OTC 83 USD (2013)11). OTC share in total pharmaceutical market not listed in10), estimation: nearly 5%.

Situation in Greece

Accessing the market requires manufacturers to obtain necessary approvals from The National Organization for Medicines (EOF), an entity of Ministry of Health and Social Solidarity. Right from informing the EOF, manufacturers might have to cope with other complex Regulatory procedures for registrations and licensing13). Price liberalization and market opening (since 2016) allows for the ability of Greek consumers to buy more OTC products while creating increased competition from new outlets will press prices down. Negotiations are currently taking place regarding the sale of OTC via channels (i.e. supermarkets) other than just pharmacies14). The main aim of the reform is to provide to patients all necessary knowledge, advice and convenience in order to be healthier, by choosing the ideal drug for their condition. A base alignment and agreement between the state, the industry and the pharmacy with the patient in the core will create a huge evolution with increasing satisfaction for consumers15). OTC that can be bought outside the pharmacies as well create the subcategory „drugs for general distribution“ 16, 18).

Spending on retail pharmaceuticals as a share of GDP (2013): total 2.8%, private 0.9%11), per capita (2015): 572 USD12), OTC share in total pharmaceutical market 5%10).

Advertising of OTC medicines is allowed in many countries in EU, including both CR19) and Greece17).

The aim of this study was to complete the list of all marketed OTC in Czech Republic and Greece, to compare them, to ascertain the real range of OTC drugs offered by selected pharmacies (3 in each country) and to analyse the sales of twenty chosen OTC in these pharmacies in one-year period (2016).

Experimental part

Methodology

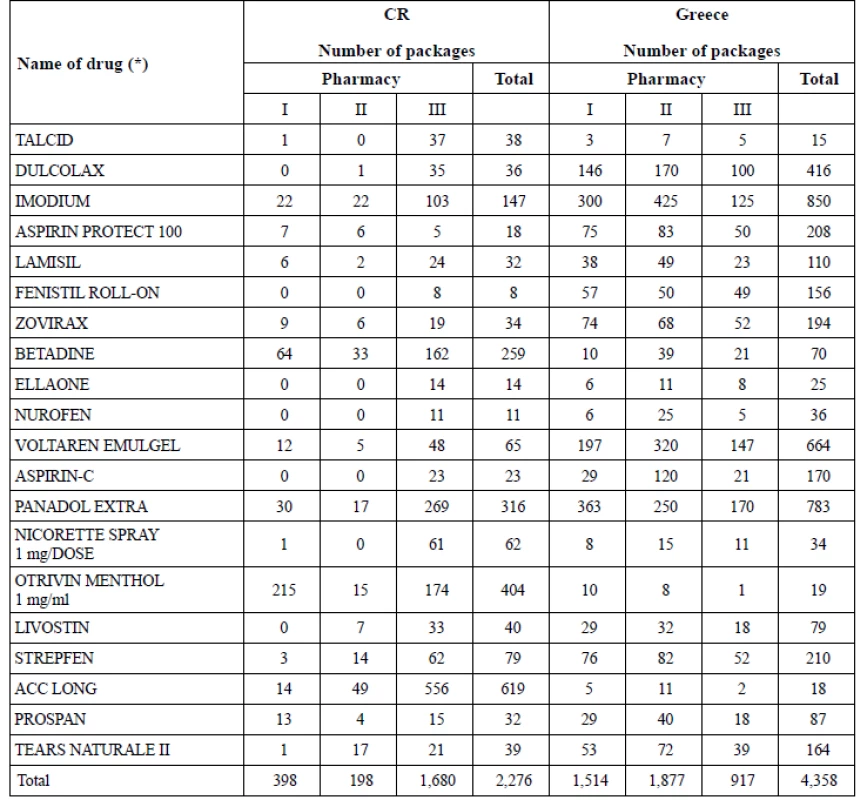

OTC marketed in CR and Greece were the subject of this research. This group presents the sub-group of authorized OTC, and the drug was included in the list of marketed OTC if it was really marketed by wholesalers and pharmacies. Analysis of national lists of OTC in CR20) and Greece21, 22) was the first step of the research. Drugs marketed in 2016 were sorted using the ATC (anatomical/therapeutical/chemical) system (5th level) and the identical drugs (the same name, dosage form, strength and size of package) were identified comparing both lists. Six pharmacies (3 in each country) were chosen to take part in data gathering. Different types of ownership and different localities were the parameters for the selection (Table 1). Finding out the range of marketed OTC drugs in pharmacies followed. The range of OTC is the aggregate of particular drugs that used to be in the stock of the pharmacy, it means they have been at least once ordered by the pharmacy, regardless of their real presence in the stock of the pharmacy in the moment of researching. To complete the range of products, the documentation of stocking drugs in chosen pharmacies was analysed in the end of 2016. There are substantial differences between CR and Greece in the methods of stock inventory – the Czech ones are more complex due to use of sofisticated computer systems. Authors performed the search under the supervision of the head of the pharmacy. Documents in Greek pharmacies showed the large variety and lack of uniformity, using different kinds of software to keep records of various structure and content. The cooperation of the pharmacist with the researcher was necessary to find corresponding data. The ratio between the real range of OTC found in pharmacies and the total number of marketed OTC included in national lists was calculated in ATC groups (1st level) in both countries and expressed in percentage. Finally, analysing the sales of 20 particular common OTC in chosen pharmacies was performed (January 1, 2016 – December 31, 2016). The sample of OTC was based on 18 OTC identified as identical in both countries, the next two were of different size of package comparing CR and Greece (Table 4). Basic condition for the choice was the presence of the drug in the range of OTC products in pharmacies. The next condition was to include maximal number of ATC groups – eight ATC groups (1st level) from the nine ones found in the group of identical OTC can be found in the sample. Completing this part of research was finished in spring 2017.

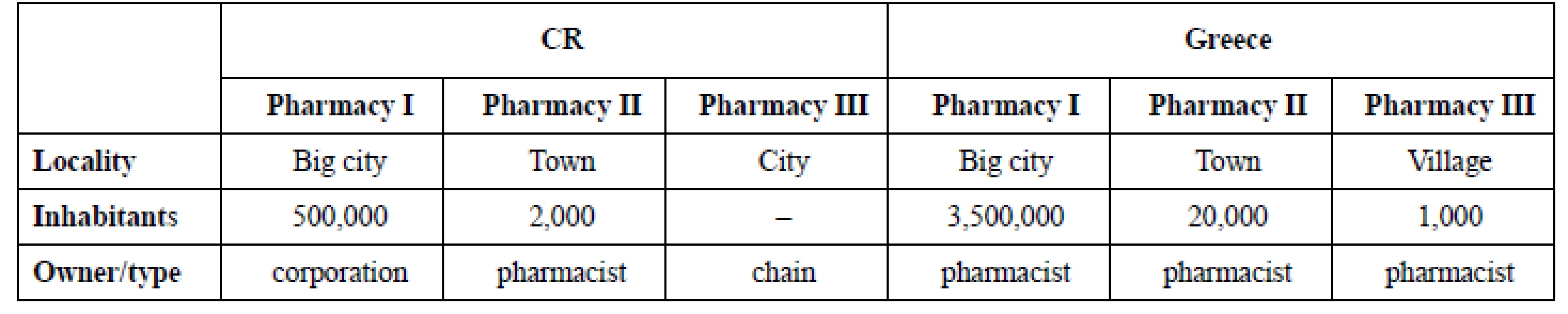

1. Description of pharmacies that took part in the research

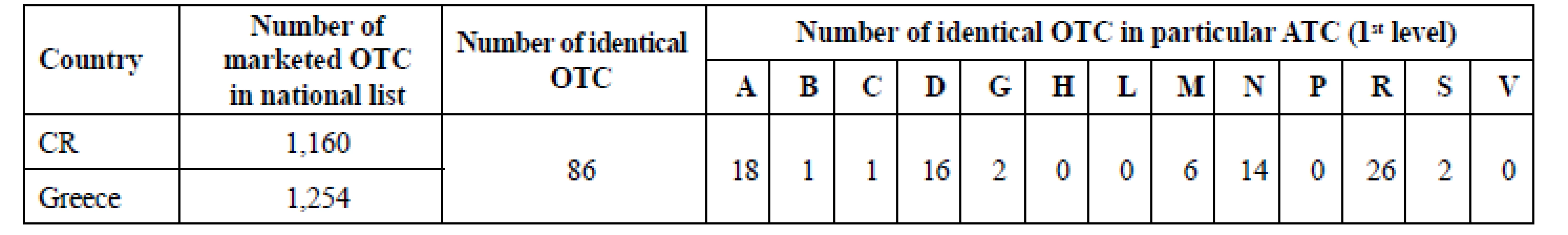

2. Identical OTC-ATC classification

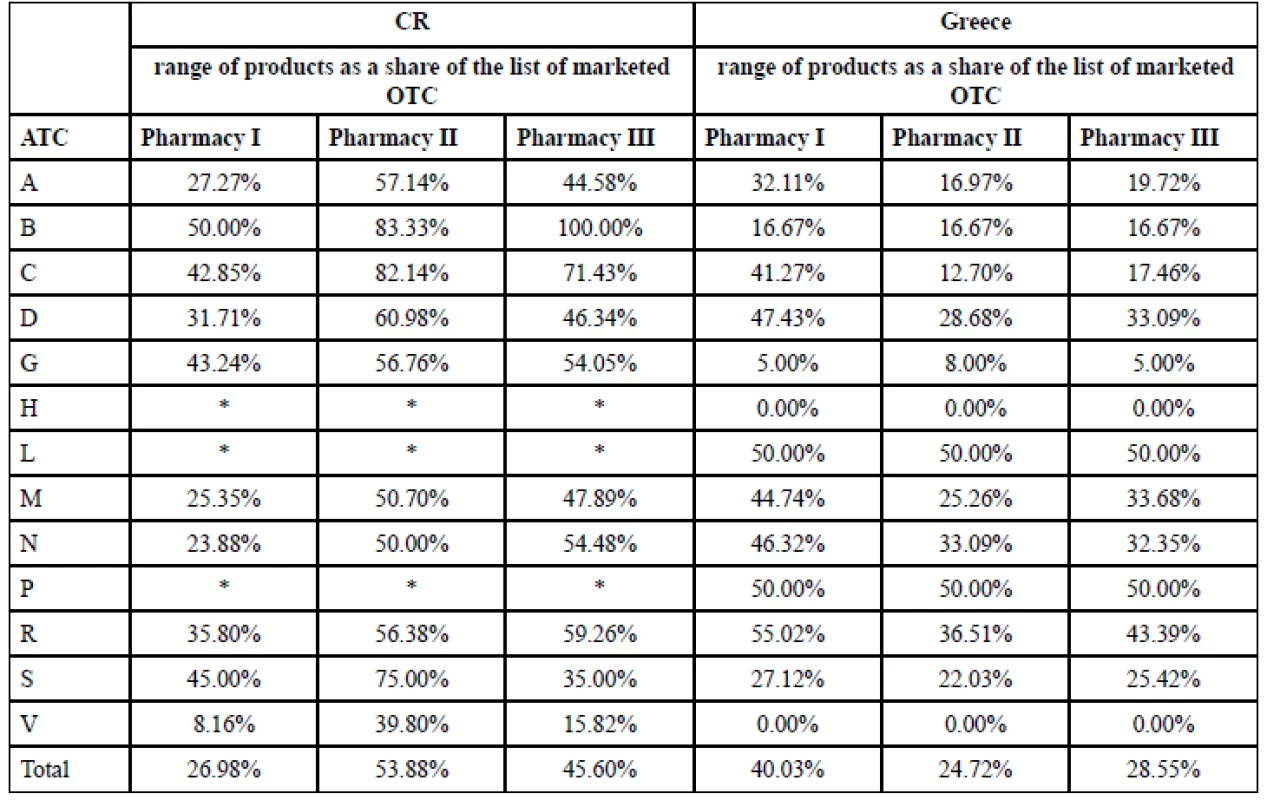

3. Comparing the range of OTC products in pharmacies with the number of marketed OTC in CR and Greece

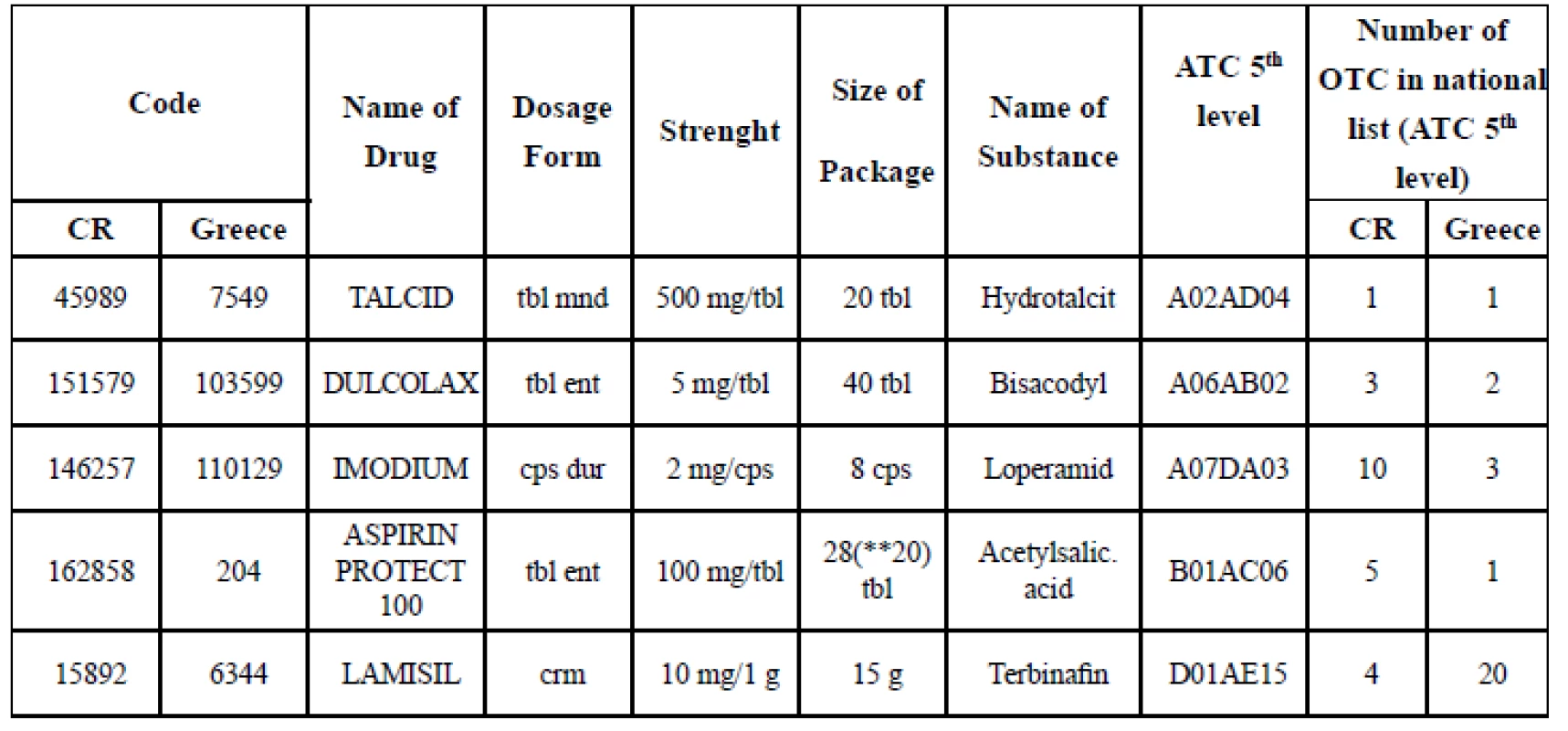

(*) no marketed OTC in the ATC group in the national list, 0.00% means that there was at least one markted OTC in the national list in the particular ATC group, but none was found in the range of products in the particular pharmacy. „Total“ means the percentage of the complete range of products in the pharmacy expressed as a share of the national list of marketed OTC. 4. List of OTC chosen for analysis of sales in the pharmacies (CR, Greece)

(*) code cancelled at May 1, 2017, replaced by 202353

(**) size of package in Greece (difference from CR)Pharmacy I. (CR) was owned by corporation, it was the only one run by this legal body, pharmacy III. (CR) was a member of the chain operating several hundreds pharmacies. The number of inhabitants in the city where the chain pharmacy was established is not mentioned because all pharmacies of the chain have the same business strategy and the range of OTC products is quite the same in all of them, not dependent on the population. All community pharmacies were owned exclusively by pharmacist in Greece in the time of research. The influence of pharmacys’ characteristics on the range of OTC drugs and on the number of sold packages is mentioned in discussion.

Results

ATC with no OTC in both countries are not included in Figure 1.

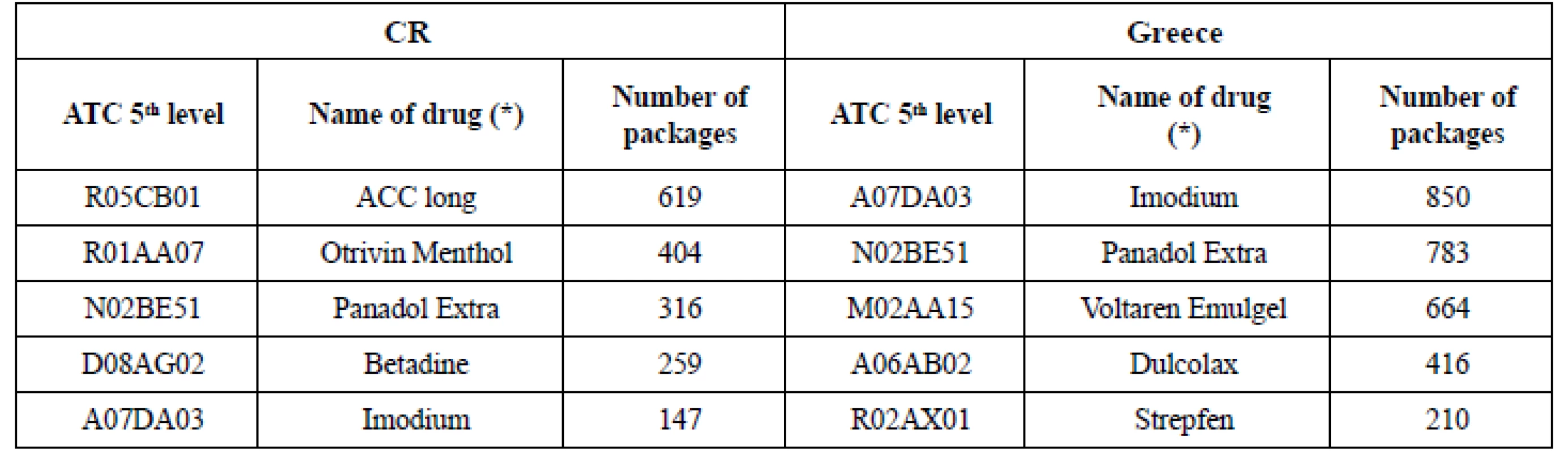

The list of OTC chosen for sales evaluation was completed by the column „number of OTC in national list ATC (5th level)“ in order to be able to assess the infuence of other OTC drugs with the same active substance on the patients’ choice and on the sale of the particular drug included in analysis. The data in columns (CR, Greece) present the number of marketed OTC in the same ATC (5th level) (Table 4).

Discussion

There were 1,160 marketed OTC in CR and 1,254 ones in Greece in 2016 (Table 2). There were 86 of them identical in both lists, it means having the same name, dosage form, strength and size of package. They were classified in 9 ATC (1st level). No identic OTC was found in ATC H, L, P and V. The only one drug (Ellaone tbl 30 mg 1 tbl) has been authorized by European Medicines Agency, the rest of them by national medicines agencies.

As for the variety of marketed OTC drugs in national lists: it was more extensive in Greece, comprising 13 ATC 1st level (Fig. 1), but OTC listed in ATC H and V were not found as a part of range of products in any of researched pharmacies (Table 3). The list of marketed OTC in Czech Republic was ranked in 10 ATC 1st level (Fig. 1) and at least one drug of each of these 10 ATC groups was really the part of range of products in pharmacies (Table 3).

The range of OTC in pharmacies (Table 3) seemed to be independent of the size of the settlement where the pharmacy was located in Greece. This was not confirmed in CR. The pharmacy in the small town offered the biggest range of products in 70.00% of ATC (1st level) comparing to pharmacies in other localities. There were found 53.88% of all marketed OTC in the range of products in this small pharmacy. The pharmacy in the big city (CR) had the smallest range of products in 90.00% of ATC (1st level), in total: 26.98% of the marketed ones. It could be deduced that the pharmacy in the small town (the only one in this town) made efforts to meet the maximum of patients’ needs in order to prevent the patients to buy their OTC in other pharmacies. The next reason could be the difference in the ownership of the pharmacies: because of the big competition the pharmacist as the owner had to supply the patients’ demands as much as possible to be attractive for clients and to stack up to the competition. The results in pharmacies in big cities were opposite: the range of products offered to patients was 26.98% in CR (minimum of the researched Czech pharmacies) versus 40.03% in Greece (maximum of the researched Greek pharmacies). Similar range of products in pharmacies in smaller settlements (24.72% town, 28.55% village) was found in Greece. Chain (CR) seemed to offer the wide range of OTC products (45.60%) comparing to the independent pharmacy in the big city (26.98%).

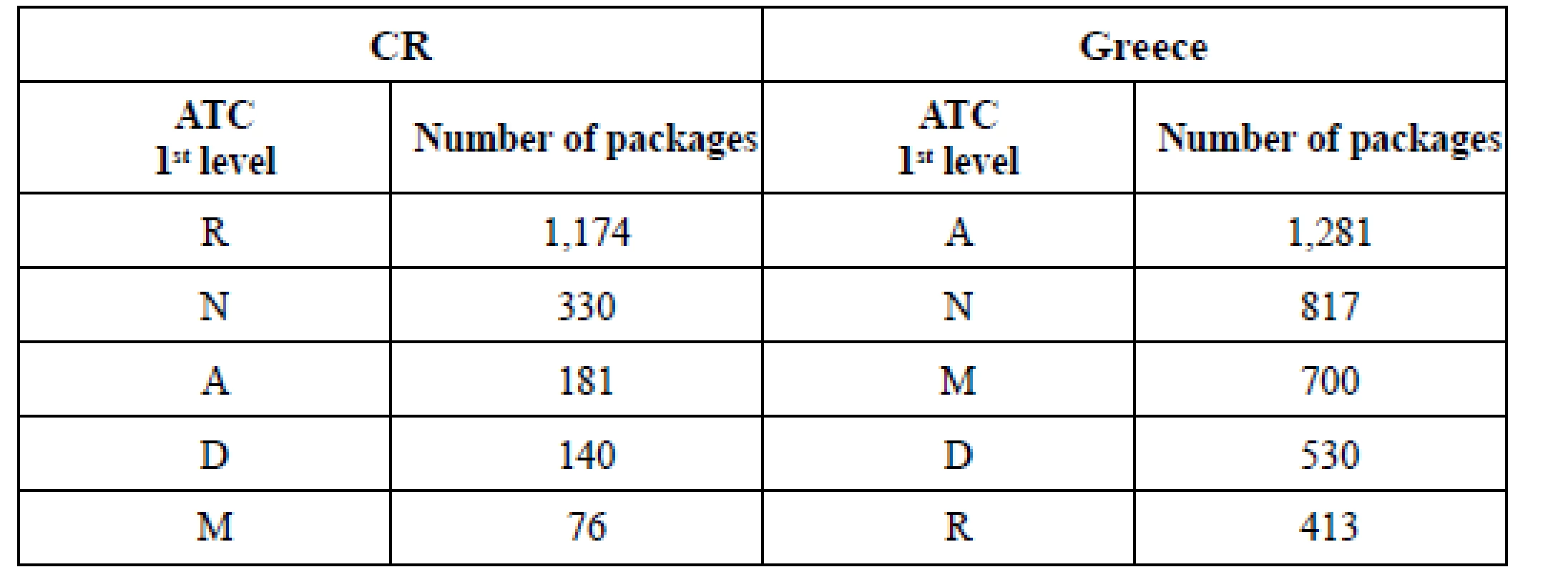

Sales of 20 common OTC (Table 4) in chosen pharmacies (Table 5) showed big differences. They were nearly twice as high (191.48%) in Greece as in CR in 2016. Despite of the similar OTC share in total pharmaceutical market (approx. 5% in 201510)) the changes that started in 2016 (non - restrictive environment, new businesses or new products14)) in Greece seemed to bring out new patterns in pharmacists’ and patients’ habitual practice. The extent of OTC sales did not rely on the extent of range of OTC in pharmacies (Table 3, 5): there were biggest sales (1,877 packages) in the pharmacy with the least range of products in Greece (locality: town). On the contrary, the sales seemed to be dependent on the ownership of the pharmacy in CR: the chain - pharmacy had the highest sales (1,680 packages) even if it did not have the broadest range of products. The pharmacies located in small town (CR) and village (Greece) showed lower sales regardless of not having the least range of OTC drugs. When detecting the highest sales in ATC groups (Table 5, 6) in Greece, the most frequently sold group was ATC A (Alimentary tract – 1,281 packages) and the most frequently sold OTC was IMODIUM cps dur 2 mg/cps 8 cps (A07DA03, 850 packages) (Table 7). The number of OTC marketed in ATC A (218 OTC) was the second highest in Greece (Fig. 1 – ATC D with 272 OTC was the first one) and the range of products in the pharmacies oscillated between 32.11% and 16.97% (Table 3). In Czech pharmacies, the most frequently sold ATC group was R (Respiratory tract – 1,174 packages) (Table 5, 6) and the most frequently sold OTC was ACC long tbl eff 600 mg/tbl 10 tbl (R05CB01, 619 packages) (Table 7). The number of OTC marketed in ATC R was the highest one in CR (Fig. 1 – 243 OTC) and the range of products in the pharmacies oscillated between 59.26% and 35.80% (Table 3).

5. Sales of chosen OTC in pharmacies in 2016 (CR, Greece)

(*) dosage form, strength and size of package: see Table 4 6. Top ATC groups sold in chosen pharmacies

7. Top OTC drugs sold in chosen pharmacies

(*) dosage form, strength and size of package: see Table 4 This research brings the simplified and non-representative look into the OTC market in Czech Republic and Greece. There are some factors impeding the generalization of results: the small number of pharmacies taking part in the research, impossibility of drawing a comparison between data on sales in pharmacies and international11, 12) and national statistics on OTC drug consumption (in Czech Republic at wholesalers’level)23). Last but not least, the Czech OTC market has been stabilized since the changes in the health care system in nineties, while the Greek one is expected to undergo big changes in the near future due to starting liberalization and market opening. On the other hand, some factors not taken in consideration in this research might modify what was found up: the climatic differences between the two countries could determine what are the most common patients’ symptoms treated by self-medication and what are the most frequently sold OTC drugs.

Conflicts of interest: none.

RNDr. Božena Macešková, CSc.

M.-P. Tsadaris

M. Machlis

Department of Applied Pharmacy, Faculty of Pharmacy, University of Veterinary and Pharmaceutical Sciences, Brno

Palackého 1946/1, 612 42 Brno, CR

e-mail: maceskovab@vfu.cz

Sources

1. What is selfmedication. http://www.wsmi.org/about-self-care-and-self-medication/what-is-self-medication/ (1. 2. 2019).

2. Statistics on OTC use. https://www.chpa.org/MarketStats.aspx#access (1. 2. 2019).

3. Better regulation of nonprescription medicines. http://www.aesgp.eu/publications/wsmi-publications/ (1. 2. 2019).

4. Directive 2001/83/EC of the European Parliament and of the Council of 6 November 2001 on the Community code relating to medicinal products for human use.

5. Minghetti P., Casiraghi A., Cilurzo F., Montanari L. The situation of OTC drugs in Italy compared to the other EU states. Pharmacol. Res. 2000; 42(1), 25–31.

6. AESPG Annual Report 2015–2016. http://www.aesgp.eu/publications/library/ (1. 2. 2019).

7. Vogler S., Arts D., Sandberger K. Impact of pharmacy deregulation and regulation in European countries (2012). https://ppri.goeg.at/technical_reports (1. 2. 2019).

8. Market access in the Czech Republic. http://www.pmlive.com/pharma_news/market_access_czech_republic_356414 (1. 2. 2019).

9. http://www.sukl.eu/medicines/marketing-authorisation-of-pharmaceuticals (1. 2. 2019).

10. Market data. Total non - prescriptions medicines market sales. http://www.aesgp.eu/facts-figures/market-data/non-prescription-market/ (1. 2. 2019).

11. OECD Health Working Paper No.87. Pharmaceutical expenditure and policies: past trends and future challenges. https://www.oecd-ilibrary.org/social-issues-migration-health/pharmaceutical-expenditure-and-policies_5jm0q1f4cdq7-en (1. 2. 2019).

12. Health at a Glance 2017. https://www.oecd-ilibrary.org/social-issues-migration-health/health-at-a-glance-2017_health_glance-2017-en (1. 2. 2019).

13. Product, Market and Regulatory Pathway Strategy. https://www.freyrsolutions.com/regulatory-services-in-greece (1. 2. 2019).

14. Healthcare Resource Guide: Greece. https://build.export.gov/main/industry/health/healthcareresourceguide/eg_main_092012 (1. 2. 2019).

15. Kontos N. Are OTC’s in Greece stepping into the new era? https://www.linkedin.com/pulse/otcs-greece-stepping-new-era-nikos-kontos/ (1. 2. 2019).

16. Greek Ministry of Health. Creating of drug subcategory ΓΕ.ΔΙ.ΦΑ http://www.moh.gov.gr/articles/ministry/grafeio-typoy/press-releases/3917 (1. 2. 2019).

17. Greece: Pharmaceutical advertising 2018. https://iclg.com/practice-areas/pharmaceutical-advertising-laws-and-regulations/greece (1. 2. 2019).

18. Active substances belonging to the subcategory ΓΕ.ΔΙ.ΦΑ https://www.farmakeutikoskosmos.gr/article-f/ayth-einai-h-lista-me-tis-drastikes-oysi/17898 (1. 2. 2019).

19. Act No 378/2007 Coll., on Pharmaceuticals and on Amendments to some Related Acts.

20. http://www.sukl.cz/modules/medication/search.php (16. 10. 2016).

21. http://www.eof.gr (18. 10. 2016).

22. https://www.galinos.gr (18. 10. 2016).

23. AISLP 2018.3 (Automated System of Medical Preparations, version 2018.3) https://www.aislp.cz/ (1. 2. 2019).

Labels

Pharmacy Clinical pharmacology

Article was published inCzech and Slovak Pharmacy

2019 Issue 2-

All articles in this issue

- Bevacizumab treatment in metastatic colorectal carcinoma – an economic perspective

- Prenylated phenols with cytotoxic and antiproliferative activity isolated from Morus alba

- Influence of formulation and process parameters on the properties of Cu2+/alginate particles prepared by external ionic gelation evaluated by principal component analysis

- OTC market – comparing Czech Republic and Greece

- Czech and Slovak Pharmacy

- Journal archive

- Current issue

- Online only

- About the journal

Most read in this issue- OTC market – comparing Czech Republic and Greece

- Bevacizumab treatment in metastatic colorectal carcinoma – an economic perspective

- Prenylated phenols with cytotoxic and antiproliferative activity isolated from Morus alba

- Influence of formulation and process parameters on the properties of Cu2+/alginate particles prepared by external ionic gelation evaluated by principal component analysis

Login#ADS_BOTTOM_SCRIPTS#Forgotten passwordEnter the email address that you registered with. We will send you instructions on how to set a new password.

- Career